What’s the rush?

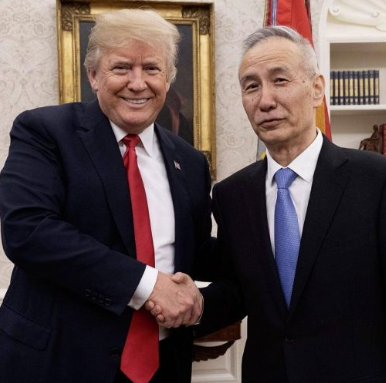

I wonder if politics played a role in removing the currency manipulator label from China? LOL, I’m kidding. I am not wondering at all.

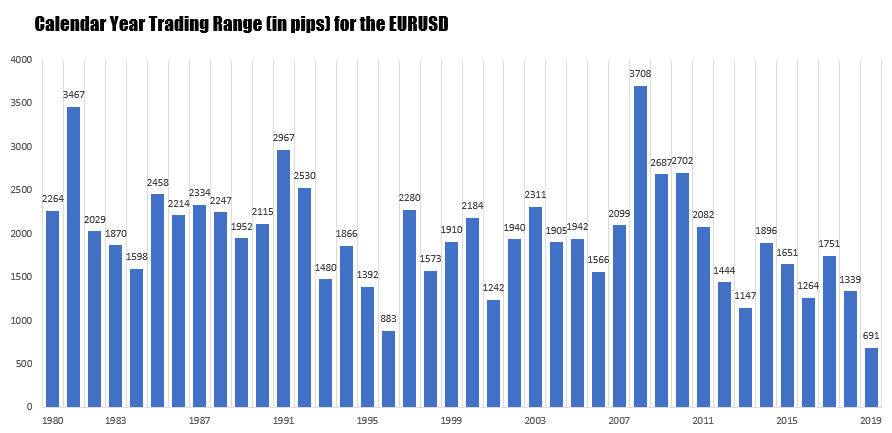

Below are the graphical historical ranges for the major currency pairs versus the dollar along with comments about each. .

The low to high trading range for the EURUSD in 2019 could only extend to 691 pips. That was the lowest range going back to 1980. The prior low was 883 pips back in 1996. In 1997, the range rose to 2280 pips.

2330 GMT Tokyo inflation data for December – Tokyo area CPI (national level CPI for the month follows in three weeks). The y/y rate has received a wee boost from the October 1 sales tax hike. But not much.

Also at 2330 GMT Japan Jobless (Unemployment) rate for November

and Job to applicant ratio for November

2350 GMT Bank of Japan monetary policy meeting ‘Summary of Opinions’ of the December meeting

2350 GMT Japan Retail sales for November

expected 5.0% m/m, prior -14.2% (the huge drop was helped along by that sales tax hike I mentioned above)

2350 GMT Japan Industrial Production for November (preliminary)

0130 GMT China Industrial Profits for November % y/y