Human emotion is both the source of opportunity in trading and the greatest challenge. Trade with an edge, manage risk, be consistent, and keep it simple. Good trading is not about being right, it’s about trading right. Trading with an edge is what separates the professionals from amateurs. Edges are found in the places between the battleground between buyers and sellers. Mature understanding of and respect of risk is the hallmark of the best traders. Ruin is the risk you should be concerned with the most. Don’t spent all your time admiring the fancy tools in the magazine. Keep it simple. Simple time-tested methods that are well executed will beat fancy complicated method every time. Trading with poor methods is like learning to juggle while standing in a rowboat during the storm. Sure, it can be done, but it is much easier to juggle when one is standing on a solid ground. Trading is not a sprint; it is boxing. The market will beat you up, screw with your head, and do anything it can to defeat you. But when the bell sounds at the end of the twelfth round, you must be standing in the ring in order to win. The market does not care how you feel. It will not prop up your ego or console you when you are down. I always say that you could publish my trading rules in the newspaper and no one will follow them. |

Latest Posts

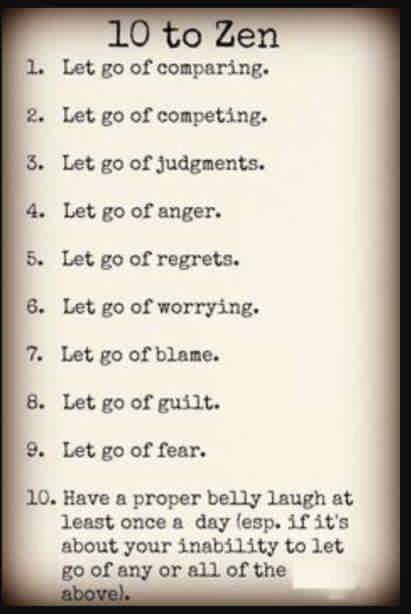

rss10 to Zen (Yes ,It's Not Easy-But Try )

What Fear Can Teach Us

Why drawdowns are s big deal. Elevator down but you have to take the stairs back up

Charlie Munger on getting ahead

Quotes from Dr Alexander Elder's -Trading for a Living.

Successful trader is a realist.

Successful trader is a realist.

Unstructured environment of the markets makes it easy to develop fantasies.

Many losers do not know that trading is intellectually fairly simple.

A loser is not undercapitalized, his mind is underdeveloped.

The market is not your mother. It consists of tough men and women who look for ways to take money away from you instead of pouring milk into your mouth.

Trading is the most dangerous human endeavor, short of war.

7 Ways to Become an Unsuccessful Trader

If you’d prefer to become an unsuccessful trader, you can start by making the following common trading mistakes.

If you’d prefer to become an unsuccessful trader, you can start by making the following common trading mistakes.

-The first big mistake is the flawed logic of extrapolation. Many traders and investors assume that a trend will remain in force until an “event” comes along to change it. But market trends are not like billiard balls on a pool table. This false assumption will put you on the wrong side of the market more times than not, especially at major turning points.

-The second big mistake is to suppose that news events drive market trends. In fact, the opposite is true: economic, political and social events lag market trends.

-One common mistake is to buy puts or calls that are way “out of the money,” with no other transactions to compliment them. Unless your timing is absolutely perfect — and who has perfect timing? — your chance of success is low. It’s like buying a lottery ticket.

-Another common mistake is to buy options with too little time left to expiration. With less than one month to expiration, the time decay begins to accelerate and the chances of success diminish.

-In the middle of a corrective pattern, it’s common to run out of patience while waiting for confirmation of a trend change. You have to give corrective patterns time to unfold before you jump in. This requires discipline, and a solid understanding of the many ways corrective patterns can unfold.

-Too many traders think Elliott wave is a trading system that tells you exactly where to enter and exit a particular market. That’s the biggest misconception. The reality is that it’s an analytical and forecasting tool, which helps you develop and use your own trading system, based on your own personal risk tolerance.

-Traders tend to over-rely on momentum indicators such as RSI, Stochastics and MACD to precisely spot turning points. But to paraphrase Mark Twain, markets can stay overbought or oversold a lot longer than either you or I can remain solvent.

"The two biggest mistakes traders make…they don't do enough homework and bit too causal about risk." ”

Mental Model: Conspiracy Theories

Why Traders Lose Their Discipline

- Environmental distractions and boredom cause a lack of focus – All of us have limits to our attention span and these are easily taxed during quiet times in the market;

- Fatigue and mental overload create a loss of concentration – The demands of watching the screen hour after hour make it difficult to be sharp, creating fatigue effects that are well-known to pilots, car drivers, and soldiers;

- Overconfidence follows a string of successes – It is common for traders to attribute success to skill and failure to situational, external factors. As a result, a string of even random wins can lead traders to become overconfident and veer from trading plans–especially by trading too frequently and/or trading excessive size;

- Unwillingness to accept losses – This leads traders to alter their trade plans after trades have gone into the red, turning what were meant to be short-term trades into longer-term holds and transforming trades with small size into large trades by adding to losers; (more…)