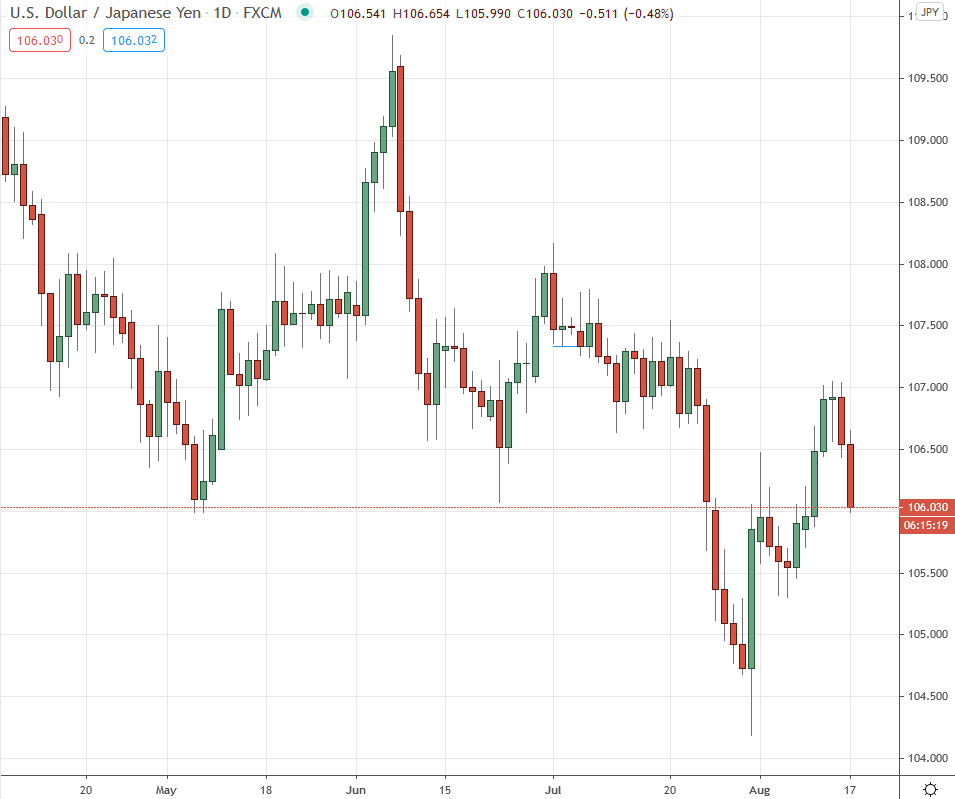

USD/JPY declines below 106.00

USD/JPY is at a six-day low as the pressure on the US dollar mounts. There is some broad-based weakness taking hold. It’s increasingly becoming the default mode in the market to sell US dollars, so long as there isn’t genuine risk aversion.

There’s nothing particularly negative for the US dollar today but there are headwinds:

- US election risk

- Lack of US stimulus will hurt relative growth

- Equity market valuation is richer in the US, better value elsewhere

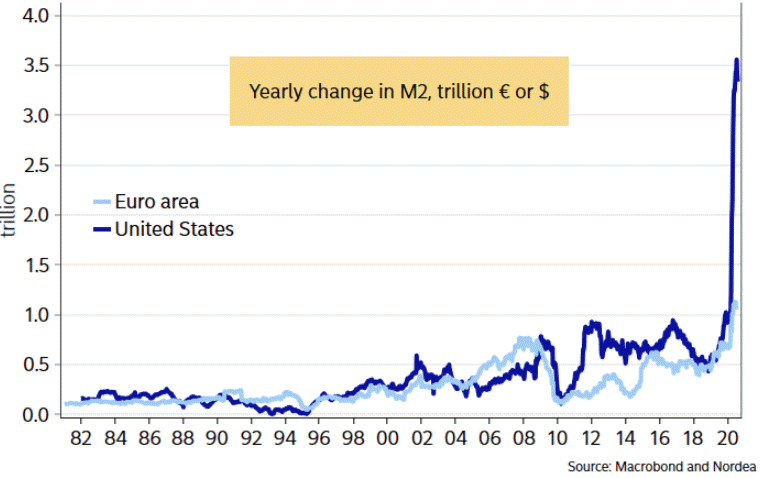

- Long-term monetization/inflation worries

Here’s chart on M2 from Nordea comparing the US and Europe:

In the smaller picture, risk sentiment is good today and that’s good enough to undercut the US dollar.

As for USD/JPY, it’s not time to worry yet but the drop in late July is starting to look like a warning shot.