Archives of “Brexit” tag

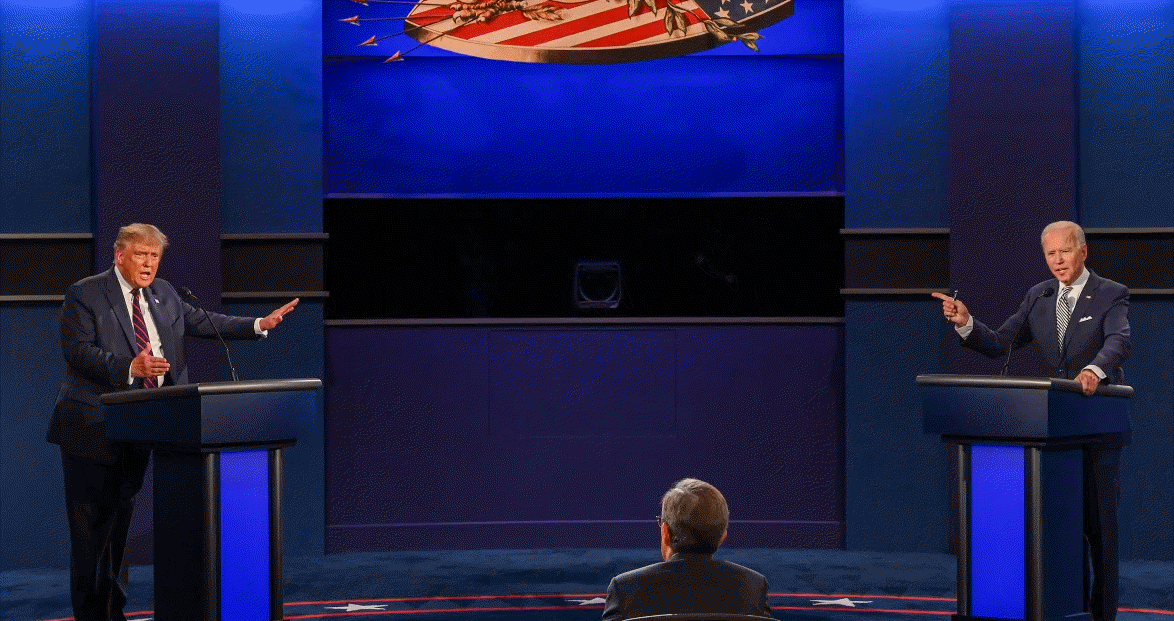

rss“Who will win the election?” is the wrong question

“Will there be a clear, uncontested and accepted winner?” is a better question

Let’s face it, very few in the market are anticipating a smooth election nor for any potential transition of power to be uneventful. The extent to which November serves to disrupt functioning of the federal government or fuel further civil unrest remains to be seen and, frankly, is the most significant tail risk as we ponder potential outcomes.

Brexit – UK says not afraid to walk away from talks. Less than 20% chance of a deal.

A couple of UK media items on Sunday with Brexit developments.

- planning for no-deal has ramped up

- senior figures in government have predicted that the chance of securing a Brexit trade agreement with Brussels is now less than 20%

- 8 am in NZ

- 6 am in Sydney

- 5 am in Tokyo

- and 4 am in Singapore & Hong Kong

Here’s a EUR/USD forecast (to 1.15) with the ECB expected to be optimistic this week

The European Central Bank meet this week, preview below.

- Meeting Thursday 16 July 2020

- Policy announcement at 1145GMT (policy likely unchanged)

- We remain constructive and expect the broad USD to decline over the coming months

- 3 month forecast is 1.15

- we expect a repetition of recent comments from various governing council members, thereby striking a cautiously optimistic tone compared to the June projections.

- We also expect they may decide not to use the EUR1,350bn PEPP envelope in full.

- No new initiatives are expected next week

- Markets may not be prepared for a ‘less dovish’ message

- with abundant liquidity, PEPP and APP still ongoing

- Our key expectation is that the ECB will reiterate its stance towards supporting a recovery, with, not least, a focus on sovereign spreads.

- the direction and stance of the ECB and euro area fiscal politics are, in our view, quite well priced and communicated (though to a lesser extent when it comes to the outcome for Brexit). In turn, it will be the breath and speed of the global recovery that sets the tone in EUR/USD, and mostly through the USD leg

The two major risk factors in markets for 2019 will still be there in 2020

US-China trade and Brexit worries will not go away despite some improvement in their respective rhetoric at the moment

We’re getting closer to a Phase One trade deal and Boris Johnson just won big in the UK election last week. Two of the biggest risk factors that has plagued markets this year appear to be finding some form of conclusion, but are they really?

US-China trade war

As great as the Phase One trade deal is and will be, it isn’t the “be all, end all” deal that will see US-China relations significantly improve.

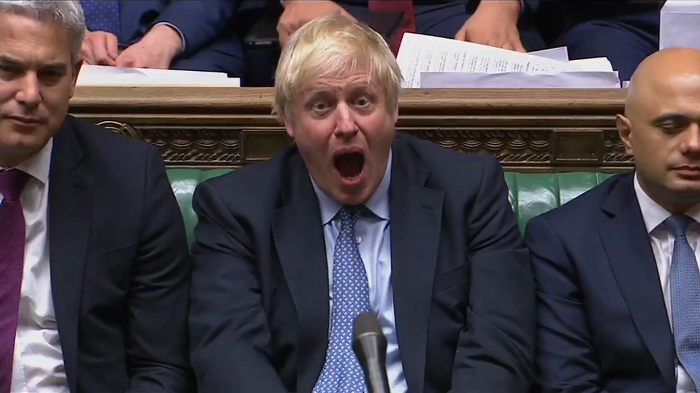

Brexit

Boris Johnson got his much sought after majority in parliament – quite comfortably as a matter of fact – and now he can get his Brexit deal across the finish line. Easy-peasy.

FT reports that the EU may give the derivatives industry and extension on Brexit

Financial Times says the European Union is readying moves to offer an extra year to the financial derivates industry to prepare for Brexit

- Valdis Dombrovskis, vice-president of the European Commission, said on Friday that contingency plans for accessing UK-based clearing houses would have to be extended beyond the current March 2020 end date because the EU financial services industry would not have alternatives in place in time.

Moodys Downgrades UK Outlook To Negative On “Brexit Paralysis”

Moody’s downgraded its outlook on Britain’s debt (currently rated Aa2) to negative from stable after the market close on Friday, saying Brexit had been a catalyst for an erosion in the country’s institutional strength, perceived “material deterioration” in UK governance, and that the country’s ability to set policy has weakened in the Brexit era along with its commitment to fiscal discipline.

The outlook cut represents a catch down to its competitors: the UK is currently rated AA by S&P and AA- at Fitch Ratings, with both companies having the UK on negative watch.

“It would be optimistic to assume that the previously cohesive, predictable approach to legislation and policymaking in the UK will return once Brexit is no longer a contentious issue, however that is achieved,” the ratings agency said adding that “the increasing inertia and, at times, paralysis that has characterized the Brexit-era policymaking process has illustrated how the capability and predictability that has traditionally distinguished the U.K.’s institutional framework has diminished.”

“The decline in institutional strength appears to Moody’s to be structural in nature and likely to survive Brexit given the deep divisions within society and the country’s political landscape,” Moody’s added.

The decision to put the UK on negative outlook even as Moody’s affirmed Britain’s Aa2 long-term issuer and senior unsecured ratings comes one month before an election that is likely to determine the future of Brexit. While the election will have a big impact on Brexit, this week has seen both sides escalate their spending pledges, drawing election battle lines with plans to end a decade of U.K. austerity. (more…)

Carney press conference after BoE remains on hold

Mark Carney

- Recent Brexit deal creates a possibility of a pick up in UK growth

- World risks slipping into low growth, low inflation but many of these dynamics occurred first in the UK

- Both reduced Brexit uncertainty and stronger world economy assumed in BoE forecasts, but neither is assured

- Now evidence that households are doing precautionary saving before Brexit

- Brexit uncertainties are weighing particularly heavily on business investment

- Reduced chance of a no -deal Brexit has pushed up sterling

- Brexit agreement reduces risk of no deal significantly

- pick up in UK growth likely to be limited by a lack of supply capacity in the economy

- New BoE Brexit assumptions assume transition occurs over 3 years vs previous much longer transition.

Is there still a possibility of a no-deal Brexit at this stage?

What if I told you that a no-deal Brexit now hinges on Boris Johnson winning the parliamentary vote tomorrow?

Before we get into the thick of things, let us set out what exactly is at stake tomorrow. Clearly, Boris Johnson’s Brexit deal motion is the main event but what does it mean really?

Is there any way to avoid this altogether?

What happens now that Boris Johnson has managed to strike a Brexit deal?

We have been down this road before

A Brexit deal is only as good as its chances to pass a vote in parliament. Just ask Theresa May how that worked out for her.