A potential funding crunch beckons for China’s property sector

Fantasia Holdings is the latest name to have missed out on its debt payment today here and it won’t be the last in this entire saga. For some context, Fantasia was downgraded by S&P to CCC and placed on a negative credit watch at the end of September.

Adding to today’s headlines is the credit downgrade for Sinic by Fitch here.

Evergrande may still be the biggest name but the spillovers and broader impact is starting to surface, and it sure ain’t looking pretty.

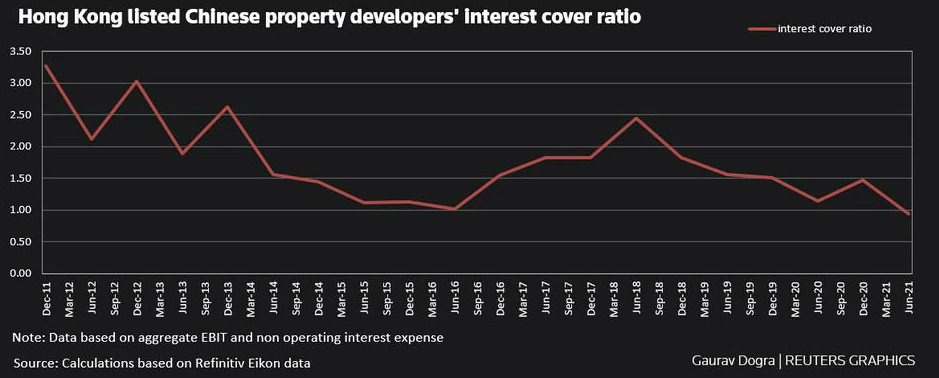

A Reuters piece from yesterday highlighted that the aggregate interest coverage ratio (in other words, the ability to repay debt) of 21 big Hong Kong-listed Chinese real estate developers fell to 0.94, the worst in at least a decade:

That’s rather concerning and the real fear is that Chinese authorities are going to allow for some of these firms to go under (in trying to make a statement) as they continue their quest to deflate the housing market bubble.

As we look towards the weeks/months ahead, expect to see more headlines surrounding this with a funding crunch looking increasingly likely for China’s property sector.