Archives of “money” tag

rssFed’s overnight repo was oversubscribed again

Fed funds effective rate

Nikkei 225 closes higher by 0.06% at 22,001.32

Tokyo’s main index returns from the long weekend to finish near flat levels today

It’s a bit of a mixed bag in Asia as Japanese stocks are playing catch up to the events in Saudi Arabia so we’re seeing O&G stocks do the heavy-lifting in Tokyo, offsetting geopolitical tensions that are weighing on risk sentiment elsewhere.

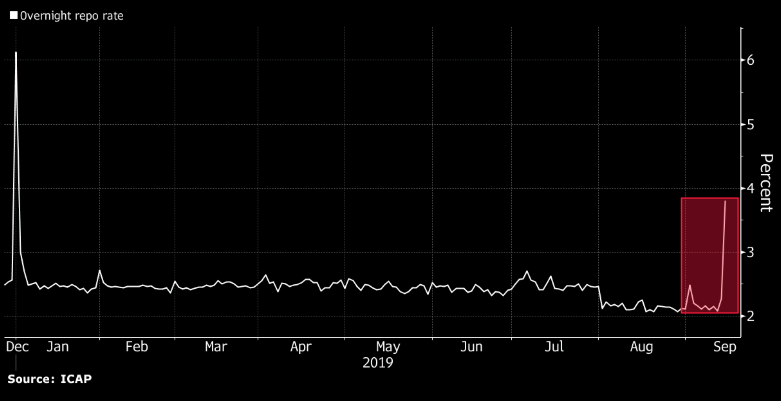

The short-term dollar funding market is feeling the squeeze

The repo market isn’t healthy

Global currency trading volumes surge to highest-ever level

Trading hits $6.6 billion per day

- 88% of all trades include USD

- London accounts for 43% of all activity

- US trading is 17%

- EM currencies are now 25% of turnover

- Trading involving the euro hit 32%

- Trading involving the yen at 17%

- Yuan trading is 4%

- Spot FX trading rose 20% to $2 trillion

JP Morgan think progress in US-China talks is unlikely

JP Morgan on the upcoming talks between the US and China.

- We are more sceptical

- still see risks to our growth outlook for 2H 2019 skewed to the downside

- “Are either likely? No.”

Berkshire taps Japan’s hunger for yields with $4bn bond debut

Warren Buffett’s Berkshire Hathaway headlined a record day in Japan’s bond market Friday by setting the terms on a 430 billion yen ($4 billion) offering, the biggest yen-denominated issue ever by a foreign multinational.

The U.S. investment group is selling five-, seven-, 10-, 15-, 20- and 30-year bonds.

The biggest chunk, 146.5 billion yen in 10-year debt, carries a 0.44% coupon — an attractive yield at a time when Japan’s benchmark long-term interest rate languishes below zero.

Banks, insurers, asset managers and other investors flocked to Berkshire’s offering, which falls under a global yen bond heading that allows foreign buyers to participate. Debt offerings under this framework have been growing gradually, with such big names as Apple, Starbucks, and Procter & Gamble joining in, and both Wall Street and Japanese financial institutions are pitching bond floats.

The success of the record debt sale could embolden other multinationals to raise capital in Japan’s bond market, where most yen-denominated offerings by foreign issuers have been small.

Berkshire’s AA issuer rating from S&P Global Ratings puts it slightly above the AA- of Japanese blue chip Toyota Motor. (more…)

S&P ratings cut for Argentina

Any surprise? Anyone?

ICYMI – Warnings of turmoil in markets if the US intervenes in the Chinese yuan

The Financial Times ran a piece overnight canvassing potential US intervention to drive the USD down against the Chinese currency.

- strong, and stronger USD, despite the Fed’s rate cut

- The US naming China as a currency manipulator

- USD/CNY and USD/CNH moving above what was though as a bit of a ‘line in the sand’ at 7 (wheter it is is/was or not remains to be seen)

- Plenty of chatter and speculation that the US admin could intervene to send the dollar lower

- One senior staffer at a London-based Chinese bank said the US could conceivably intervene in the offshore renminbi market, where the currency is traded more freely than on the mainland. But the consequences could be serious.

- “If you take on China on the currency . . . it would be interpreted as a political act and it would throw markets into turmoil,” said the senior staffer, speaking on condition of anonymity. The political fallout would be “unprecedented”, the person added.

US stocks mixed as attention turns to Fed

US stocks were mixed as Federal Reserve officials cast doubts on further rate cuts and a reading on domestic manufacturing stoked concerns over the health of the economy. The S&P 500 ticked 0.1 per cent lower after drifting between gains and losses, with investors turning their attention to the central bank’s annual summit where chairman Jay Powell will speak on Friday. The Nasdaq Composite was down 0.4 per cent, while the Dow Jones Industrial Average rose 0.2 per cent on a rally in shares of Boeing. Central bankers from around the world have descended on Jackson Hole, Wyoming, for a policy symposium that is closely watched by investors seeking clues on monetary policy.

Market participants are looking for the Fed to follow its July rate cut with another one in September, but at the start of the Jackson Hole gathering on Thursday, Philadelphia Fed president Patrick Harker and Kansas City Fed president Esther George indicated in television interviews that they would not back further cuts. “My sense was we’ve added accommodation, and it wasn’t required in my view,” Ms George, one of two dissenters in the July decision, told CNBC. Mr Harker, who is not a voting member of the Fed’s policy setting committee, said he believes the federal funds rate is around its neutral level, adding: “I think we should stay here for a while and see how things play out.” The US 10- and two-year yield curve inverted for the second time this week following the remarks. The yield on the benchmark 10-year Treasury rose 3.3 basis points to 1.6097 per cent, while the policy-sensitive two-year yield was up 4.5bp at 1.6141 per cent. An inverted yield curve is considered a sign that investors expect a recession.