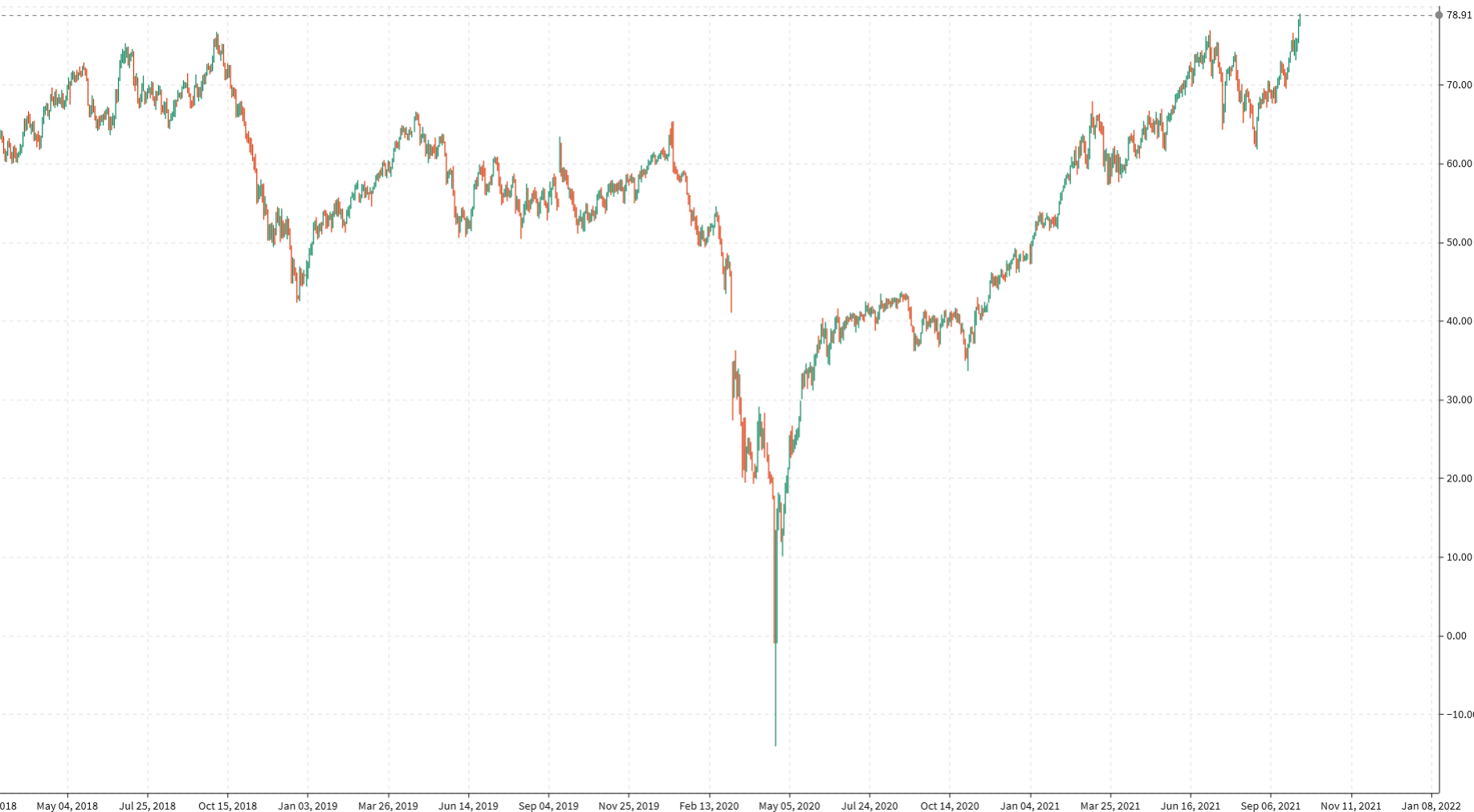

Coal shortages in China have resulted in a degree of capitulation.

China has been refusing to take Australian coal out of spite, not happy with Australia over various political matters. ANZ (overnight summary note) is noting however that the shortages of coal in China, which has resulted in electricity shortages and all of the associated costs to industry and keeping people warm, has prompted China to receive some coal. ANZ say a ‘handful’ of ships have been unloaded, circa 450k tonnes of coal.