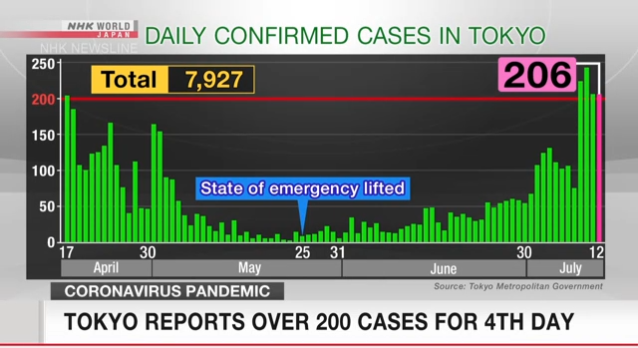

Comments by Japanese prime minister, Shinzo Abe

- Coronavirus cases are rising, government is watching closely

“The Governing Council will hold the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved.”

German bunds were trading at -0.46% yesterday on the 10 year chart which is 10bps lower than a Bloomberg modelled curve mentioned on the Bloomberg Live Blog yesterday. This is most likely due to positioning ahead of the European Council’s summit.

On Friday and Saturday of this week EU policy makers will meet to discuss the proposed €750 billion recovery plan.The big questions is whether nations like Austria, Denmark, Sweden, Netherland and Finland will block the plan. The issue is that these countries are opposed to the idea of large handouts on principle.However, despite their reluctance, the present crisis means their reticence may be seen as mean spirited in a time of shared humanitarian crisis. The pressure is for the countries concerned about the ideas of grants rather than loans to approve this proposed fund.On July 10 we had a German official state that Netherlands is unlikely to block the EU recovery fund which is supportive of the fund being accepted.

On Thursday we have the ECB rate meeting with little change expected. With the PEPP program increasing by €600 billion euros last month it is unlikely that we see any changes to the PEPP program on Thursday.

The risk

If the recovery fund is rejected by the frugal four expect immediate downside for the EUR. However, given that the second day of the meeting is taking place over the weekend this is going to be weekend risk for the EUR.