This is what Crude Oil looks like.

Mexico is paying the price for not being open in its development of crude reserves.

What is the real consumer impact on our economy?

Not only should we not get rid of nuclear weapons, but giving one to an unstable country often makes it safer to deal with them.

Just another step along China’s path to economic and political liberalization, it’s happening right before our eyes people.

My father, who is a real estate attorney in NYC, told me this week that all of the sudden he is slammed with deals after nothing for the past year, interesting.

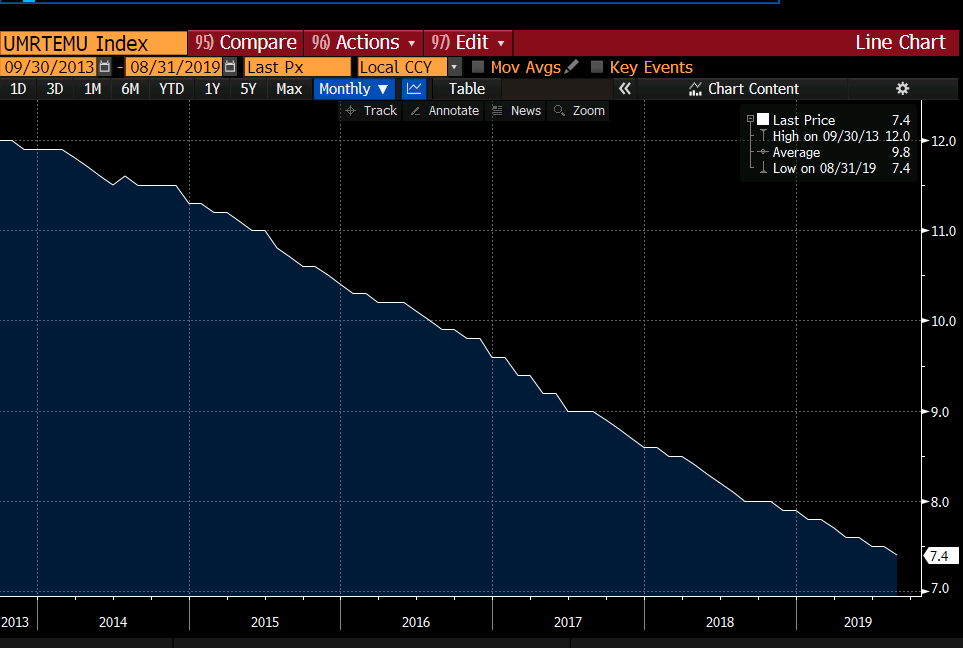

Good luck finding a job right now.

What happens when California reaches 15% unemployment and crude trades at 100$.

The is ZERO value in cable news, Thomas Barnett is one of my favorite writers by the way.

I will volunteer to colonize the moon, but I don’t ever want to pay taxes up there.

Who gets how much oil from Iran.

There is no such thing as a safe haven for terrorist organizations anymore.

If you have the time and desire, please read this report on China, it’s long, but well worth it.

For all the ruckus in 08′, investing in hedge funds will always be better than leaving it to the market.

Smart kids will always want to go into investment banking, dumb rich kids as well.