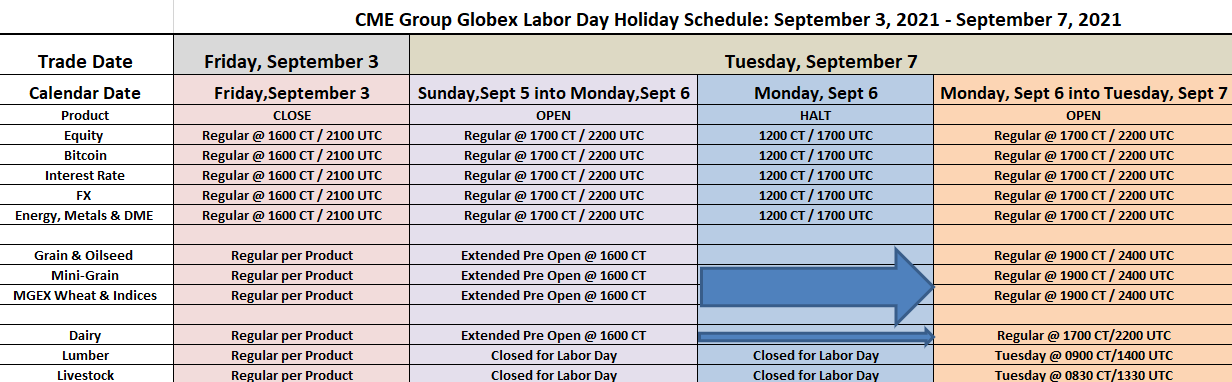

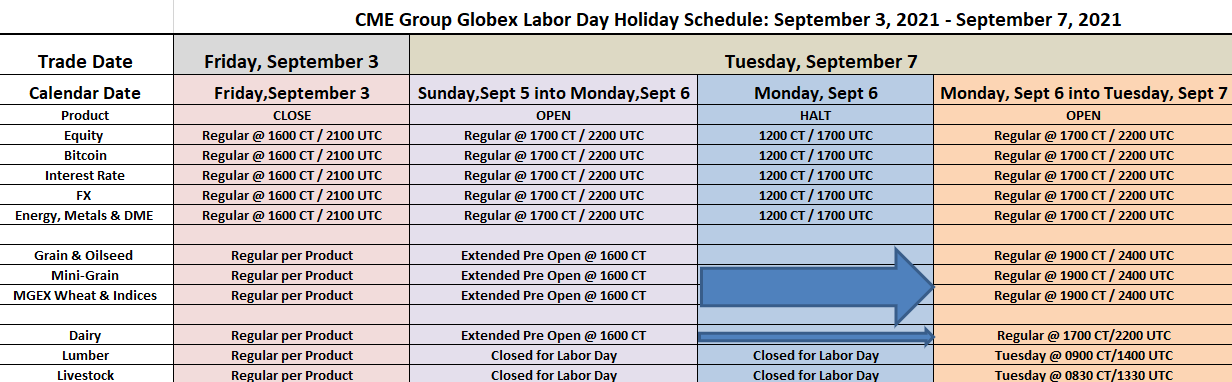

It’s Labor day (and next Tuesday will be a slow one as well)

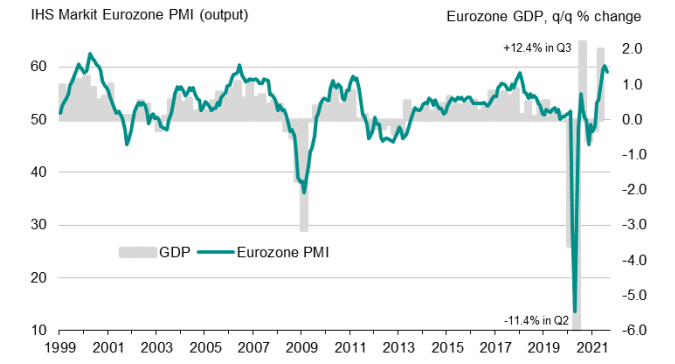

“It was another solid result for euro area businesses in August, according to the PMI numbers, which still point to rapid rates of expansion in output and demand. The labour market is also performing well and will further encourage this domestic-driven growth spurt.

“The benefit of looser lockdown restrictions has fuelled two of the best expansions since mid-2006 in July and August, but a step down since the preliminary ‘flash’ number tells us that this growth momentum is fading.

“While growth will naturally lose some impetus as the post-lockdown boom peters out, there are a number of other downside factors at play. The Delta variant has taken hold in Europe, while further material shortages and transport bottlenecks continue to restrain business activity. Rampant cost increases also persist, but slightly weaker rates of input and output price inflation provided some respite to both businesses and consumers alike, however.

“Regardless, another strong quarter-on-quarter rise in GDP is on the cards for the third quarter, and we’re certainly on track for the eurozone economy to be back at pre-pandemic levels by the end of the year, if not sooner.”

The aussie and kiwi are the two movers so far on the session, as they are continuing their good form over the past two weeks in pushing higher against the dollar.

For now, the technicals are supportive for the aussie against the dollar and it points towards a potential test of 0.7400 again, where upside momentum stalled previously during July and August trading.

As such, that offers a key line in the sand for buyers to contest in order to establish any fresh upside leg while sellers will have to defend that to hold their ground.

As things stand, the dollar side of the equation is a key consideration this week with the US non-farm payrolls release

tomorrowtoday a key risk event.That will set the tone towards the end of the week but a poor jobs report may yet spur a fresh break for AUD/USD to the upside back towards 0.7500 potentially.

Otherwise, we may see more of a middling tone ahead of the weekend with 0.7400 capping gains with downside limited closer to key near-term levels at

0.72750.7300 and0.73160.7344.

Remarks from JP Morgan (speaking with Yahoo finance)

Criteria for joining have been tightened: