Archives of “February 1, 2019” day

rssNever Revenge On The Market

There is a direct correlation between your ability to let the market tell you what it is likely to do next and the degree to which you have released yourself from the negative effects of any beliefs about losing, being wrong, and revenge on the markets. Not being aware of this relationship, most traders will continue to observe the market from a contaminated perspective.—-The Disciplined Trader,Mark Douglas

There is a direct correlation between your ability to let the market tell you what it is likely to do next and the degree to which you have released yourself from the negative effects of any beliefs about losing, being wrong, and revenge on the markets. Not being aware of this relationship, most traders will continue to observe the market from a contaminated perspective.—-The Disciplined Trader,Mark Douglas

Economics has evolved into a corrupt, obfuscating and harmful field of study

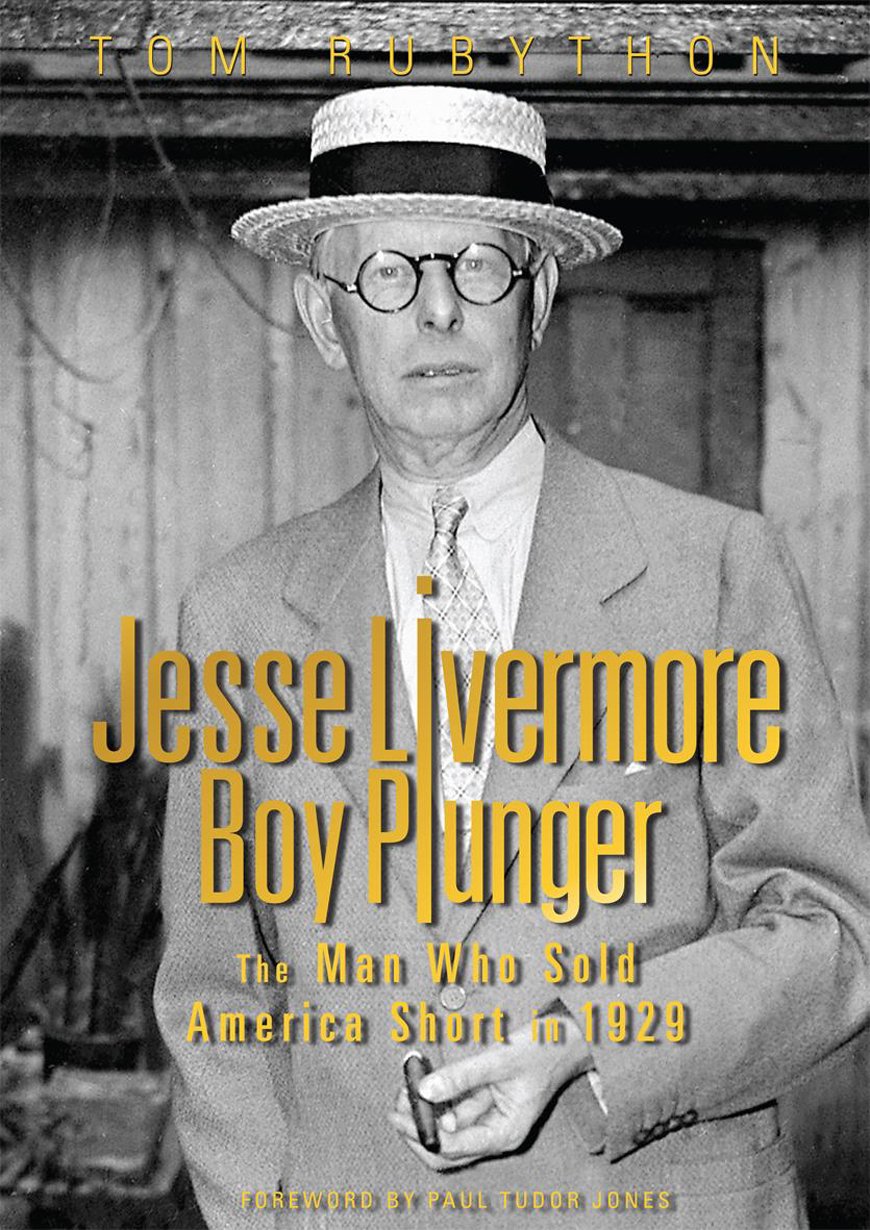

Book Review : Jesse Livermore: Boy Plunger

This is a story of triumph and tragedy. Jesse Livermore is notable as one of the few people who ever made it into the richest tiers of society by speculating — by trading stocks and commodities — betting on price movements.

This is a story of triumph and tragedy. Jesse Livermore is notable as one of the few people who ever made it into the richest tiers of society by speculating — by trading stocks and commodities — betting on price movements.

This is three stories in one. Story one is the clever trader with an intuitive knack who learned to adapt when conditions changed, until the day came when it got too hard. Story two is the man who lacked financial risk control, and took big chances, a few of which worked out spectacularly, and a few of ruined him financially. Story three is how too much success, if not properly handled, can ruin a man, with lust, greed and pride leading to his death.

The author spends most of his time on story one, next most on story two, then the least on story three. The three stories flow naturally from the narrative that is largely chronological. By the end of the book, you see Jesse Livermore — a guy who did amazing things, but ultimately failed in money and life.

Let me briefly summarize those three aspects of his life so that you can get a feel for what you will run into in the book:

The Clever Trader

Jesse Livermore came to the stock market in Boston at age 14, and was a very quick study. He showed intuition on market affairs that impressed the most of the older men who came to trade at the brokerage where he worked. It wasn’t too long before he wanted to invest for himself, but he didn’t have enough money to open a brokerage account, so he went to a bucket shop. Bucket shops were gambling parlors where small players gambled on stock prices. He showed a knack for the game and made a lot of money. Like someone who beats the casinos in Vegas, the proprietors forced him to leave.

He then had more than enough money to meet his current needs, and set up a brokerage account. But the stock market did not behave like a bucket shop, and so he lost money while he learned to adapt. Eventually, he succeeded at speculating on both stocks and commodities, leading to his greatest successes in being short the stock market prior to the panic of 1907, and the crash in 1929. During the 1920s, he started his own firm to try to institutionalize his gifts, and it worked for much of the era. (more…)

Tuff & Goldbach, Detonate -Book Review

Here I’ll summarize three points the authors make.

First, force your opponents to make a choice. “[A] truism in poker is that you can’t learn anything about your opponents if you don’t bet. … If you want to get information about your opponent, you need to force them to make a decision.” Businesses, they contend, should “stop asking, and start observing, simulating, and inferring.” A very funny cartoon illustrates their point.

Second, don’t try to design a whole system at the outset. The “mother of all snow forts” is a case in point. A snowstorm that leveled Boston in 2006 prompted one of the authors and his sons to design an elaborate snow fort, with an access point where they could drop into the fort from a second-floor bedroom window and “an offshoot tunnel that went right up to the kitchen window from which they could supply the fort with hot chocolate and something slightly stronger for the adults…. After a morning’s worth of design and a table full of drawings, they truly had something magnificent. Then they did nothing.” The task was too daunting. The authors ask what would have happened had they just started digging instead of spending all their time planning. They might have created something magnificent, or perhaps not much more than an igloo. But it would at least have been something rather than nothing. The point of the story: “focus on a minimally viable move to get going, trusting that something good will come of it even though you may not have the end game in mind.” Another cartoon illustrates the futility of over-systematizing in the planning stage.

Third, focus on the core rather than the periphery. Although there is a rationale for tinkering around the edges, the authors want to shift “the core from the inside.” They “don’t think you can blow up playbooks effectively and permanently from the periphery.”

Detonate challenges assumptions, tradition, and apathy. It is a business book, yes, but some of its principles reach far beyond the corporate world. I thoroughly enjoyed it.

Global Stock Market in one Chart

Repercussion of OverTrading in 7 Simple Steps

Jesse Livermore On You Don’t Have To Be Active Every Day

Always Remember This….

Two Key Questions

1) Do the problems that affect your trading also impact other areas of your life? – Let’s say that you find yourself overtrading and taking too much risk relative to your planned exposure. You realize that these lapses of discipline are costing you money and creating significant frustration. The key question to ask is whether these lapses also occur in other spheres of life: in managing personal finances, in failing to follow through on personal responsibilities, or in impulsive decision-making regarding career, relationships, and the future. If so, then you know that this is a general problem that is spilling over into trading. Working with a psychologist or other licensed therapist or counselor could be the best way to go, as this is not uniquely a trading problem. Alternatively, if the problem truly is unique to trading, then it is probably triggered by situational factors related to how you are trading. Relying on a trading coach to review your trading practices and address these factors can be promising.

1) Do the problems that affect your trading also impact other areas of your life? – Let’s say that you find yourself overtrading and taking too much risk relative to your planned exposure. You realize that these lapses of discipline are costing you money and creating significant frustration. The key question to ask is whether these lapses also occur in other spheres of life: in managing personal finances, in failing to follow through on personal responsibilities, or in impulsive decision-making regarding career, relationships, and the future. If so, then you know that this is a general problem that is spilling over into trading. Working with a psychologist or other licensed therapist or counselor could be the best way to go, as this is not uniquely a trading problem. Alternatively, if the problem truly is unique to trading, then it is probably triggered by situational factors related to how you are trading. Relying on a trading coach to review your trading practices and address these factors can be promising.

2) Do the problems primarily result from poor trading, or are the problems a primary cause of poor trading? – This can be tricky to sort out, because the direction of causality often goes both ways. Many times, poor trading practices–such as trading excessive risk–lead to emotional fallout, such as frustration, anxiety, or even depression. Working on changing emotions might be helpful, but the root cause–the faulty money management–needs to be addressed. Conversely, there are times when emotional problems, such as performance anxiety, get in the way of trading plans and trading results. It is very helpful to examine trading problems in a step-by-step fashion, to see where emotions are affecting trading and to see where trading is creating emotional pressures. (more…)