Archives of “February 3, 2019” day

rssBooking Losses Before They Occur

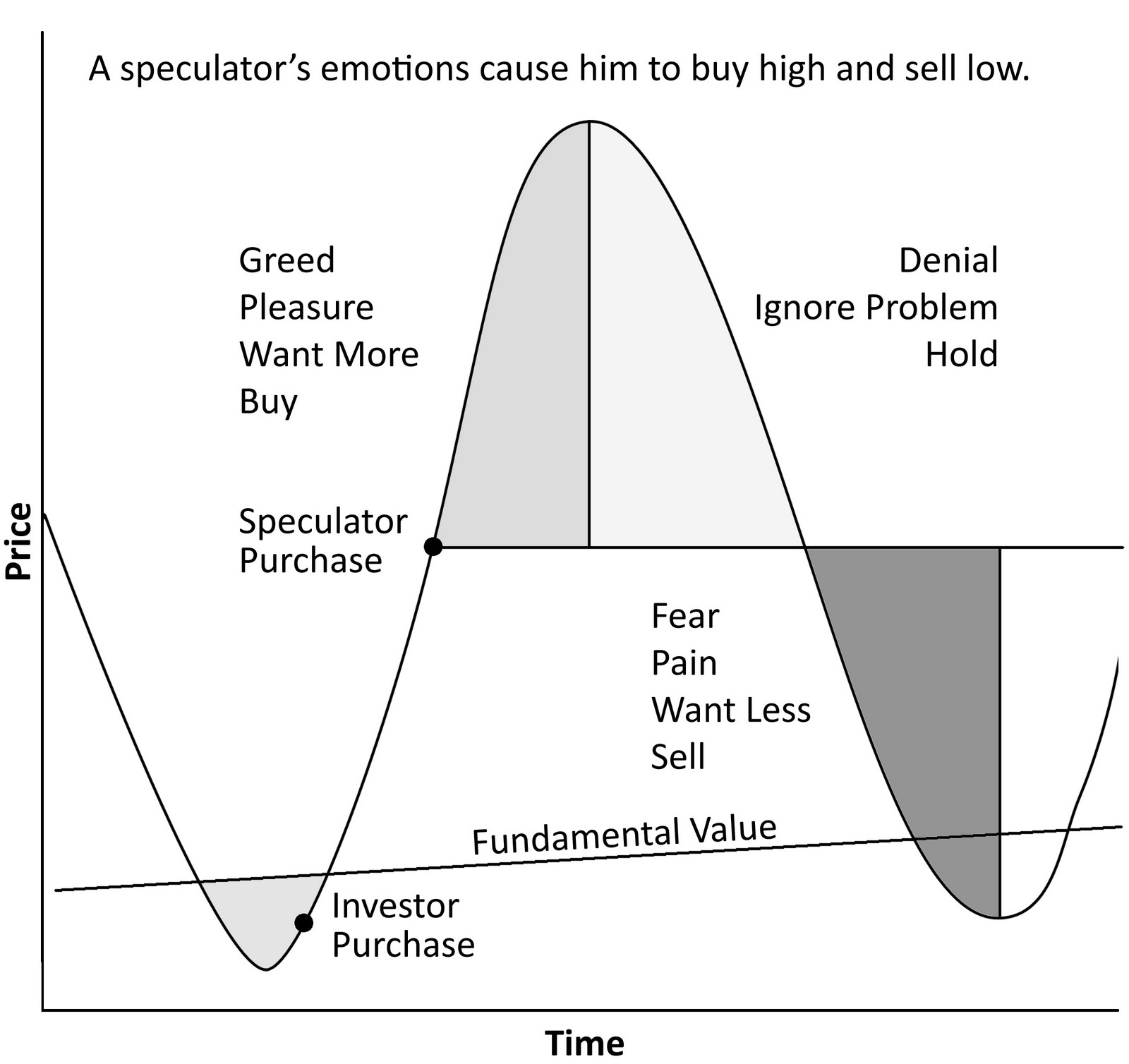

There is a meaningful difference between trading to win and trading to not lose. The average person feels more psychological pain over a loss than they feel pleasure over a gain–particularly once they have already “booked” that gain mentally.

When we enter a trade, we expect to be paid out. Mentally, we book a potential profit. When a loss materializes, it is the unexpected event–and we respond more strongly to the unexpected than to the familiar.

What is the solution to this dilemma? The answer, surprisingly, is to book losses before they occur.

It’s human nature to not want to think about such unpleasant things as losses. But by knowing our maximum possible loss in advance and by mentally rehearsing what we’ll do on those occasions when the loss occurs, we normalize the losing process. That divests it of its emotional grip.

We can never eliminate loss from life or trading; nor can we repeal the basic uncertainties of markets. What we *can* do is develop an edge in the marketplace and, over the course of many trades, let that edge accumulate in our favor.

John C. Maxwell,Sometimes You Win—Sometimes You Learn (Book Review )

We’ve all read innumerable times that we learn more from failure than from success. Well, that’s not quite accurate. The sentence should probably read: “Failure provides a better opportunity for learning than does success.” Not all people—in fact, probably few people, take advantage of the opportunity that failure offers.

We’ve all read innumerable times that we learn more from failure than from success. Well, that’s not quite accurate. The sentence should probably read: “Failure provides a better opportunity for learning than does success.” Not all people—in fact, probably few people, take advantage of the opportunity that failure offers.

John C. Maxwell, a prolific author of self-help books, wants to increase the number of learners. Sometimes You Win—Sometimes You Learn: Life’s Greatest Lessons Are Gained from Our Losses (Center Street/Hachette, October 2013) explains how to turn failure into learning. John Wooden wrote the foreword to the book, based on its outline, a few months before he died.

Losses are tough, there’s no getting around this fact. They cause us to become emotionally stuck and mentally defeated, they create a gap between knowing and doing, they never leave us the same. They hurt, but when we don’t learn from them they really hurt.

Maxwell approaches learning from multiple perspectives: the foundation of learning, the focus of learning, the motivation of learning, the pathway of learning, the catalyst of learning, the price of learning, and the value of learning. His final chapter is entitled “Winning Isn’t Everything, But Learning Is.” He incorporates anecdotes, insights from others, and apposite quotations such as Bill Gates’s famous line: “Success is a lousy teacher. It makes smart people think they can’t lose.” (more…)

Your time is limited, so don't waste it living someone else's life. —Steve Jobs

17 Trading Rules

1. Trade needs to fit like a leather glove. 100% your terms or pass. Follow your instincts!!

1. Trade needs to fit like a leather glove. 100% your terms or pass. Follow your instincts!!

2. A complete trade plan consists of entries, STOPS, and profit targets. Set a hard stop immediately for ½ position and watch other half for better exit.

3. Stick to plan and cut losers immediately! You can ALWAYS re-enter.

4. Respect your max daily loss and liquidate all positions immediately if/when hit.

5. Focus on only 1 position during the first 30 minutes for complete, undivided attention.

6. Never long a stock that is red on the day until after half time and very, very selectively (<10%).

7. Treat every trade like it is your only trade of the day/month/year.

8. Add to winners by recycling shares. Cover 1/2 into washes and re-short 1/4 on pops but reduce size each time.

9. Take a considerable timeout before switching bias from short to long.

10. Avoid shorting day 1 on low floaters – only para scalps with cover into following wash.

11. Wait for the back side of move to bring the hammer down when shorting.

12. Focus on the meat of the move, not trying to top and bottom tick everything.

13. If you have given back ¾ of daily profits, call it quits. You should never turn a green day to red.

14. Just had a monster day (good or bad)? Take tomorrow off.

15. NEVER say NEVER! Even shit can fly high if thrown hard enough.

16. Be very cautious when dip buying (small size, tight stops) – especially near potential back side.

17. 3 day rule. Better to bring the heat after day 3 of big moves.

Trading Decision-Making Process

There is a huge difference between a wish and a decision. A wish is a negative and puts the trader in a frozen state waiting for something to happen (generally associated with trying to get even on losing trades). That is negatively charged energy. Decisions, on the other hand, are positively charged energy. It makes the trader take action. Taking action is taking responsibility. You alone are responsible for your current mental state or condition. Decisions can be both good and bad of course. The sooner the trader realized the bad decision, the sooner they can act to correct it.

There is a huge difference between a wish and a decision. A wish is a negative and puts the trader in a frozen state waiting for something to happen (generally associated with trying to get even on losing trades). That is negatively charged energy. Decisions, on the other hand, are positively charged energy. It makes the trader take action. Taking action is taking responsibility. You alone are responsible for your current mental state or condition. Decisions can be both good and bad of course. The sooner the trader realized the bad decision, the sooner they can act to correct it.

The first step in the decision-making process is to realize that what you are doing is not working. Remember that falling down is a positive motions is you bounce right back. Make a list of the positive and negative things that will happen when you take action on the decision.

Don’t expect instant gratification if you make the decision. Decision-making is a process that begins with the first step but these steps are the foundation for a stronger behavioral structure. This structure will give you the confidence in your trading. Confidence plays a key role in successful trading. Having the confidence necessary for successful trading can help the trader in difficult trading environments. Whereas one trader lacking confidence and good decision-making skills may be frozen and unable to act, the trader who has taken the time to build this foundation will be prepared to take the appropriate actions.

Many times specific decisions a trader makes will not yield profits, they will result in a loss, but more importantly, it will position the trader to be able to recognize and act on the next opportunity. Practicing and applying this process will pay dividends throughout your lifetime.

Why Switzerland Has The Lowest Crime Rate In The World

Profile Of The Successful Trader:

Trading is being young, imperfect, and human – not old, exacting, and scientific. It is not a set of techniques, but a commitment. You are to be an information processor. Not a swami. Not a guru. An information processor.

Participating in the markets can only develop your trading skills. You need to become a part of the markets, to know the state of the markets at any given time, and most importantly, to know yourself. You need to be patient, confident, and mentally tough.

Good traders offer no excuses, make no complaints. They live willingly with the vagaries of life and the markets.

In the early stages of your trading career, pay attention not only to whether you should buy or sell but also to how you have executed your trading ideas. You will learn more from your trades this way.

Never assume that the unreasonable or the unexpected cannot happen. It can. It does. It will. (more…)

Which are the most atheist European countries?

Becoming a Successful Speculator

The capacity for rigorous thought; the flexibility and resilience to adapt to changing circumstances; the love of disciplined risk-taking; the hungry intellect: perhaps successful speculators already display those qualities in other life domains and then learn to apply them to markets.

Trading is being young, imperfect, and human – not old, exacting, and scientific. It is not a set of techniques, but a commitment. You are to be an information processor. Not a swami. Not a guru. An information processor.

Trading is being young, imperfect, and human – not old, exacting, and scientific. It is not a set of techniques, but a commitment. You are to be an information processor. Not a swami. Not a guru. An information processor.