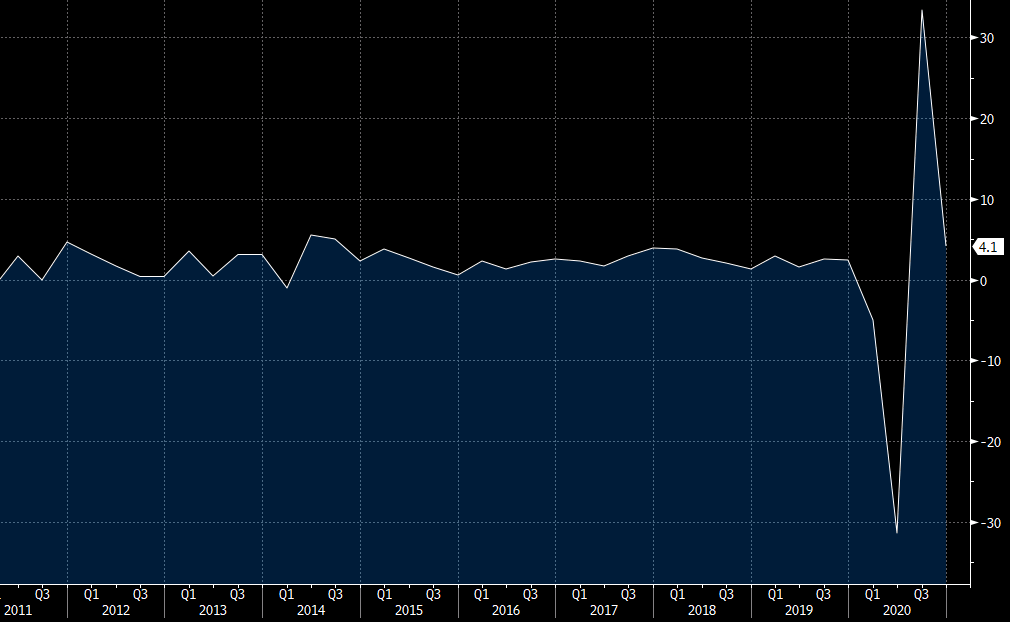

Taper back on the table?

There’s a sweet spot for many markets where delta pushed back the taper but the economy remains solid and rates stay low.

Of course, that’s an impossible paradigm to hold. Yes, Powell probably won’t signal a taper this week but beyond that either delta will meaningfully hurt the global economy or delta will fade and the case for tapering will return.

At the moment, the bond market appears to be hinting at a fade in delta and rising odds of a September taper. Overall, I suspect this is more about delta and confidence this round of cases will fade quickly but I see the Fed argument too.

From where I stand, Powell’s best course of action is to preserve some optionality into the Sept meeting but emphasize that the Fed will do everything it can to support the recovery. Ultimately, a November taper hint and December announcement makes the most sense.

Despite the uptick in rates, the bond market certainly isn’t seeing any inflation.