Nasdaq up over 35% on year

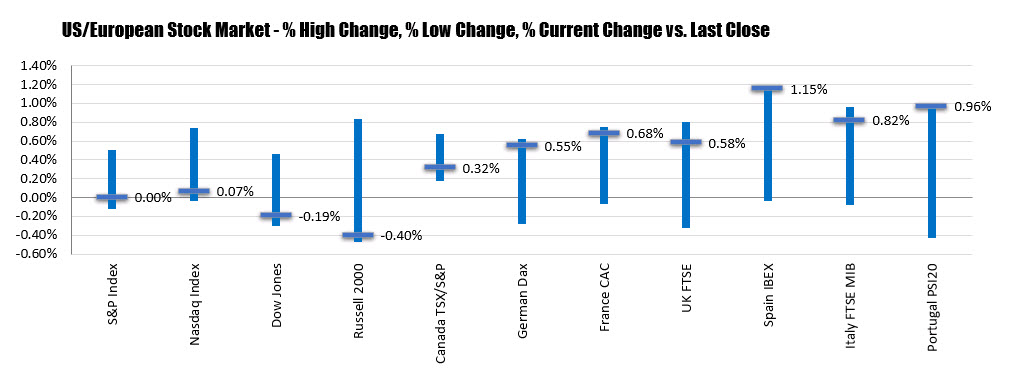

- S&P index rose 9.41 points or 0.29% to 3230.70

- NASDAQ index rose 26.611 points or 0.30% to 8972.60

- Dow rose 76.1 points or 0.27% to 28538.24

Some winners on the day include:

The bias has turned more favourable in the most recent poll with a slim majority of respondents (53/102) viewing that risks to the outlook are now skewed more to the upside.

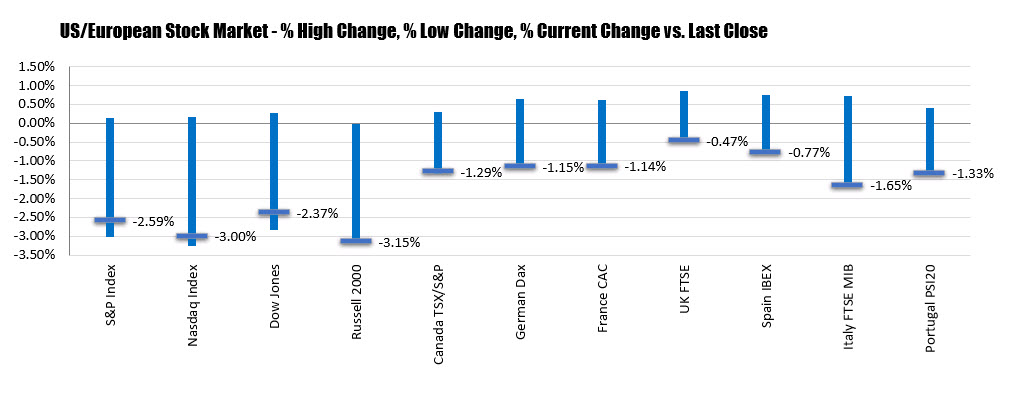

For the year, the major indices are still showing strong gains after the down year in 2018.

For practitioners of Schadenfreude, seeing high-profile investors losing their shirts is always amusing.

But for the true connoisseur, the finest expression of the art comes when a high-profile investor identifies a bubble, perhaps even makes money out of it, exits in time – and then gets sucked back in only to lose everything in the resultant bust.

An early example is the case of Sir Isaac Newton and the South Sea Company, which was established in the early 18th Century and granted a monopoly on trade in the South Seas in exchange for assuming England’s war debt.

Investors warmed to the appeal of this monopoly and the company’s shares began their rise.

Britain’s most celebrated scientist was not immune to the monetary charms of the South Sea Company, and in early 1720 he profited handsomely from his stake. Having cashed in his chips, he then watched with some perturbation as stock in the company continued to rise.

In the words of Lord Overstone, no warning on earth can save people determined to grow suddenly rich.

Newton went on to repurchase a good deal more South Sea Company shares at more than three times the price of his original stake, and then proceeded to lose £20,000 (which, in 1720, amounted to almost all his life savings).

This prompted him to add, allegedly, that “I can calculate the movement of stars, but not the madness of men.”

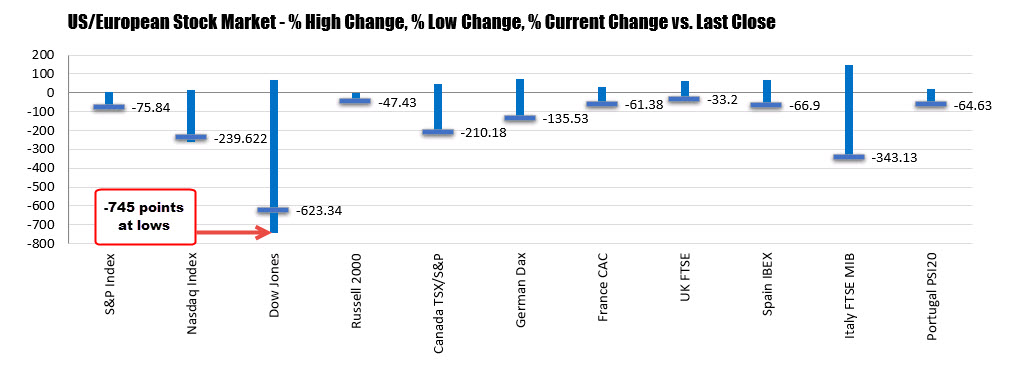

The major US stock indices were spooked by weaker than expected ISM manufacturing data . Shortly after the data came out, the major indices turned from being up to being down.

What seemed to be a negative catalyst for stocks was a report that a White House official commented that tariffs on China could go as high as 50 to 100%. That spooked the market and prices started to ratchet lower.

Looking at the point changes, the Dow was down -745 points at the lows.