- By cutting off that possibility (or imposing a self-restriction on my flexibility), my psychological immune system gets triggered to synthesize happiness.

- My non-conscious processes immediately ‘downgraded’ the idea of trend continuation (if I can’t get on, the trend must be bad), and boosted the idea that the trend will end.

Archives of “Li Li (badminton)” tag

rssECB meet this week (preview) but they are already driving the higher euro

As was noted during the US time zone, EUR/USD pierced 1.14. A factor that appears to have flown under the radar is this sign of (continued) aggressive policy support from the ECB, that is:

- ECB corporate bond-buying was up 3.3bn EUR last week, which is around 400m higher than the previous record high over the past 4 years operation of the Bank’s corporate bond purchasing program

—

ps, ICYMI, the EU Recovery Fund will be the discussion point of note for markets in the ECB meeting Thursday

- financing totalling up to EUR750 bn, split between grants of EUR500 billion and loans of EUR250 billion

- Netherlands, Austria Denmark and Sweden want to reduce the amount of funds distributed as grants

Strong close for US stocks

Major indices close at session highs

Today saw the stock market rotate into the Dow and broader S&P indices. The tech heavy NASDAQ was the laggard. However a late day surge “raised all boats”. The Dow had its best day since June 29. The dow rose for the 3rd day in a row.

The final numbers are showing:

- S&P index rose 42.39 points or 1.34% to 3197.61

- NASDAQ index rose 97.73 points or 0.94% to 10488.53

- Dow industrial average rose 557.72 points or 2.14% at 26643.53

Leading the Dow 30 were:

- Caterpillar, +4.96%

- Travelers, +3.8%

- Chevron, +3.49%

- Exxon Mobil, +3.31%

- Home Depot, +3.25%

- McDonald’s, +3.19%

- UnitedHealth, +2.96%

- Goldman Sachs, +2.58%

- Boeing, +2.48%

Other big gainers today included:

- First Solar, +9.96%

- Alcoa, +9.47%

- Rite Aid, +7.57%

- Schlumberger, +5.81%

- Ford Motor, +5.12%

- NVIDIA, +3.31%

Laggards included:

- Wells Fargo, -4.55%

- Intuit, -4.13%

- Citigroup, -3.93%

- Slack, -3.14%

- LYFT, -3.02%

- Delta Air Lines, -2.61%

- Uber, -2.51%

European shares end the session with declines

UK FTSE outperforms

The European shares are ending the session with declines. The UK FTSE 100 the better than others on the GBPs weakness.

The provisional closes are showing:

- German DAX, -1.06%

- France’s CAC, -1.25%

- UK’s FTSE 100, -0.10%

- Spain’s Ibex, -1.02%

- Italy’s FTSE MIB, -0.7%

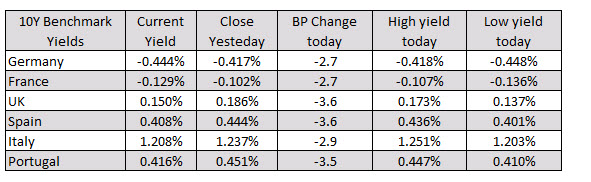

In the European debt debt market, the benchmark 10 year yields are ending lower across the board. Declines range from -2.7 basis points to -3.6 basis points:

In other markets as European traders look to exit:

- spot gold is trading up $6.05 or 0.34% at $1808.82. The low extended to $1790.79. The high for the day is near current levels at $1809.74

- WTI crude oil futures are trading up $0.31 or 0.77% at $40.41 for the August contract. The September contract is also higher by $0.33 or 0.82% at $40.65

In the US stock market the Dow industrial average outperforms while the NASDAQ index get whipped around and volatile trading. The current snapshot shows

- S&P index up 12.8 points or 0.41% at 3168.16

- NASDAQ index down 2.6 points or -0.02% at 10391.16

- Dow industrial average up 288 points or 1.11% at 26374

The NASDAQ index has whipped around in with the low falling -2.01%. The high extended up 0.42%. The point range is around 250 points from low to high.

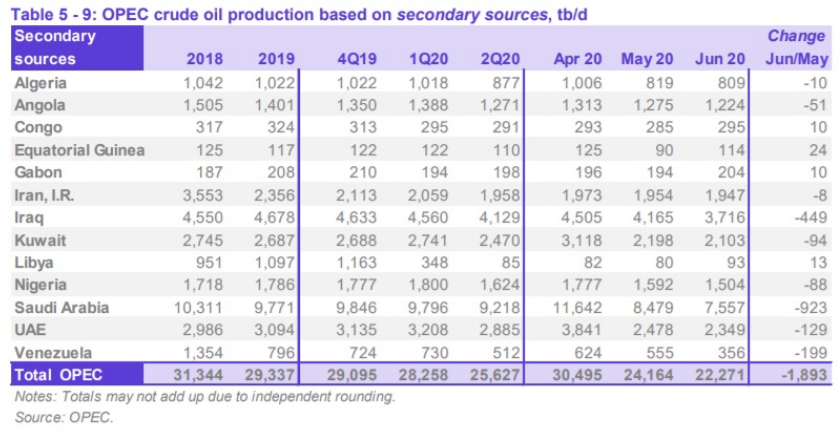

OPEC: Sees demand falling 8.95 mbpd this year, rising by 7 mbpd in 2021

Highlights of the OPEC monthly oil report

- Sees 2020 demand -8.95 mbpd vs -9.07 in prior report

- Sees US output down 1.37 mbpd this year; +0.24 mbpd next year

- Oil stocks are 210 million barrels above 5-year avg

- Efficiency gains and remote working to cap demand rise in 2021 to below 2019 levels

A separate report, citing delegates, sees OPEC+ June compliance at 107%.

Heads up for oil traders – OPEC to release June report Tuesday

OPEC will release its monthly market report later on Teusday (I donlt don’t have the time sry).

- will provide OPEC production numbers for June

- which will show compliance levels so far (with the agreed cuts)

- preliminary numbers showed compliance for the group was over 100%, aggregated,due to extra output curbs by from Saudi Arabia, the UAE and Kuwait

More China trade data, this time in USD dollar terms

USD terms:

- Exports +0.5% y/y: expected -2.0%, prior -3.3%

- Imports +2.7% y/y: expected -9.0%, prior was -16.7%

Add this to the data agenda for Tuesday 14 July 2020 – China June trade data

Trade balance, exports and imports data are due from China today for june June 2020

There is no specific time set for the releases, and it has been very unpredictable in past months.

Yuan terms:

trade balance: expected CNY 425bn, prior was CNY 442.75bn

- Exports y/y: expected +3.5%, prior was +1.4%

- Imports y/y: expected -4.7%, prior was -12.7%

USD terms:

trade balance: expected $59.6bn, prior was $62.93bn

- Exports: expected -2.0%, prior -3.3%

- Imports: expected -9.0%, prior was -16.7%

NASDAQ tumbles over 2% after reaching all time

California rolling back reopening and the outside the lower close pressure tech talks

The US stocks are ending the session with mixed/negative results. The Dow industrial average actually close marginally higher on the day. The S&P index and NASDAQ, however, reversed earlier gains and fell sharply. Contributing to the declines was the news that California was rolling back some of the reopenings

- The S&P index fell -29.77 points or -0.93% at 3155.27. The S&P index turned briefly positive for the year above 3230.78% intraday with the high price reaching 3235.32. That is the 2nd time since February 25 that the price briefly extended above the close from 2019 only to fail in the same trading day. Bearish

- NASDAQ index -226.59 points or -2.13% at 10390.84. The index had a outside day lower close, after trading to a new all time high of 10824.78. Bearish

- The Dow industrial average close up 10.7 points or 0.04% 26086.00

All the major indices closed near the lows for the day, after giving up some hefty gains.

- The S&P index was up 1.58% before closing down -0.94%

- the NASDAQ index is up 1.95%, before reversing lower in closing down -2.13%

- the Dow industrial average was up +2.13% before reversing and closing near unchanged at +0.04%.

Florida coronavirus cases 12624 vs 15299 yesterday

Coronavirus data from Florida for July 13, 2020:

- Florida yesterday set a one-day state record of 15,299 cases (6274 last Monday)

- Total cases 282,435 vs 269,811 yesterday

- Residents hospitalized vs 18,271 yesterday

- Currently hospitalized +514 to 8038

- Median age 41 vs 38 yesterday

- Deaths +35

- Number of people tested 112,264 vs 142,981 yesterday (48,503 last Monday)

- Positivity 11.51% vs 11.25% yesterday (14.92% last Monday)

This is worse than expected. Given the usual weekend effect, I would have expected a number below 10,000. However testing was still fairly high.