Latest Posts

rss10-year Treasury yields at the highest since mid-June ahead of US non-farm payrolls later today

10-year yields are up another 2 bps today to 1.59%

Used vehicle prices new high. Thanks for playing.

The U.S. stock market is larger than the next 11 combined. Kinda insane.

ARE YOU PREPARED FOR BATTLE?

Sun Tzu wrote the book on battle preparations, claiming that battles are won and lost BEFORE swords are drawn. Why? Because preparation is key to success. Knowing when, where, why, and how to fight is more important than the weapons used to fight. Too many traders search for success while in the heat of battle, trusting that their instinct or higher education or technical knowledge of this indicator or that price pattern will guarantee victory. However, seasoned, successful traders have discovered that the battles in the market begin and end in the mind.

Those traders who suffer defeat in one too many battles, never to fight again, do so because they refuse to prepare for the uncertainty inherent in the markets. They choose instead to “shoot from the hip” with a gunslinger mentality. Battlefields change. The stock market is in a constant state of change. Those who win are prepared for these changes knowing that no two battlefields are alike. They are prepared with a plan of attack for any market condition. They prepare to win battles and they prepare to lose battles, knowing that defeat in battle does not mean ultimate defeat in the war.

Who will win and who will lose? It’s fairly simple isn’t it?

Governor of the Central Bank of Nigeria (CBN) says will launch digital currency in a couple of days

Nigeria stopped banks and financial institutions from dealing in or facilitating transactions in cryptocurrencies back in February of this year.

- Emefiele had previously said the eNaira would operate as a wallet against which customers could hold existing funds in their bank accounts, and that this would accelerate financial inclusion and enable cheaper and faster remittance inflows.

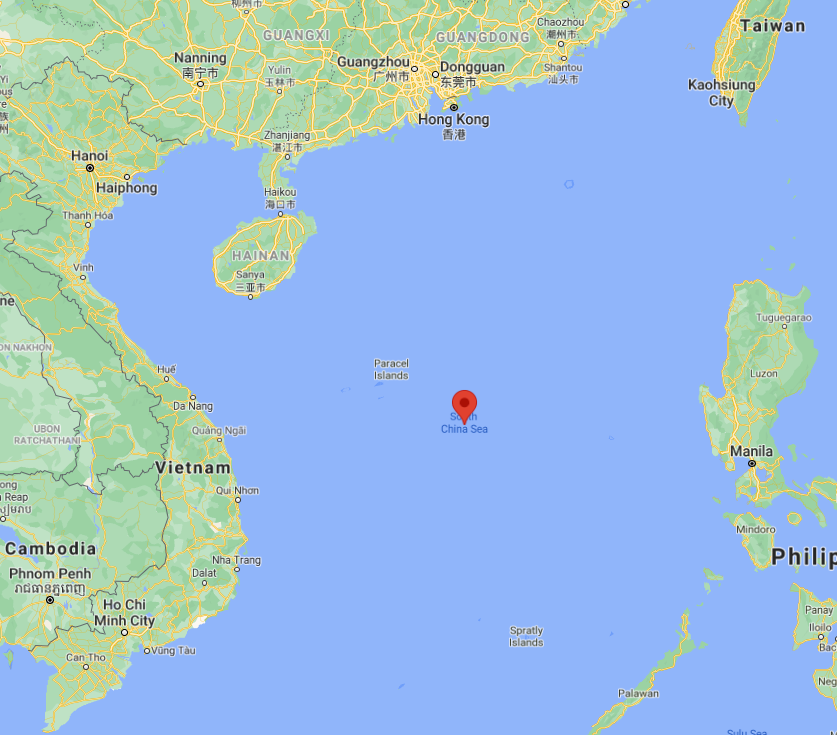

A US nuclear submarine has been damaged in international waters (South China Sea reportedly)

Various sources reporting, this below via CNN:

A US nuclear-powered submarine struck an object underwater in the South China Sea on Saturday, according to two defense officials.

- A number of sailors on board the USS Connecticut were injured in the accident

- None of the injuries were life-threatening

- Navy reports that the submarine is in safe and stable condition

- It’s unclear what the Seawolf-class submarine may have hit while it was submerged

The US major indices close higher but get back some of the gains

Up for the third straight day

The US major indices are closing higher on the day with the NASDAQ index and the Dow industrial average leading the way with gains near 1%. That’s good news. The not so good news is that the gains were much higher. The Dow industrial average was up 1.62% at its highs. The NASDAQ index was up 1.75%. The Russell 2000 index of low cap stocks was the big winner with a gain of 1.58%

- Dow industrial average up 337 points or 0.98% at 34754.15. The high saw the Dow up 558.2 points

- S&P index is up 36.28 points or 0.83% at 4399.83. The high saw the S&P up 67.04 points

- NASDAQ index is up 152.1 points or 1.05% at 14654.02. The high saw the NASDAQ up 253.80 points

- Russell 2000 rose 35.11 points or 1.59% at 2250.07

- Dow is 2% from its all-time high

- NASDAQ is trading less than 5% from its all-time high

- S&P is trading 3% from its all-time high

- The Dow S&P and NASDAQ is now on track for a gain for the week

Thought For A Day