You don't have to understand why prices are moving to profit from them. The best way to learn to trade is by trading.

One of the great challenges of trading is that it requires intense and singular concentration on markets, but also an equal focus on one’s performance in those markets. That combination of market awareness and self-awareness enables traders to make the most of their “edges” in markets while also cultivating fresh sources of edge.

It is interesting that very successful traders usually don’t achieve monetary success and then walk away from markets. That is because what drives them is not just the outcome, but also the process: the ongoing challenges of market mastery and self-mastery. Even after the money has been made, the game retains its appeal.

If your motivation is primarily to make money, you probably won’t get to the point of career success, because the inevitable periods of drawdown will sap whatever drive is present. When the motivation is mastery, losing periods provide fuel for reflection, learning, and improvement.

If market or individual stock a has a positive predictive correlation with market b, and b had a positive predictive correlation with market a, then there is positive feedback, and an explosive growth when a is up would occur. Similarly, if there is a positive predictive correlation, i.e. the serial correlation of a with b say one day forward is 0.2, then market a goes down. If there is a negative predictive correlation of market a with market b, then when a goes up, b will tend to go down, and vice versa, and there will be a stable equilibrium between the two with each pulling the other in opposite directions.

If market or individual stock a has a positive predictive correlation with market b, and b had a positive predictive correlation with market a, then there is positive feedback, and an explosive growth when a is up would occur. Similarly, if there is a positive predictive correlation, i.e. the serial correlation of a with b say one day forward is 0.2, then market a goes down. If there is a negative predictive correlation of market a with market b, then when a goes up, b will tend to go down, and vice versa, and there will be a stable equilibrium between the two with each pulling the other in opposite directions.

The situation is very similar to what occurs in all feedback circuits in electronics, including what you seen in any kind of amplifiers where there is negative feedback to maintain stability.

What are the markets that have positive predictive correlation with each other, i.e. when a is up today, b tends to go up tomorrow, and when b is up today, a tends to go up tomorrow? There aren’t many. And when such occurs, it is only for a limited time. So you have to be on your toes if you wish to use positive feedback. All this can be quantified with varying degrees of reality and rigor.

More important than any entry system….Money management and trading psychology are much important

Keep Losses Small…

Trade with stops

Trade in the direction of the trend

Doubling down is a sure way to lose money and blow up

Trade with a complete plan knowing exactly what to buy/sell…how much to buy/sell and know exactly when the trade does not work… (more…)

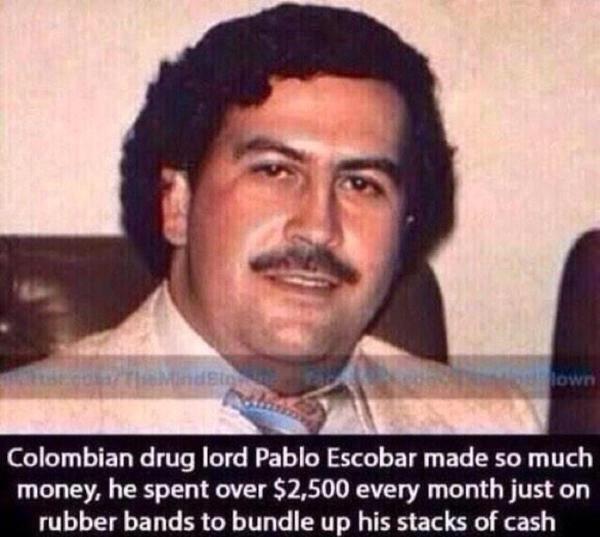

During its heyday, Pablo Escobar’s drug cartel spent $2,500 per month on rubber bands for bricks of cash. Mental Floss has a interesting profile of the drug lord.

The profits were astronomical at every step. In 1978 each kilo probably cost Escobar $2,000 but sold to Lehder and Jung for $22,000, clearing Escobar $20,000 per kilo. In the next stage they transported an average of 400 kilos to south Florida (incurring some additional expenses in hush money for local airport authorities) where mid-level dealers paid a wholesale price of $60,000 per kilo; thus in 1978 each 400-kilo load earned Escobar $8 million and Lehder, Ochoa, and Jung $5 million each in profits. Of course the mid-level dealers did just fine: after cutting the drug with baking soda each shipment retailed on the street for $210 million, almost ten times what they paid for it.

Soon Lehder was hiring American pilots to fly a steady stream of cocaine into the U.S., paying them $400,000 per trip. At one trip per week, in 1978 this translated into wholesale revenues of $1.3 billion and profits of $1 billion.

1. A trader can only build confidence to take a real time trade entry after they have done the necessary homework in back testing through multiple market environments to know the probabilities of success and the possibilities of failure. Understanding how the markets have behaved with past price patterns can give the trader the boldness they need to push the submit button on their broker’s screen.

2. Understanding the price level where your stop loss on a trade will be and also your potential price target will give you a good idea of the risk and reward dynamics of a trade set up. It is easier to trade when you know that you are risking $100 for a chance to make $300 and the odds are on your side with a great entry.

3. Structuring your position sizing so that if your stop is hit you will only lose 1% of your total trading capital will eliminate much of your fear of failure. The urgency and importance of any one trade should be converted into the calm assurance of knowing that the current trade is just one of the next one hundred trades. You can overcome the majority of anxiety around trading when you simply trade small enough so that any one trade or a string of trades will not affect your long term trading success.

4. Trading what you know and are familiar with is low stress trading. Trading a chart pattern, stock, or index that you have traded for years is familiar territory. Also trading markets inside your circle of competence creates confidence. Only trade futures, options, stocks, bonds, forex, and indexes that you understand. Many traders drown chasing unfamiliar waterfalls.

5. A lot of performance confidence comes from having a detailed trading plan on what you will do before the market opens and the faith in yourself to execute that plan after the market opens. Knowing that your decisions will be based on the facts and the reality of price action and that you will not be swept away with emotions and ego while trading can allow you to rise above anxiety and instead operate with faith in yourself and your system

Eurozone-wide manufacturing data for November has met forecasts, reaching their best level since June 2011 as national-level numbers from the sector also beat expectations.

The Markit purchasing managers’ index survey for the shared currency area came in at 51.6, just ahead of the 51.5 predicted in a poll undertaken by Reuters.

Any reading above 50 indicates growth.

Markit said:

The recovery in the eurozone manufacturing sector accelerated again in November. Although the pace of expansion remained modest overall, the real positives were that growth extended into a fifth successive month with the rate of increase hitting a near two-and-half year high.

At national level:

France’s manufacturing sector continued to shrink, but by less than expected, with its PMI reading 48.4 against expectations of 47.8