NASDAQ down for the 2nd week in a row

US major indices are ending the session with declines. For the week each of the major indices are also lower. It was the 1st negative week for the Dow and S&P in 4 weeks. For the NASDAQ is on a 2 week losing streak. The NASDAQ led the way to the downside this week with a -1.33% decline.

The final numbers for the day show:

- S&P index -20.03 points or -0.62% at 3215.63

- NASDAQ index -98.24 points or -0.94% at 10363.13

- Dow -182.44 points or -0.68% at 26469.89

For the week, the NASDAQ led the way to the downside:

- S&P index -0.28%

- NASDAQ index -1.33%

- Dow industrial average -0.76%

Year to date, the S&P index turned back negative on the year:

- S&P index -0.47%

- NASDAQ index +15.5%

- Dow industrial average -7.25%

For the last year:

- S&P index +6.49%

- NASDAQ index +24.53%

- Dow -2.93%

Investing:

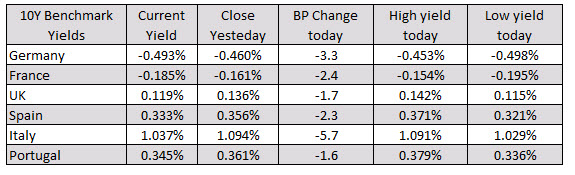

Investing: In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: