Comments by Japan prime minister, Shinzo Abe, in parliament

- Economy is in an extremely severe state

- This will continue for some time

- Japan not seeing an explosive increase in virus cases now

Highlights for today’s near trading session:

Their sampling of 1,000 Likely Voters taken a week ago shows a slight edge to the Big Orange. 46% think the President will be re-elected; 33% think he will lose to the Democrat and 12% think he will be convicted by the Senate. 9% are unsure. The sample weights a Democrat preponderance 38% to 32% Republican with the remaining 30% as independent. PredictIt shows the same: 52 cents for the Republican candidate to win; 51 cents for the Democrat.

The London Bookies have a very different view.

From Oddschecker:

Donald Trump -110

Joe Biden +500

Bernie Sanders +750

Pete Buttigieg +2000

Elizabeth Warren +2000

Michael Bloomberg +2000

Hillary Clinton +5000

Andrew Yang +5000

This was expected at this point but there was a small risk he would change his mind.

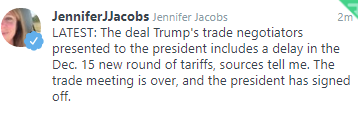

This was expected at this point but there was a small risk he would change his mind.As U.S. President Donald Trump prepares for high-level trade negotiations with China next month, a sharp turn of events has blurred the timeline of a deal.

On Tuesday, Democratic House Speaker Nancy Pelosi shocked the nation when she announced an impeachment inquiry into Trump. Pelosi had resisted calls to start formal proceedings against the president during and after the Mueller investigation, but the latest allegations about Trump pressing Ukrainian President Volodymyr Zelensky to investigate former U.S. Vice President and Trump’s political rival Joe Biden’s family pushed her to act.

Trump on Wednesday sought to shift the focus away from the inquiry, praising the U.S. economy and an imminent trade deal with China.

“We have created the greatest economy in the history of our country, the greatest economy in the world…. Right now China is way behind us and they will never catch us if we have smart leadership,” Trump told reporters. “We have picked up trillions of dollars and they have lost trillions of dollars and they want to make a deal very badly. It could happen. It could happen sooner than you think.”

The comment came an hour after Trump released a transcription of his phone call with Zelensky from July 25. The president was under pressure from Democrats and some Republicans to make public the transcript after a whistleblower filed a complaint saying he pressured the Ukrainian president to investigate Biden’s son Hunter Biden as well as a Democratic National Committee computer server related to Russian interference in the 2016 election.

Trump said last week that China would like to see someone else win the 2020 presidential election, but they think he is going to win. He has warned Beijing that if the deal comes after the Nov. 3, 2020 election, trade talks will be on “far worse” terms.