The head of Shell spoke in an online interview, in a nutshell said that there will be no V-shaped recovery for the global economy after the coronavirus epidemic

- this will curtail oil and gas demand for years to come

Ben van Beurden, Chief Executive of Royal Dutch Shell:

- “Energy demand, and certainty mobility demand, will be lower even when this crisis is more or less behind us. Will it mean that it will never recover? It is probably too early to say, but it will have a permanent knock for years”

- “It is most likely not going to be a v-shaped recovery.”

- Shell & others have had to reduce spending sharply, postpone investment and will continue to do so “for some time to come”

via Reuters

After the close Netflix showed a greater than expected rise in new subscribers (10.1 million vs. 8.2M estimate),. But forecast Q3 subscribers much less than expectations at 2.5 million vs. 5.1 million estimate

After the close Netflix showed a greater than expected rise in new subscribers (10.1 million vs. 8.2M estimate),. But forecast Q3 subscribers much less than expectations at 2.5 million vs. 5.1 million estimate

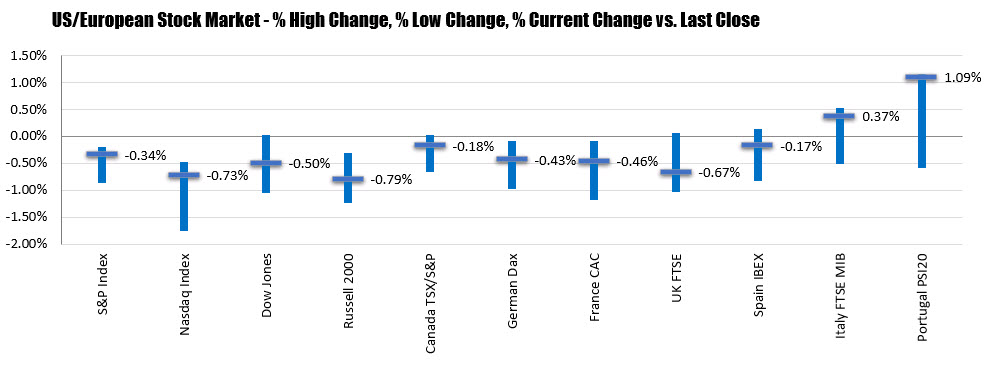

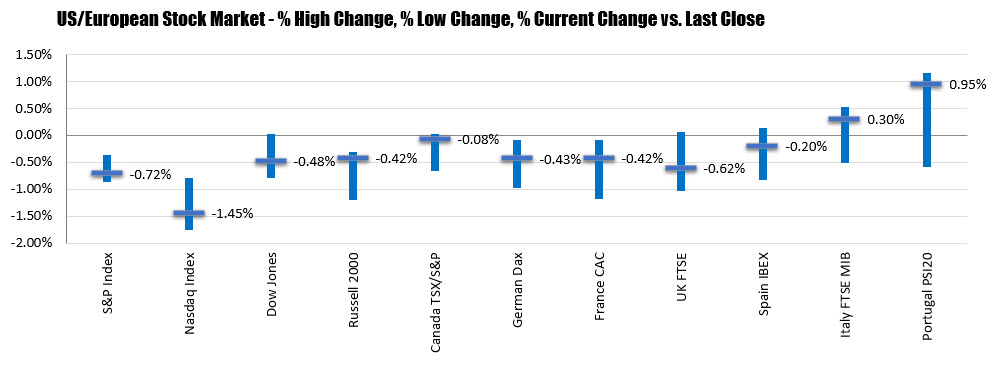

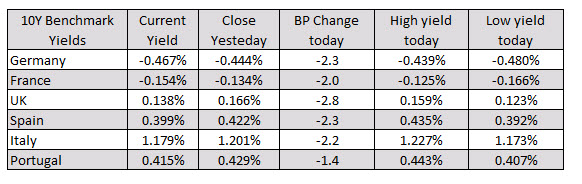

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: