GOLD is up 8% in 1 MONTH SILVER is up 27.5% in 1 MONTH PALLADIUM is up 18.2% in 1 MONTH PLATINUM is up 15.9% in 1 MONTH RHODIUM is up 15.9% in 1 MONTH No inflation?

Archives of “money supply” tag

rssOne Dam Metaphor For The 2012 Global Financial System

One Dam Metaphor for the 2012 Global Financial System

What do you do when flood waters threaten the dam? If you’re the Federal Reserve, you close the floodgates and let the water rise.

Metaphors have an uncanny ability to capture the essence of complex situations. Here is one dam metaphor that distills and explains the entire global financial system in 2012. The way to visualize the current situation is to imagine a dam holding back rising storm waters.

The dam is the regulatory system, the rule of law, trust in the transparency and fairness of the system and the machinery of perception management. All of these work to keep risk, fraud and excesses of speculation and leverage from unleashing a destructive wave of financial instability on the real economy below.

As legitimate regulation and transparency have been replaced with simulacra and manipulated data, the dam’s internal strength has been seriously weakened.

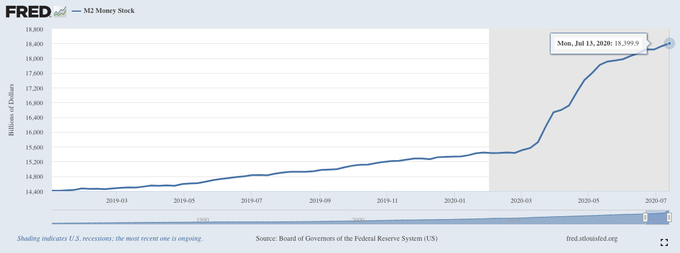

Depending on how you date various rivers of financialization, water has been piling up behind the dam since either 1982, 1992 or 2000. In this metaphor, the water is comprised of multiple sources of destabilization: rising money supply, debt, speculation, leverage, fraud, shadow banking and lax regulation.

Common sense suggests that water rising to dangerous levels would trigger an official response of opening the floodgates to relieve the pressure. Unfortunately for the real economy, common sense has nothing to do with the official response of central governments and banks. Their entire raison d’etre (reason to be) is self-preservation and the preservation of the financial Elites that set the context and policy of the State and central bank.

In effect, the State and central bank recognize that it is highly dangerous to let any water out, lest the toxic waste of fraud, speculative incentives, excessive leverage, etc. corrode the spillway and cause the entire dam to give way.

The official rationalization for keeping the gates closed even as the water is rising to the very lip of the dam is that the flood water released might harm the real economy downstream. (more…)

How to Develop Yourself as a Trader -Anirudh Sethi

There is a well-known axiom in business: “Neglect to plan and you intend to fall flat.” It might sound chatty, yet the individuals who are not kidding about being fruitful, including traders, ought to take after these eight words as though they were composed of stone. Ask any trader who profits on a reliable premise and they will let you know, “You have two options: you can either efficiently take after a composed arrangement, or come up short.” Mastering the specialty of Forex trading is not as basic as it appears. Each and every day the number of retail traders in the internet trading group is expanding at an exponential rate because of its outrageous level of benefit potential. The master traders at Saxo have secured their money related opportunity in life just by trading the live resources in the market. Be that as it may, keeping in mind the end goal to profit in the internet trading world, you have to know how to deal with your Forex trading account available. Not at all like the expert traders, the tenderfoot traders in the monetary business bounce into the web based trading world without thinking about the market subtle elements and in this way they lose an immense measure of money. In this article, we will examine how to wind up noticeably an expert trader in the Forex trading world. On the off chance that you have a composed trading or venture design, congrats! You are in the minority. While it is still no undeniable certainty of achievement, you have disposed of one noteworthy barricade. On the off chance that your arrangement utilizes imperfect procedures or needs planning, your prosperity won’t come promptly, however at any rate you are in a position to diagram and adjust your course. By archiving the procedure, you realize what works and how to abstain from rehashing expensive slip-ups.

Acknowledging Direct Resources for Profit

In order to develop yourself as an expert Forex trader, you have to consider trading as your business. On the off chance that you take a gander at the expert traders in the money market then you will see that each and every one of them is trading the live resources in their Forex trading account with an extraordinary level. Much the same as the expert specialist the master in the monetary business likewise has a strong trading plan to trade the live resources in the market. A large portion of the fledgling traders in the budgetary market consider trading as a get rich speedy plan and at last, loses money in the internet trading world. So on the off chance that you genuinely need to wind up plainly an expert trader at that point ensure that you build up a trader’s attitude and consider trading as your business. Trading is a business, so you need to regard it in that capacity on the off chance that you need to succeed. Perusing a few books, purchasing an outlining program, opening an investment fund and beginning to trade is not a strategy for success – it is a formula for calamity. Once a trader knows where the market can possibly respite or invert, they should then figure out which one it will be and act as needs are. An arrangement ought to be composed of stone while you are trading, yet subject to re-assessment once the market has shut. It changes with economic situations and modifies as the trader’s aptitude level moves forward. Every trader ought to compose their own arrangement, considering individual trading styles and objectives. Utilizing another person’s arrangement does not mirror your trading qualities. Such a large amount of the reason numerous traders fall flat is that they never seek after trading the correct route, as an execution teach. They don’t have an organized procedure of learning. They don’t have the instruments to legitimately replay, audit, and right there trading. They don’t have guides to good example great trading rehearses. They don’t learn methodologies with genuine edges and rather trade arbitrary examples on outlines or features existing apart from everything else. They don’t have enough funding to survive their expectations to absorb information. They don’t discover the trading markets and styles that best fit their specific qualities.

Milton Friedman's Brilliant 2 Minute Defense Of Capitalism

Nobel prize winning economist Milton Friedman would’ve turned 101-years-old today.

And there are plenty of people who would’ve loved to have him around today to witness how the Federal Reserve is running monetary policy.

Friedman, who is famous for his ideas on monetarism, was against the idea of a Federal Reserve. However, he did support the expansion of money supply. (more…)

I Say Lower Rates Below 0%!

Richard Russell can write:

“The big advance from the May 2009 lows was a bear market rally. The good economic news of the last few months were a mixture of hopes, BS government statistics and rosy propaganda from bleary-eyed economists and the administration. There’s no point in my going over all the damage — the plunge in the NASDAQ, the crash in the Stoxx Europe 600 Index, the smash in the Morgan Stanley World Index, the gruesome fact that at 1071, the S&P 500 is 24% below its level of ten years ago. The damage in dollar terms is reported to be $5.3 trillion. That sounds to me to be a sh– load of money. And the tragedy is that our government has spent two trillion dollars in a vain attempt to halt or reverse the primary bear trend of the market. I said at the beginning, “Let the bear complete his corrective function.” One way or another, it’s going to happen anyway. Better to have taken the pain and losses — than to push the US to the edge of the cliff. Now with the stock market crashing, the national debt is larger than ever. In fact, it is so large that it can never be paid off, regardless of cut-backs in spending or increases in taxes. Had Obama or Summers or Bernanke understood this, they never would have bled the nation dry in their vain battle to halt the primary bear trend. As I’ve said all along, the primary trend of the market is more powerful than the Fed, the Treasury, and Congress all taken together. Our know-nothing leaders have boxed the US into a situation that is so difficult that, for the life of me, I don’t see how we’re going to get out of it. Well, there’s always one way — renege on our debt. Can a sovereign nation renege on its debt and in effect, declare bankruptcy? Sad to say, I think we may find out. One basic force that the world will have to deal with is deflation. This is the monster that Bernanke is so afraid of. To fight inflation is easy — you just raise interest rates and cut back on the money supply. But deflation is a totally different animal. Interest rates are already at zero. The money has been passed out by the trillions of dollars. The stimuli have been issued. What can Bernanke do in the face of deflation?” (more…)

Ten Key Principles in Economics

Everything has a cost. There is no free lunch. There is always a trade-off.Cost is what you give up to get something. In particular, opportunity cost is cost of the tradeoff.

Everything has a cost. There is no free lunch. There is always a trade-off.Cost is what you give up to get something. In particular, opportunity cost is cost of the tradeoff.

One More. Rational people make decisions on the basis of the cost of one more unit (of consumption, of investment, of labor hour, etc.).

iNcentives work. People respond to incentives.

Open for trade. Trade can make all parties better off.

Markets Rock! Usually, markets are the best way to allocate scarce resources between producers and consumers.

Intervention in free markets is sometimes needed. (But watch out for the law of unintended effects!)

Concentrate on productivity. A country’s standard of living depends on how productive its economy is.

Sloshing in money leads to higher prices. Inflation is caused by excessive money supply.

Five Timeless Rules of Investing Learned From Jesse Livermore

. “My greatest discovery was that a man must study general conditions, to size them up so as to be able to anticipate probabilities.” What did Livermore mean by “general conditions”? He meant the macroeconomic environment and geopolitics. Are they favorable or not favorable to buying stocks? Today, the Fed is raising rates and squeezing the money supply (the monetary base declined last month for the first time in years; a year ago, it was going up 10%.) The war in the Middle East is heating up. These general conditions are not conducive to a bull market, except for gold!

“My greatest discovery was that a man must study general conditions, to size them up so as to be able to anticipate probabilities.” What did Livermore mean by “general conditions”? He meant the macroeconomic environment and geopolitics. Are they favorable or not favorable to buying stocks? Today, the Fed is raising rates and squeezing the money supply (the monetary base declined last month for the first time in years; a year ago, it was going up 10%.) The war in the Middle East is heating up. These general conditions are not conducive to a bull market, except for gold!

2. Learn from wise old men who have experience in the markets. In Reminiscences of a Stock Operator , the author talks about “the Old Turkey,” a “very wise old codger” who counseled Jesse Livermore on making good investment decisions and avoiding mistakes. How can you do this? The best way is to read histories of the great investors such as Warren Buffett, Peter Lynch, John Templeton and J. Paul Getty.

3. Learn your strengths and weaknesses. “We’ve all got a weak spot. What’s yours?” asks the Old Turkey. A good question that we must all answer. “Study mistakes,” he counsels. You don’t learn from your successes, only from your mistakes!

4. Always save some of your gains. “I was again living pretty well, but always saving something, to increase the stake that I was to take back to Wall Street.” Unfortunately, Livermore made the mistake of not living up to his own advice. He leveraged himself too much, and often went bankrupt. By taking some of your gains and investing the funds in alternative investments, such as real estate, art and collectibles, or gold coins, you protect yourself in case you are wrong.

This reminds me of something that happened to me many years ago. I had made a $2 million profit on a penny stock and my wife sat me down and insisted I pay off the mortgage, which was sizeable. I told her I preferred to reinvest the profits in more penny stocks, but she insisted, and I finally agreed with her and paid off the mortgage. It was the best decision “I” ever made! Had I invested the profits in more penny stocks, I would have lost my shirt, because the penny stocks went into a major bear market soon after.

5. Beware the charismatic financial guru! “It cost me millions to learn that another dangerous enemy to a trader is his susceptibility to the urgings of a magnetic personality when plausibly expressed by a brilliant mind.” Oh, how true. I well remember the times I invested in several tax shelters that eventually went bust, because I was thoroughly convinced by a smooth talking salesman who seemed brilliant at the time.