Keep an eye out for stops

Mood in Beijing about #trade deal is pessimistic, government source tells me. China troubled after Trump said no tariff rollback. (China thought both had agreed in principle.) Strategy now to talk but wait due to impeachment, US election. Also prioritize China economic support.

The big moves in sterling came last week and I’m surprised there wasn’t any covering through Tuesday. That’s good news if you’re long GBP because it leaves lots of juice to squeeze.

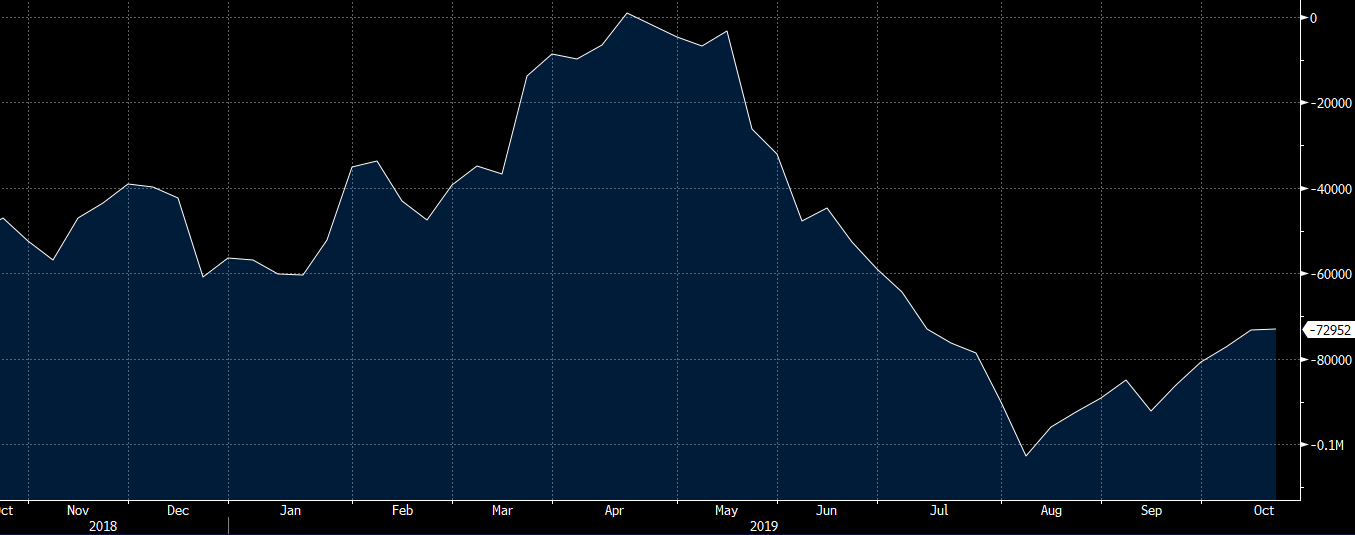

Modest changes in the major currencies for the current week. Although speculators trimmed short positions in the pound, it remains the largest specular position. The EUR shorts increased by 5K. It is the 2nd largest short position.

In other markets:

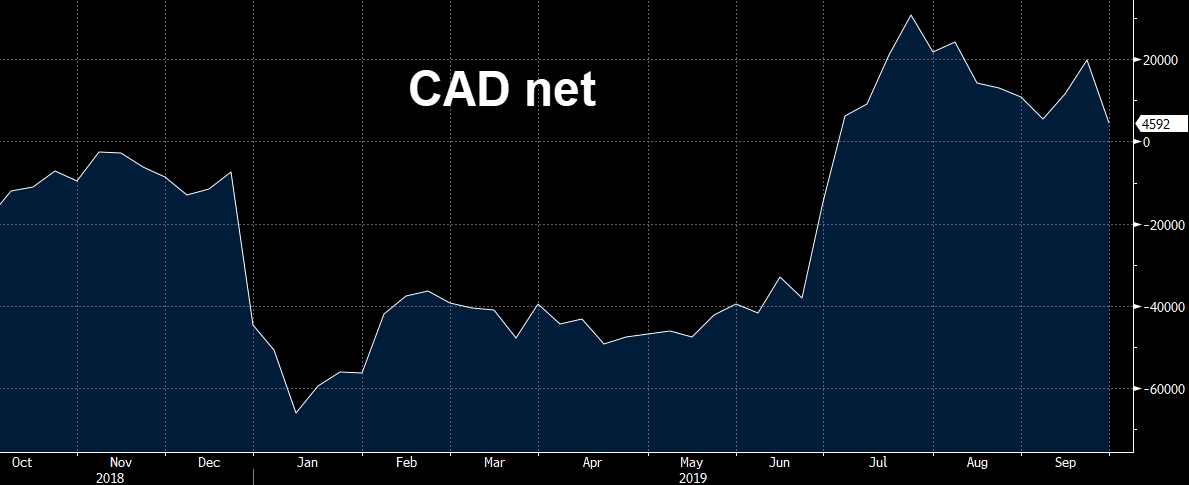

There were some substantial moves across the board in this week’s data. There was no overarching theme in the US dollar. The loonie has stubbornly held onto longs but I suspect the jump in oil prices and lack of a corresponding climb in the loonie may have sent some specs to the sidelines — that data certainty hasn’t eroded.