Archives of “February 10, 2019” day

rssTwo Corollaries

Corollary 1

If most of the money that is lost in the markets is lost by traders who thought they knew which way the market was supposed to go, then most of the opportunity that is missed in the markets is missed by those who couldn’t possibly believe the market would go that expected distance — but in the opposite direction.

Corollary 2

If most of the money that is lost in the markets is lost by traders who thought they knew which way the market was supposed to go, then most of the money to be made in the markets is made at the places where most traders are proven wrong and stopped out.

Thought For A Day

Rare Pic of Trading Room

Decide that you are not going to stay where you are

Traders: Millions by the Minute- video

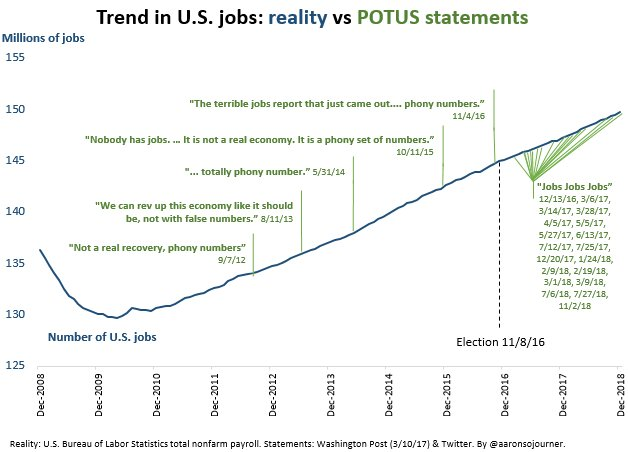

The talking points changed, not the job growth trend.

Dow Jones :Update

Correction Starts…

Yesterday closed 10897 level.

Now below 10938 level ,Bears will have upperhand.

Iam expecting DOW to crash upto 10788-10738 level in this slide.

I will update more on Sunday about DOW ,S&P 500 !!

Updated at 16:17/08th April/Baroda

Know Your Risk Tolerance

Every trader is different, and only you know your risk tolerance. Are you the type of trader who can risk 20% to make 20%, or do you feel the need to have a much higher risk/reward payout in order to enter a trade? Be sure to define your risk before placing any trade orders. Doing so helps ensure that you have an exit strategy, which is arguably just as important as your entrance strategy. A little extra work in the beginning can make all the difference in the end.

Every market stat could be a bullish or bearish argument, depending on what u want it to be. Bias beats everything