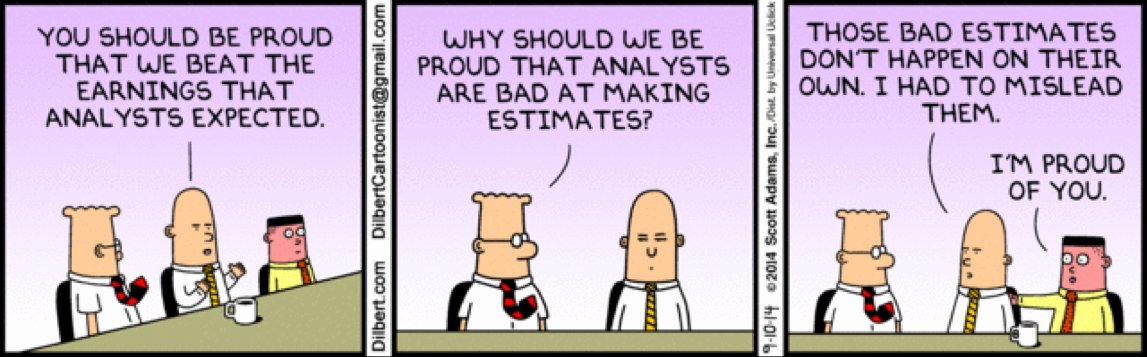

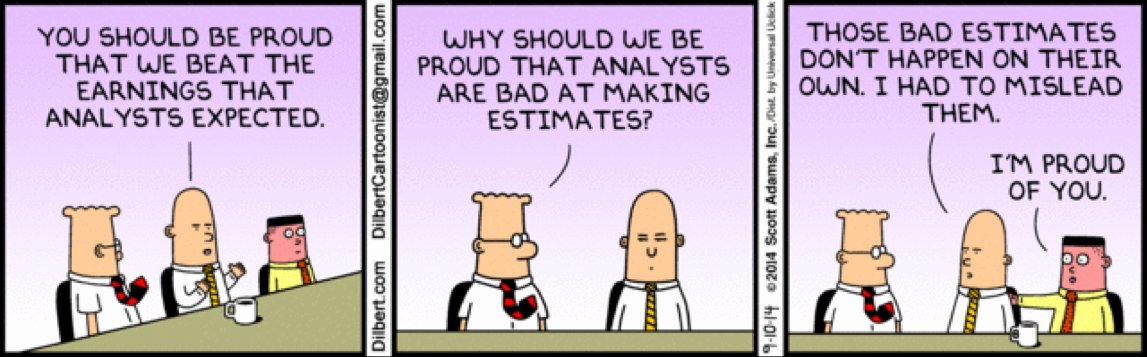

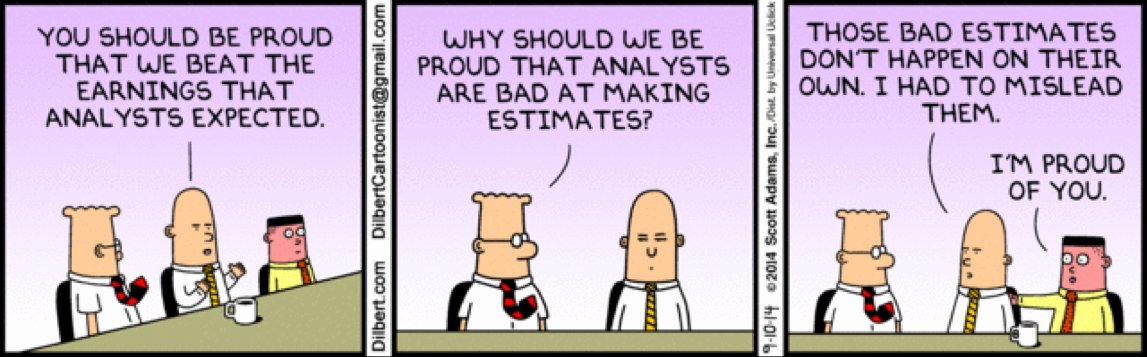

Earning Season in India :This is Best Cartoon seen (Naked Truth )

What separates the 10% that make money from the 90% that don’t?

10,000 hours.

In his recent book ‘Outliers’ Malcolm Gladwell describes the 10,000-Hour Rule, claiming that the key to success in any cognitively complex field is, to a large extent, a matter of practicing a specific task for a total of around 10,000 hours. 10,000 hours equates to around 4hrs a day for 10 years. For some reason most people that ‘try their hand’ at trading view it as a get rich quick scheme. That in a very short space of time, they will be able to turn $500 into $1 million! It is precisely this mindset that has resulted in the current economic mess, a bunch of 20-somethings being handed the red phone for financial weapons of mass destruction. The greatest traders understand that trading much like being a doctor, engineer or any other focused and technical endeavor requires time to develop and hone the skill set. Now you wouldn’t see a doctor performing open heart surgery after 3 months on a surgery simulator. Why would trading as a technical undertaking require less time?

In his recent book ‘Outliers’ Malcolm Gladwell describes the 10,000-Hour Rule, claiming that the key to success in any cognitively complex field is, to a large extent, a matter of practicing a specific task for a total of around 10,000 hours. 10,000 hours equates to around 4hrs a day for 10 years. For some reason most people that ‘try their hand’ at trading view it as a get rich quick scheme. That in a very short space of time, they will be able to turn $500 into $1 million! It is precisely this mindset that has resulted in the current economic mess, a bunch of 20-somethings being handed the red phone for financial weapons of mass destruction. The greatest traders understand that trading much like being a doctor, engineer or any other focused and technical endeavor requires time to develop and hone the skill set. Now you wouldn’t see a doctor performing open heart surgery after 3 months on a surgery simulator. Why would trading as a technical undertaking require less time?

Trading success, comes from screen time and experience, you have to put the hours in!

Education, education, education.

The old cliché touted by politicians when they can’t think of anything clever to say to their audience. The importance of education to success in trading cannot be placed on a high enough pedestal. You have to learn to earn, the best traders work obsessively to refine their edge further to stay ahead of the curve.

Think for yourself.

“NO! NO! NO!”… “Bear Stearns is not in trouble”…”Don’t move your money from Bear! That’s just silly! Don’t be silly!”

A quote from well known stock guru Jim Cramer aired on CNBC days before Bear Stearns lost 90% of its value. Many followed this call and felt the obvious pain as a result. As the old saying goes, “too many cooks spoil the broth” it is very much the same in trading. Successful traders blinker themselves from the opinions of others; they focus on their own analysis of fundamental and technical information.

Adapt or Die.

Market conditions change and technology advances, thus the conditions for trading are always evolving, the rise in mechanical trading is testament to that. The very best traders through a process of education and adaptation are constantly staying ahead of the curve and creating ever new and ingenious methods to profit from the markets evolution.

Fail to plan, you plan to fail.

The best traders have a well documented plan; they know exactly what they are looking for and follow that plan to the letter. Their preparation for a trade starts long before the market open, it is this meticulous planning and importantly adherence to that plan that helps them avoid the biggest demons for any trader, over trading and revenge trading.

“Be like Machine”

As human beings emotions pay a key role in our existence, for a trader emotions can be a source of great pain. Trading psychology and the management of your emotions in a trade play a key role in overall success. Fear and greed can cut your winners short and let your losers run. Dealing with emotions follows on from your plan; the more robust your plan the less likely you are to fall into the emotional mine field.

Know your tools

Every trader has a set of tools they use, DOM, Charts, News feeds etc. These tools are a traders bread and butter; they are the most vital part of a traders arsenal, without which it would be impossible to trade. The best traders have mastered their order entry methodology, they know all about the features they need from their charts. This mastery of their tools, allows the trader to get the very best out of the resources they have available to them and ensures perfect execution of their trading ideas.

Know Thyself

Behind all the egos and excess, the best traders know their limitations; they focus on what can go wrong in a trade, and expend a lot of energy in limiting and controlling their risk before thinking about profits. They have a heightened sense of self-awareness and focus on incremental self improvement.

Profit & Loss

The best traders focus on the trade itself rather than the P&L; they view each trade as a technical exercise and focus on getting the most out of the market in accordance with their plan. They do not think in terms of the grocery payment, the electric bill and the desire to make X amount to cover a mortgage payment. Focusing on the money behind a trade can cloud technical objectivity.

In Conclusion

The greatest traders work hard to get ahead and even harder to stay ahead. Through increased and niche knowledge they constantly adapt with the market and remain profitable in every environment. Drive, tenacity and the will to succeed is the greatest edge of every successful trader.

1) Strategy – There are so many different strategies: value, growth, momentum, short selling, etc. Find one that fits your personality and do your best to master it. The fastest way to learn is to study success. In other words, find someone who is successful at the strategy you like, and then mimic them with your own style. Another key is to recognize when the market environment is not conducive to your strategy, and make the proper adjustments.

2) Confidence – If you don’t have confidence, you have very little chance of succeeding. This doesn’t just apply to trading, it applies to EVERYTHING in life (business, athletics, relationships, etc.). With regards to trading, you have to believe in what you are doing and not be afraid to make mistakes. The key is to learn from them, make adjustments, and constantly reevaluate your progress.

3) Product Focus – There are so many different trading vehicles: futures, commodities, currencies, stocks, bonds, options, etc. It’s ok to dabble in a few things at first, but eventually you need to find out what product works best for you, focus on it, and MASTER it. As they say, don’t be a “jack of all trades and master of none.”

4) Know Your Time Frame – You must find a time frame that fits your personality. If you are too nervous, maybe short-term trading isn’t for you. Everyone wants to make tons of money in the market really fast, but keep in mind that is not a healthy approach. Most people with this mindset tend to be “boom and bust” traders. They make a bunch of money and eventually blow up. If you are truly passionate about trading and hope to be in the game for a long time, I recommend focusing on a slow and steady approach. (more…)

AMATEURS

Have tons of ideas, are excited about all of them and see none to fruition.

PROFESSIONALS

Have tons of ideas, pick one and do their best to make it happen.

AMATEURS

Think they can do everything.

PROFESSIONALS (more…)

The only thing that can change it is you. You have to make change happen yourself.

You are the Director of your life. You are the Producer. You are the Lead Actor. You are the Choreographer and Makeup Artist. You write the soundtrack. Your name is next to every title on the credits at the end of your life story.

You.

This post will not change your life. It is just words floating around in cyberspace, written by me, some guy who lives in Poona. I can’t change your life, I’ve never even met you.

You are responsible for the decisions you make. They happen between your ears and they are entirely within your control.

This post will not change your life. Only you can do that.

Updated at 12:16/19th May/Baroda

It seems crime pays… or “committing crimes, writing about them, having them adapated into a screenplay, and made into an oscar-winning movie” pays. Jordan Belfort, the “Wolf of Wall Street”, as Bloomberg reports, expects to make more money this year than he “ever made in his best year as a broker.” Having spent 22 months in jail in the 1990s, Belfort comments that ‘my goal is to make north of a $100 million so I am paying back everyone this year,” and adds some remarkably irresponsbible philosophy given the markets today and the world in which we are told we live in… “Greed is not good. Ambition is good, passion is good.” How do we BTFD if we are not greedy?

As Bloomberg reports, Jordan Belfort, whose memoir “The Wolf of Wall Street” was turned into a film by Martin Scorsese, expects to earn more than he made as a stockbroker this year, allowing him to repay the victims of his financial fraud.

“I’ll make this year more than I ever made in my best year as a broker,” Belfort told a conference in Dubai today. “My goal is to make north of a $100 million so I am paying back everyone this year.”

Belfort, a motivational speaker, will use his earnings from a 45-city speaking tour in the U.S. to repay about $50 million to investors. That was his share of the fine, he said. (more…)