Likely more noise more than anything else

The market will be keenly eyeing the release of the July FOMC meeting minutes later today but it is unlikely to tell us much that we don’t already know at the moment.

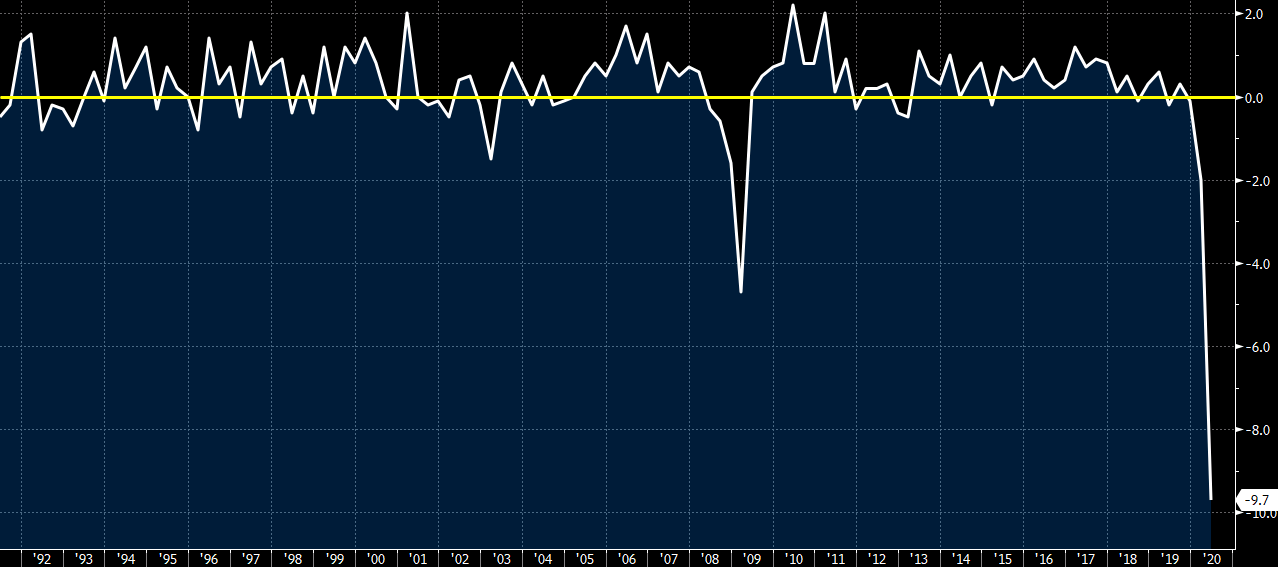

The Fed has acknowledged that the economic situation is starting to worsen a little and cast a bit of a dark cloud over the outlook in 2H 2020, considering the fact that the virus situation was escalating rather rapidly across the US last month.

If anything, I would say the minutes should just reaffirm that sentiment and also highlight that the Fed will still do whatever it takes to bolster the economy.

Other than that, there may be room to look out for potential policy changes/tweaks – possibly on future communication – but that is unlikely to offer much as the longer-term plan remains in tact (still just be mindful of this space in any case).

While the market may be looking to the minutes for further suggestions, it is not likely to change the themes that we have been seeing so far to start the week.

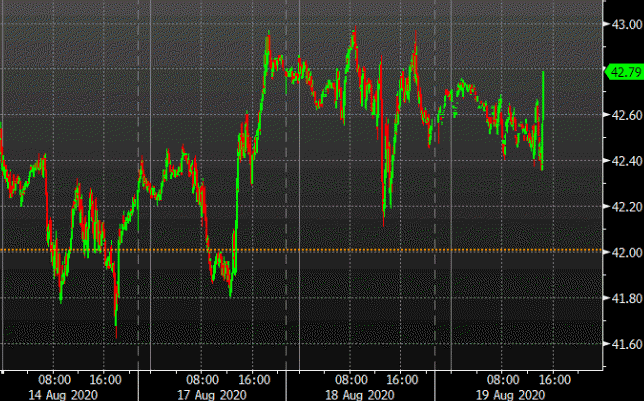

The softer outlook may be a signal for equities to pause after hitting all-time highs but for the dollar, election uncertainty and the stalemate on stimulus talks have been

factors that are weighing on the currency; and those won’t be going away.

The dollar gave up on some key technical levels in trading yesterday but amid a tricky August so far, let’s see if sellers have the conviction to follow through ahead of the weekend.