Russia has admitted a submersible involved in the country’s worst naval accident in more than a decade was nuclear powered, nearly three days after it caught fire during a top secret mission off the northern coast.

Defence minister Sergei Shoigu told president Vladimir Putin that the submersible’s nuclear reactor was “completely isolated and unmanned” and in full working condition, according to a transcript published on the Kremlin’s website on Thursday.

Mr Shoigu said the fire began in the submersible’s battery compartment, which then spread, killing 14 sailors from smoke inhalation and injuring an unspecified number of others. The sailors evacuated some of the people on board, then isolated the fire at the cost of their own lives, Mr Shoigu said.

The Kremlin has said it will not name the ship or clarify its mission. Russian media have reported that the fire broke out on an AS-31 submarine complex known as the Losharik, which normally travels under a larger submarine to avoid detection and can itself release another, smaller submersible.

One of the Russian navy’s most secret vessels, the Losharik is built to dive much deeper than an ordinary submarine and can survey the ocean floor.

The accident was Russia’s most fatal submarine tragedy since a fire killed 20 and injured 21 during sea trials of a nuclear-powered submarine in the Sea of Japan in 2008.

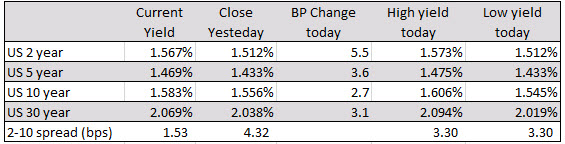

Below are the changes and ranges for the US debt curve (from 2-30 years). The 2-10 spread is 1.53 bps currently, down from 4.32 bps at the close yesterday. The thing about today’s move is the yields are higher across the board with the shorter end up more due to the taking out more of the 50 BP cut idea.

Below are the changes and ranges for the US debt curve (from 2-30 years). The 2-10 spread is 1.53 bps currently, down from 4.32 bps at the close yesterday. The thing about today’s move is the yields are higher across the board with the shorter end up more due to the taking out more of the 50 BP cut idea.

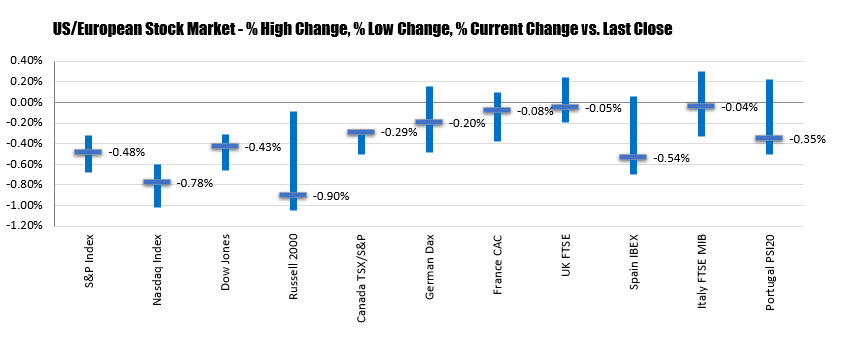

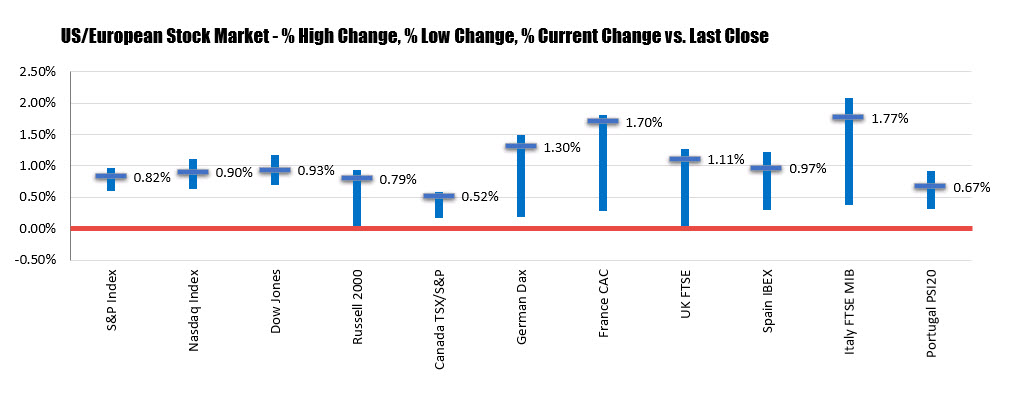

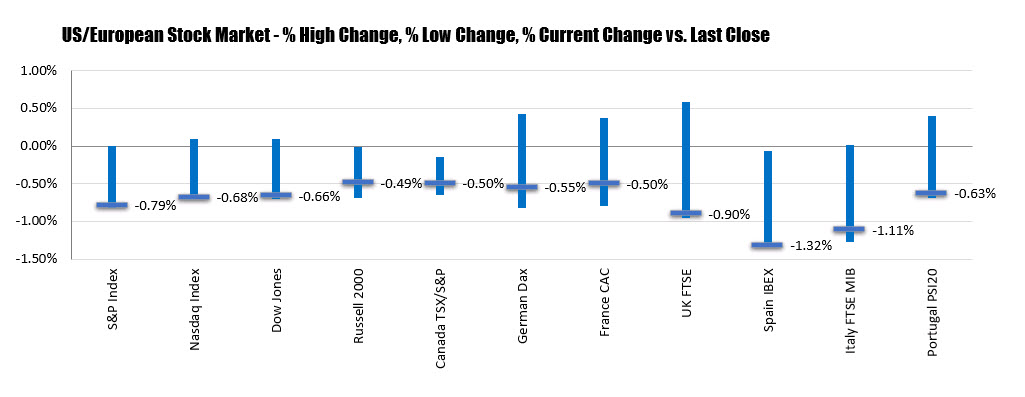

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.

The major indices open lower but did recover midday and traded marginally higher before reversing and moving back down.