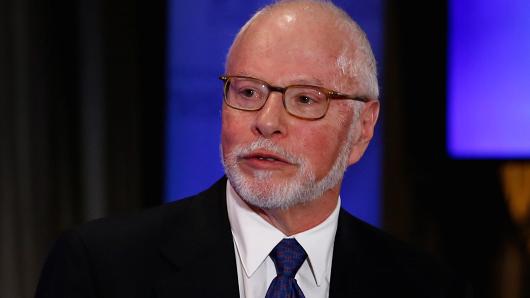

From Forbes:

Coming off a huge debt deal with Argentina, hedge fund billionaire Paul Singer’s advise is to be wary of expert advice. “The important turning points in markets are never identified with precision in advance by ‘experts’ and policymakers. This lack of foresight is not surprising, because markets and the course of the economy are not model-able scientific phenomena but rather are examples of mass human behavior, which are never predictable with anything like precision,” says Singer. “But what is surprising is that even the most sophisticated investors, traders and commentators continue to rely on predictions issued by those who have no record of success at such forecasts.”

Nice.