Latest data released by Eurostat – 14 July 2020

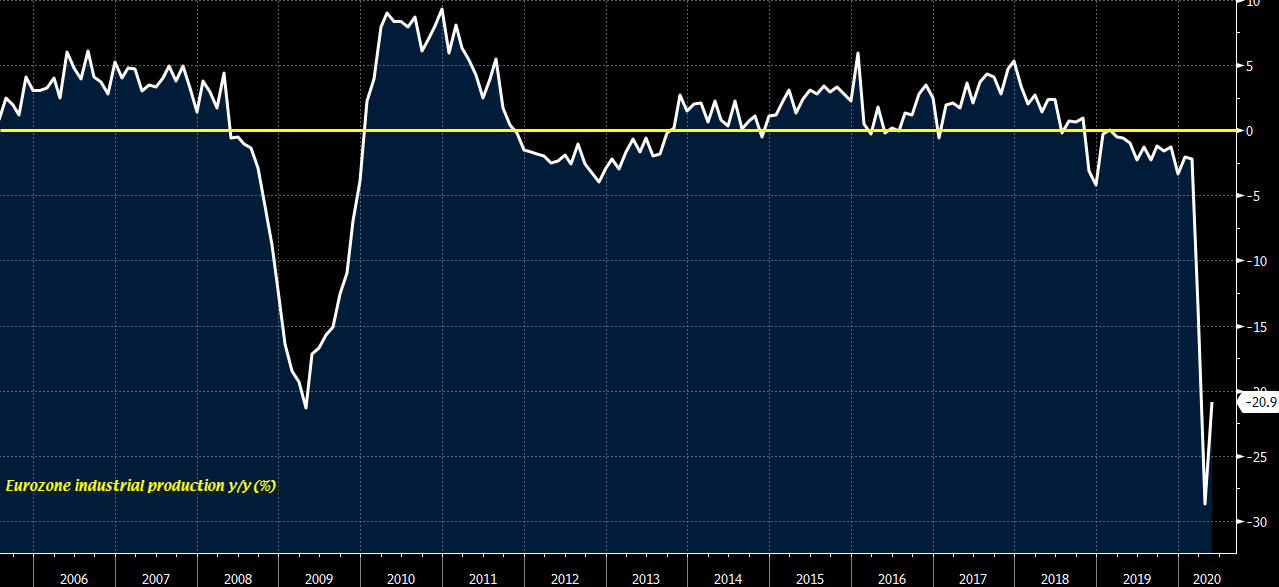

- Prior -17.1%; revised to -18.2%

- Industrial production WDA -20.9% vs -18.9% y/y expected

- Prior -28.0%; revised to -28.7%

Factory output rebounded in May but not as robust as anticipated, with the annual reading highlighting the plight faced by the euro area economy despite the gradual easing of lockdown measures. June should also reflect a rebound but new normal conditions and the pace of the recovery will likely only be seen in July to August or later in Q3.