- You can have virtually anything you want, but you can’t have everything you want.

- Life is like a giant smorgasbord of more delicious alternatives than you can ever hope to taste. So you have to reject having some things you want in order to get other things you want more.

- Some people fail at this point, afraid to reject a good alternative for fear that the loss will deprive them of some essential ingredient to their personal happiness. As a result, they pursue too many goals at the same time, achieving few or none of them.

- In other words, you can have an enormous amount: much, much more than what you need to have for a happy life. So don’t get discouraged by not being able to have everything you want, and for God’s sake, don’t be paralyzed by the choices. That’s nonsensical and unproductive. Get on with making your choices.

Archives of “ray dalio” tag

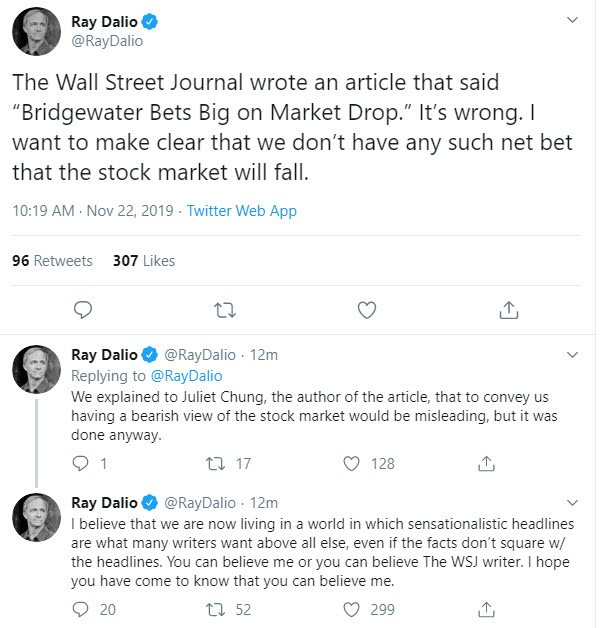

rssRay Dalio debunks WSJ story about his bearish position

Ray Dalio from Bridgewater Associates responsed to WSJ article

3 Trading Lessons

A good trade can lose money, and a bad trade can make money. Even the best trading processes will lose a certain percentage of the time. There is no way of knowing a priori which individual trade will make money. As long as a trade adhered to a process with a positive edge, it is a good trade, regardless of whether it wins or loses because if similar trades are repeated multiple times, they will come out ahead. Conversely, a trade that is taken as a gamble is a bad trade regardless of whether it wins or loses because over time such trades will lose money. Ray Dalio, the founder of Bridgewater, the world’s largest hedge fund, strongly believes that learning from mistakes is essential to improvement and ultimate success. Each mistake, if recognized and acted upon, provides an opportunity for improving a trading approach. Most traders would benefit by writing down each mistake, the implied lesson, and the intended change in the trading process. Such a trading log can be periodically reviewed for reinforcement. Trading mistakes cannot be avoided, but repeating the same mistakes can be, and doing so is often the difference between success and failure. For some traders, the discipline and patience to do nothing when the environment is unfavorable or opportunities are lacking is a crucial element in their success. For example, despite making minimal use of short positions, Kevin Daly, the manager of the Five Corners fund, achieved cumulative gross returns in excess of 800% during a 12-year period when the broad equity markets were essentially flat. In part, he accomplished this feat by having the discipline to remain largely in cash during negative environments, which allowed him to sidestep large drawdowns during two major bear markets. The lesson is that if conditions are not right, or the return/risk is not sufficiently favorable, don’t do anything. Beware of taking dubious trades out of impatience. |

15 Great Investor & Trader Quotes

Warren Buffett (Net Worth $39 Billion) – “‘Price is what you pay; value is what you get.’ Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

George Soros (Net Worth $22 Billion) – ”I’m only rich because I know when I’m wrong…I basically have survived by recognizing my mistakes.”

David Rubenstein (Net Worth $2.8 Billion) – “Persist – don’t take no for an answer. If you’re happy to sit at your desk and not take any risk, you’ll be sitting at your desk for the next 20 years.”

Ray Dalio (Net Worth $6.5 Billion) – “More than anything else, what differentiates people who live up to their potential from those who don’t is a willingness to look at themselves and others objectively.”

Eddie Lampert (Net Worth $3 Billion) – “This idea of anticipation is key to investing and to business generally. You can’t wait for an opportunity to become obvious. You have to think, “Here’s what other people and companies have done under certain circumstances. Now, under these new circumstances, how is this management likely to behave?”

T. Boone Pickens (Net Worth $1.4 Billion) – “The older I get, the more I see a straight path where I want to go. If you’re going to hunt elephants, don’t get off the trail for a rabbit.”

Charlie Munger (Net Worth $1 Billion) – “If you took our top fifteen decisions out, we’d have a pretty average record. It wasn’t hyperactivity, but a hell of a lot of patience. You stuck to your principles and when opportunities came along, you pounced on them with vigor.”

David Tepper (Net Worth $5 Billion) – “This company looks cheap, that company looks cheap, but the overall economy could completely screw it up. The key is to wait. Sometimes the hardest thing to do is to do nothing.”

Benjamin Graham – “The individual investor should act consistently as an investor and not as a speculator. This means that he should be able to justify every purchase he makes and each price he pays by impersonal, objective reasoning that satisfies him that he is getting more than his money’s worth for his purchase.”

Louis Bacon (Net Worth $1.4 Billion) – “As a speculator you must embrace disorder and chaos.”

Paul Tudor Jones (Net Worth $3.2 Billion) – “Were you want to be is always in control, never wishing, always trading, and always, first and foremost protecting your butt. After a while size means nothing. It gets back to whether you’re making 100% rate of return on $10,000 or $100 million dollars. It doesn’t make any difference.”

Bruce Kovner (Net Worth $4.3 Billion) – ” My experience with novice traders is that they trade three to five times too big. They are taking 5 to 10 percent risks on a trade when they should be taking 1 to 2 percent risks. The emotional burden of trading is substantial; on any given day, I could lose millions of dollars. If you personalize these losses, you can’t trade.”

Rene Rivkin (Net Worth $346 Million) – “When buying shares, ask yourself, would you buy the whole company?”

Peter Lynch (Net Worth $352 Million) – “I think you have to learn that there’s a company behind every stock, and that there’s only one real reason why stocks go up. Companies go from doing poorly to doing well or small companies grow to large companies.”

John Templeton (Net Worth $20 Billion)– “The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell.”

John (Jack) Bogle (Net Worth $4 Billion) – “If you have trouble imagining a 20% loss in the stock market, you shouldn’t be in stocks.”

Ray Dalio Principles

- I remained wary about being overconfident, and I figured out how to effectively deal with my not knowing. I dealt with my not knowing by either continuing to gather information until I reached the point that I could be confident or by eliminating my exposure to the risks of not knowing.

- While most others seem to believe that learning what we are taught is the path to success, I believe that figuring out for yourself what you want and how to get it is a better path.

- How much do you let what you wish to be true stand in the way of seeing what is really true?

- How much do you worry about looking good relative to actually being good?

- The most important qualities for successfully diagnosing problems are logic, the ability to see multiple possibilities, and the willingness to touch people’s nerves to overcome the ego barriers that stand in the way of truth.

- Know what you want and stick to it if you believe it’s right, even if others want to take you in another direction.

- In a nutshell, this is the whole approach that I believe will work best for you—the best summary of what I want the people who are working with me to do in order to accomplish great things. I want you to work for yourself, to come up with independent opinions, to stress-test them, to be wary about being overconfident, and to reflect on the consequences of your decisions and constantly improve.

What Ray Dalio and Art Cashin think of the latest market moves

Two articles are doing the rounds. The first is a letter from Bridgewater hedge fund titan Ray Dalio, who has long believed the world is in a great deleveraging. He doubles down today and says the next ‘big’ Fed move will be more QE.

Here’s the crux:

the ability of central banks to ease is limited, at a time when the risks are more on the downside than the upside and most people have a dangerous long bias. Said differently, the risks of the world being at or near the end of its long-term debt cycle are significant.

That is what we are most focused on. We believe that is more important than the cyclical influences that the Fed is apparently paying more attention to.

While we don’t know if we have just passed the key turning point, we think that it should now be apparent that the risks of deflationary contractions are increasing relative to the risks of inflationary expansion because of these secular forces. These long-term debt cycle forces are clearly having big effects on China, oil producers, and emerging countries which are overly indebted in dollars and holding a huge amount of dollar assets-at the same time as the world is holding large leveraged long positions.

While, in our opinion, the Fed has over-emphasized the importance of the “cyclical” (i.e., the short-term debt/business cycle) and underweighted the importance of the “secular” (i.e., the long-term debt/supercycle), they will react to what happens. Our risk is that they could be so committed to their highly advertised tightening path that it will be difficult for them to change to a significantly easier path if that should be required.

Next is NYSE floor veteran Art Cashin at UBS. Some of his comments are mute because he talks about the potential for China to cut rates and that’s already taken place. He says to watch high yield closely and Jackson Hole.

Vice-Chair Stanley Fischer will be speaking later this week at the Jackson Hole conference. I think he will be addressing the problem of inflation and that it’s not growing in the pace they want it. That will give the world a hint that the Fed is not quite ready to raise interest rates.

Schwager’s New Hedge Market Wizards Book w/ Dalio, Thorp, Woodriff

Looks like Schwager is putting out a new version of his famous Market Wizards series. Personally I’d like to see a “where are they now” from the past few books. (His other books here.)

Hedge Fund Market Wizards

Table of Contents

Introduction

Part I: Macro Men

Chapter 1 Colm O’Shea: Knowing When It’s Raining

Chapter 2 Ray Dalio: The Man Who Loves Mistakes

Chapter 3 Scott Ramsey: Low-Risk Futures Trader

Chapter 4 Jamie Mai: Seeking Asymmetry

Chapter 5 Jaffray Woodriff: The Third Way

Part II: Multi

Chapter 6 Edward Thorp: The Innovator

Chapter 7 Larry Benedict: Beyond Three Strikes

Chapter 8 Michael Platt: The Art and Science of Risk Control

Part III: Equity

Chapter 9 Steve Clark: Do more of What Works and Less of What Doesn’t

Chapter 10 Martin Taylor: The Tsar Has No Clothes

Chapter 11 Tom Claugus: A Change of Plans

Chapter 12 Joe Vidich: Harvesting Losses

Chapter 13 Kevin Daly: Who Is Warren Buffett?

Chapter 14 Jimmy Balodimas: Stepping in Front of Freight Trains

Chapter 15 Joel Greenblatt: The Magic Formula

Conclusion 40 Market Wizard Lessons

Appendix 1 The Gain to Pain Ratio

Appendix 2 TITLE TK

Ray Dalio eclipses George Soros as most successful fund manager

Bridgewater founder with ‘radically transparent’ approach to investing has the last laugh

Almost 40 years ago, a young Harvard graduate called Ray Dalio was trading futures at a brokerage called Shearson Hayden Stone. His boss was one Sandy Weill, who would go on to become famous as chairman and chief executive of Citigroup.

It was a promising start in finance. But the promise did not last long: Wall Street legend has it that after just a year in the job Dalio was sacked for taking a stripper to a client presentation.

Such a debut could have led to the rookie drifting off into obscurity – or just as easily have been the beginning of prolonged fame. Yet neither happened.

Instead, the son of a jazz musician sloped off and founded his own hedge fund, Bridgewater, from a two-bedroom apartment. It took three decades operating out of Westport, Connecticut before people outside the sector started to talk about Dalio once again.

The credit crisis was the trigger that propelled the money manager’s name back into Wall Street conversation, after providing him with the platform to outshine rivals and reap massive rewards.

This week the 62-year-old’s fortune was put at $10bn (£6.3bn) in Forbes’s latest list of billionaires. Last month he was lauded as the most successful hedge fund manager in history, after new rankings compiled by LCH Investments showed the $13.8bn that his Bridgewater Pure Alpha fund made in 2011 had propelled Dalio past the grandaddy of hedge fund investing, George Soros, in terms of returns to investors. (more…)

Five Market Wizard Lessons

“Five Market Wizard Lessons”

Hedge Fund Market Wizards is ultimately a search for insights to be drawn from the most successful market practitioners. The last chapter distills the wisdom of the 15 skilled traders interviewed into 40 key market lessons. A sampling is provided below:

1. There Is No Holy Grail in Trading

Many traders mistakenly believe that there is some single solution to defining market behavior. Not only is there no single solution to the markets, but those solutions that do exist are continually changing. The range of the methods used by the traders interviewed in Hedge Fund Market Wizards, some of which are even polar opposites, is a testament to the diversity of possible approaches. There are a multitude of ways to be successful in the markets, albeit they are all hard to find and achieve.

2. Don’t Confuse the Concepts of Winning and Losing Trades with Good and Bad Trades

A good trade can lose money, and a bad trade can make money. Even the best trading processes will lose a certain percentage of the time. There is no way of knowing a priori which individual trade will make money. As long as a trade adhered to a process with a positive edge, it is a good trade, regardless of whether it wins or loses because if similar trades are repeated multiple times, they will come out ahead. Conversely, a trade that is taken as a gamble is a bad trade regardless of whether it wins or loses because over time such trades will lose money. (more…)

15 Great Investor Quotes

Insightful Investment Quotes

Warren Buffett (Net Worth $39 Billion) – “‘Price is what you pay; value is what you get.’ Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

Warren Buffett (Net Worth $39 Billion) – “‘Price is what you pay; value is what you get.’ Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

George Soros (Net Worth $22 Billion) – ”I’m only rich because I know when I’m wrong…I basically have survived by recognizing my mistakes.”

George Soros (Net Worth $22 Billion) – ”I’m only rich because I know when I’m wrong…I basically have survived by recognizing my mistakes.”

David Rubenstein (Net Worth $2.8 Billion) – “Persist – don’t take no for an answer. If you’re happy to sit at your desk and not take any risk, you’ll be sitting at your desk for the next 20 years.”

David Rubenstein (Net Worth $2.8 Billion) – “Persist – don’t take no for an answer. If you’re happy to sit at your desk and not take any risk, you’ll be sitting at your desk for the next 20 years.”

Ray Dalio (Net Worth $6.5 Billion) – “More than anything else, what differentiates people who live up to their potential from those who don’t is a willingness to look at themselves and others objectively.” (more…)

Ray Dalio (Net Worth $6.5 Billion) – “More than anything else, what differentiates people who live up to their potential from those who don’t is a willingness to look at themselves and others objectively.” (more…)