The Fed will start buying ETFs early this month

A notice from the New York Fed saying that it plans to begin purchasing corporate bond ETFs early this month has helped to trim losses in equity markets.

The SMCCF is expected to begin purchasing eligible ETFs in early May. The PMCCF is expected to become operational and the SMCCF is expected to begin purchasing eligible corporate bonds soon thereafter. Additional details on timing will be made available as those dates approach.

The acronyms stand for: Primary Market Corporate Credit Facility (PMCCF) and the Secondary Market Corporate Credit Facility (SMCCF).

They’re two of the roughly 20 programs and actions the Fed has rolled out since the pandemic.

The PMCCF will provide a funding backstop for corporate debt to Eligible Issuers so that they are better able to maintain business operations and capacity during the period of dislocation related to COVID-19. The SMCCF will support market liquidity for corporate debt by purchasing individual corporate bonds of Eligible Issuers and exchange-traded funds (ETFs) in the secondary market.

This describes what the Fed will be buying:

The PMCCF will provide companies access to credit by (i) purchasing qualifying bonds as the sole investor in a bond issuance, or (ii) purchasing portions of syndicated loans or bonds at issuance. The SMCCF may purchase in the secondary market (i) corporate bonds issued by investment-grade U.S. companies; (ii) corporate bonds issued by companies that were investment-grade rated as of March 22, 2020, and that remain rated at least BB-/Ba3 at the time of purchase; (iii) U.S.-listed ETFs whose investment objective is to provide broad exposure to the market for U.S. investment-grade corporate bonds; and (iv) U.S.-listed ETFs whose primary investment objective is exposure to U.S. high-yield corporate bonds.

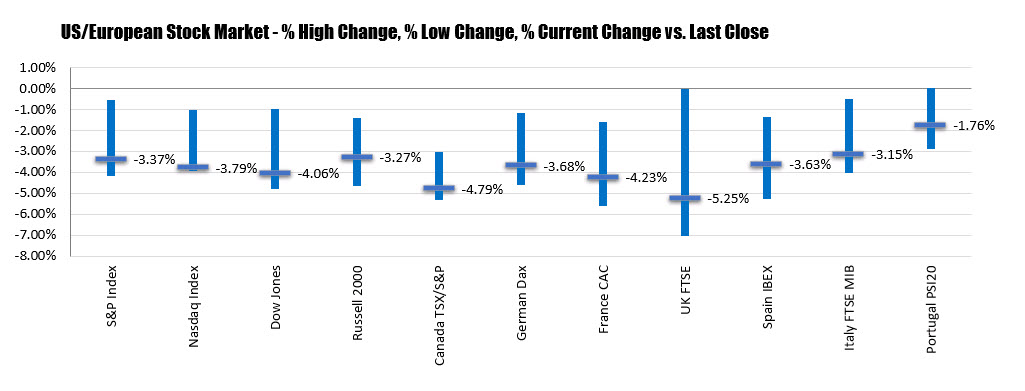

Today’s trading is a microcosm of the past 6 weeks. One one side is the reality of the pandemic, on the other is are central banks and governments trying to take on the losses.

Overall, I don’t see this is as a particularly meaningful program but it sets a precedent and it doesn’t take too much creative thinking to see this applied to equity markets one day, like the BOJ.

Although lower for the day for all major indices closed with gains.

Although lower for the day for all major indices closed with gains.