If I borrow £1,000 from you and then, because of spectacular bad luck cannot pay it back, but I come to you and say, “here is £750, can we call it quits?” – that is a controlled default. If I borrow £1,000 from you and you ring me up and you get directory inquiries in the Dominican Republic – that is an uncontrolled default. Right now, Greece’s fate hangs in the balance somewhere between these two. |

Archives of “bad luck” tag

rss10 Big Lies Traders always says…

1. The losing position wasn’t my fault, the market 2. The trade was right and the market wrong. 3. I just have bad luck. 4. Eventually the stock will go up (or down)… eventually. 5. Bigger size equals bigger profits. 6. No need to close the postion just yet.I can average down. 7. Because I made so much money on the last trade I can take on more risk the next. 8. If the market is going down I can’t make any money. 9. I need to trade a larger account in order to be a better trader. 10. I’ve had many winners in a row, so now I need a big loser. |

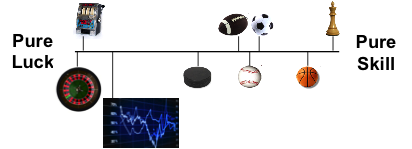

The Difference Between Skill and Luck

Basketball comes closest to chess in terms of being the game with the most skill involved. In comparison, hockey looks more like the lottery (and don’t even ask about trading).

The bottom line is that the law of smaller numbers allows for more variance in individual player and game outcomes in a sport like baseball or hockey – in baseball the most skilled hitter only gets up to bat a few times per game and in hockey the star players aren’t on the ice much more than a period or two out of three. Less plate appearances or ice time can mean that it is more likely that a fluke of some sort, good or bad luck, can make an impact. This is in contrast to basketball where there are only five players at any time and the stars typically play most of the game – more playing time means a bigger sample, by extension this means less variance.

Investing vs Gambling

“Investors are the big gamblers. They make a bet, stay with it, and if it goes the wrong way, they lose it all.”

“Investors are the big gamblers. They make a bet, stay with it, and if it goes the wrong way, they lose it all.”

Jesse Livermore

Not having an exit strategy before initiating a trading position is worse than gambling, where you realize that the chance to lose is too big, therefore you risk only money you can afford to lose. Not having a stop loss means that you are most likely risking more than you could afford to lose. As they say amateurs go out of business because of taking big losses. Professionals go out of business by taking small profits. Cut your losses short when your stop level is hit. Even more, make sure to put your stop loss order immediately after you initiate a trade. Put your stop loss at a place where the trend you are following will be over. Let your profits run by gradually lifting you profit protection stop order. In order to maximize your profits you have to be willing to give some of them back.

I” don’t believe anyone ever gets wiped out in the market because of bad luck; there is always some other reason for it. Either you were off when you did the trade, or you didn’t have the experience. There is always a mistake involved.”

Trading Secret

“The most important warrior secret of all: Your level of success in the world of financial markets is entirely up to you and has nothing to do with what the markets are doing. There will always be bull markets and bear markets. The occurrence of good or bad luck, if luck exists at all, evens out over time. Great success and the attaining of warrior trader status come about as a result of commitment, a never-ending willingness to learn, steadfast determination, and that rare ingredient, a touch of humility. Throughout the ages, all great warriors have had these same characteristics.”

“The most important warrior secret of all: Your level of success in the world of financial markets is entirely up to you and has nothing to do with what the markets are doing. There will always be bull markets and bear markets. The occurrence of good or bad luck, if luck exists at all, evens out over time. Great success and the attaining of warrior trader status come about as a result of commitment, a never-ending willingness to learn, steadfast determination, and that rare ingredient, a touch of humility. Throughout the ages, all great warriors have had these same characteristics.”

Good Luck Bad Luck!

There is a Chinese story of a farmer who used an old horse to till his fields. One day, the horse escaped into the hills and when the farmer’s neighbors sympathized with the old man over his bad luck, the farmer replied, “Bad luck? Good luck? Who knows?” A week later, the horse returned with a herd of horses from the hills and this time the neighbors congratulated the farmer on his good luck. His reply was, “Good luck? Bad luck? Who knows?”

There is a Chinese story of a farmer who used an old horse to till his fields. One day, the horse escaped into the hills and when the farmer’s neighbors sympathized with the old man over his bad luck, the farmer replied, “Bad luck? Good luck? Who knows?” A week later, the horse returned with a herd of horses from the hills and this time the neighbors congratulated the farmer on his good luck. His reply was, “Good luck? Bad luck? Who knows?”

Then, when the farmer’s son was attempting to tame one of the wild horses, he fell off its back and broke his leg. Everyone thought this very bad luck. Not the farmer, whose only reaction was, “Bad luck? Good luck? Who knows?”

Some weeks later, the army marched into the village and conscripted every able-bodied youth they found there. When they saw the farmer’s son with his broken leg, they let him off. Now was that good luck or bad luck?

Who knows?

7 Lessons for Traders

1. You always have to have cash, especially when no one else has it. (John Burbank of Passport Capital has said the same: “Cash is most valuable when others don’t have it.”)

2. No free lunch- it’s not free, or it’s not lunch.

3. You can’t change people! You can change yourself, but not others.

4. You only see reality under extreme stress- you want to get to know someone, you need to see them under extreme stress.

5. Volatility is not risk!

6. Always assume you will have bad luck.

7. Few variables to win. Once you have to think about more than 3 variables, your odds of winning are low.

7 Psychological habits

1. Overconfidence and optimism

Most of us are way too confident about our ability to foresee the future, and overwhelmingly too optimistic in our forecasts.

This finding holds across all disciplines, for both professionals and non-professionals, with the exceptions of weather forecasters and horse handicappers.

Lesson: Learn not to trust your gut.

2. Hindsight

We consistently exaggerate our prior beliefs about events.

Market forecasters spend a lot of time telling us why the market behaved the way it did. They’re great at telling us we need an umbrella after it starts raining as well, but it doesn’t improve our returns. We’re all useless at remembering what we used to believe.

Lesson: Keep a diary, revisit your thinking constantly.

3. Loss aversion

We hurt more when we sell at a loss than we feel happy when we (more…)

Dealing With Losses

A few quick caveats:

- There is no place for denial in successful investing.

- Don’t blame your losses on bad luck or outside manipulators. Accept the responsibility yourself.

- Don’t be dependent upon trading for all your fulfillment and happiness.

- Focus on opportunities, not on regrets.

- Proper risk control and discipline is non-negotiable for every trade everyday.

- Revenge trading – trying to make back a loss – carries with it far too much emotion and is always costly.

- Poor money management skills are the number one reason that novice traders wash out.

- Learn to recognize your impulsive state of mind and take action to stop it.

Even the best traders in the world book small losses on a regular basis. If you manage your emotions with consistency and if you strive for a disciplined trading mindset, then you should have no problem surviving a string of bad trades and showing profits at the end of the year.

THE FIBS TRADERS TELL

1. The losing position wasn’t my fault, the market moved against me.

1. The losing position wasn’t my fault, the market moved against me.

2. The trade was right and the market wrong.

3. I just have bad luck.

4. Eventually the stock will go up (or down)…eventually.

5. Bigger size equals bigger profits.

6. No need to close the postion just yet. I can average down.

7. Because I made so much money on the last trade I can take on more risk the next.

8. If the market is going down I can’t make any money.

9. I need to trade a larger account in order to be a better trader.

10. I’ve had many winners in a row, so now I need a big loser.

Any of these resonate with you? I am sure there are others but there is not enough room here to elaborate. Besides, I need to get back in the market. It can’t move without me!