Hopes f him him him rom Gilead news propel European shares higher.

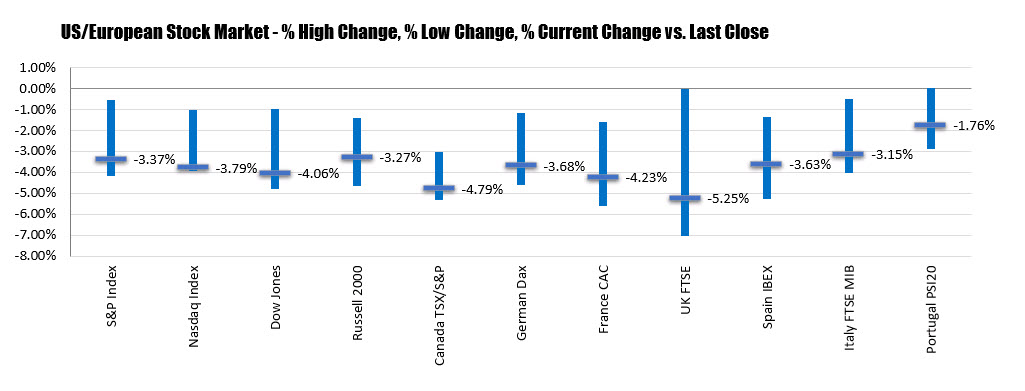

- German DAX, +3.0%

- France’s CAC, +2.32%

- UK’s FTSE 100, +2.77%

- Spain’s Ibex, +3.24%

the major indices all closing higher for the day with the NASDAQ index leading the way to the upside. The Dow industrial average posted a gain for the 3rd day in a row. All 11 sectors of the S&P closed higher.

The NASDAQ index is the star performer today, rising for the 4th day in a row closing above its 50 day and 200 day moving averages. The close above the 200 day moving averages the 1st since March 6. The other indices also had solid days today with the S&P and Dow closing at the highest level since March 10.

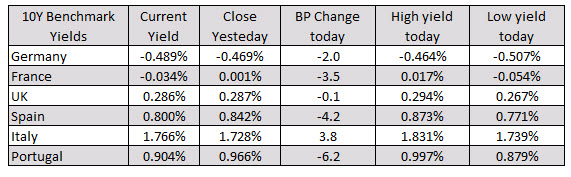

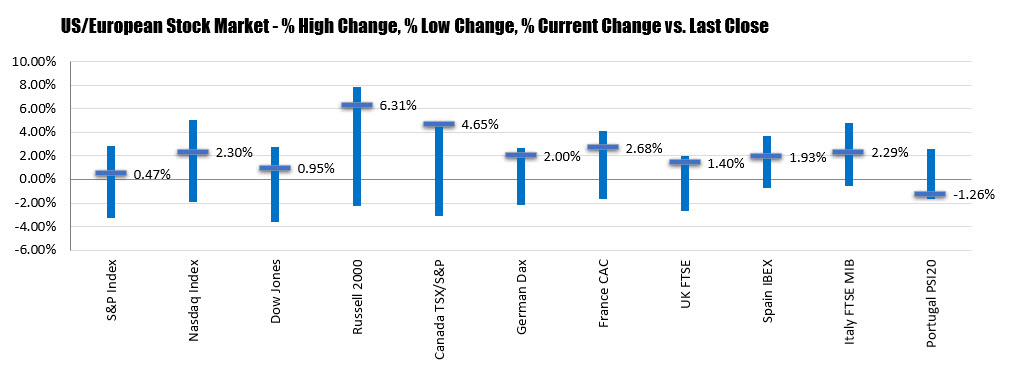

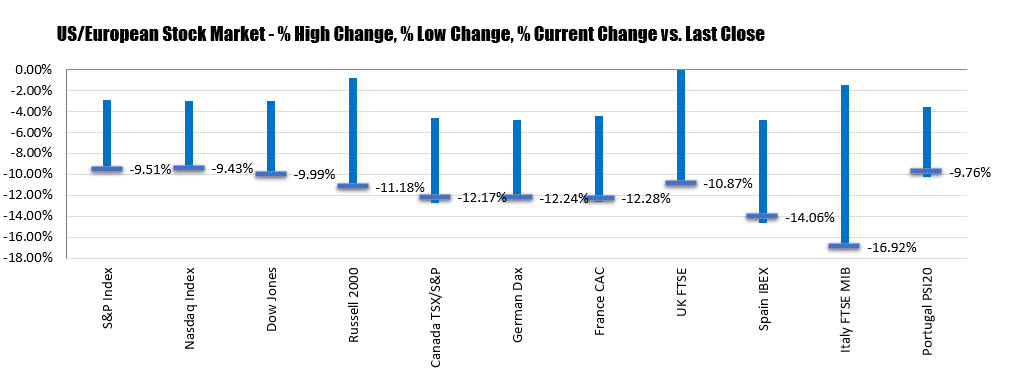

The closing levels are lower at:

Although lower for the day for all major indices closed with gains.

Although lower for the day for all major indices closed with gains.

The US stock indices are closing higher on the day but off the highs for the day. I guess you can say there well off the lows for the day too. The NASDAQ index was down -1.8% at the lows, and up 5.03% the highs. It closed up 2.3%. The volatility is red hot.

What an active day:

So what happened in the markets?

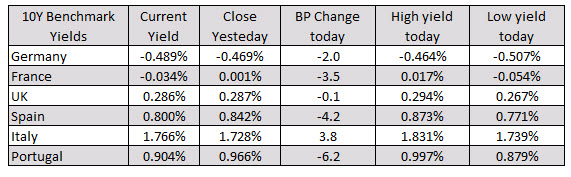

Stocks plummeted

In the gold and precious metals market, prices fell.

Year to date numbers are showing:

Year to date numbers are showing: