Of all the ways to make money in the financial markets, being a short seller is one of the toughest. The short seller is fighting the upward bias of the equity markets as well as the wrath of deep-pocketed, litigious individuals with vested interests in the stocks he is targeting. He has to be both a sleuth and a promoter; after all, what good is all his detective work if other investors don’t know what he uncovered and don’t join him in putting downward pressure on the stock?

Of all the ways to make money in the financial markets, being a short seller is one of the toughest. The short seller is fighting the upward bias of the equity markets as well as the wrath of deep-pocketed, litigious individuals with vested interests in the stocks he is targeting. He has to be both a sleuth and a promoter; after all, what good is all his detective work if other investors don’t know what he uncovered and don’t join him in putting downward pressure on the stock?

In The Most Dangerous Trade: How Short Sellers Uncover Fraud, Keep Markets Honest, and Make and Lose Billions (Wiley, 2015), Richard Teitelbaum, a financial journalist, has written illuminating profiles of ten top short sellers, complete with their investing strategies. Combining interviews with well-researched back stories, he explores the highs and lows (and there are a lot of lows) of short selling.

Bill Ackman, Manuel Asensio, Jim Chanos, David Einhorn, Carson Block, Bill Fleckenstein, Doug Kass, David Tice, Paolo Pellegrini, and Marc Cohodes are the featured investors. We learn about their early years, how they ended up being short sellers, even the significance of their fund names. Why Muddy Waters, for instance? Block, trying to find a good name for his nascent firm, recalled a Chinese proverb: “Muddy waters make it easy to catch fish.”

We read about positions that worked and those that didn’t—and what these investors learned from the latter. We learn how they construct their portfolios (including long positions) and how they try to mitigate risk (sometimes with options).

Latest Posts

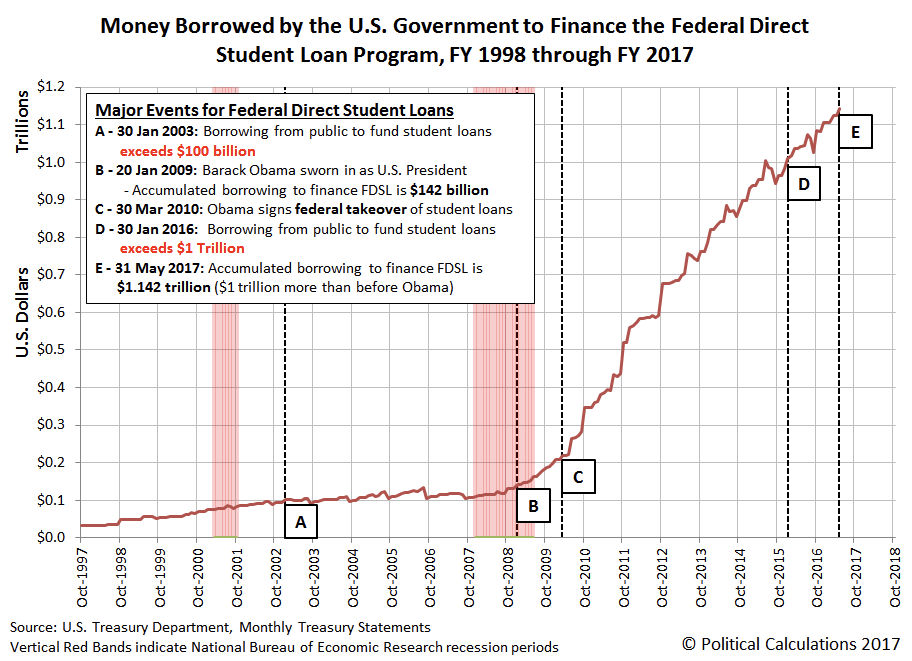

rssUS Student Loan Explosion

Learning From Losers

Traders will typically approach a large loss in one of two ways. First is the dumb way, and that is to become a petulant whiner and throw a fit. Next is the more-constructive way, and that is to use the loss as a means of developing as a trader and to “quote” — learn from your mistakes. But there is a third way. And that is to view the loss as the cost of information.

Traders will typically approach a large loss in one of two ways. First is the dumb way, and that is to become a petulant whiner and throw a fit. Next is the more-constructive way, and that is to use the loss as a means of developing as a trader and to “quote” — learn from your mistakes. But there is a third way. And that is to view the loss as the cost of information.

I don’t mean the cost of doing business per se. This is not typically associated with large losses. Small losses, yes. Because to make money you have to lose some along the way, as casinos do every day. And not the cost of tuition where the market charges a fee to school us. No, I mean information.

Instead of asking yourself about where you placed your stops and getting all personal about the whole thing, ask yourself what happened. Why did the market move the way it did? If you haven’t suffered a capital depletion, you are not likely to demand an answer and more likely to throw off the question with a wave of the hand and a shrug. “Who knows, who cares. I only play odds.”

Markets are a beast and if you want to play with them, you’ll have to be careful. Wear protective goggles and gloves. If you want to tame them though, you’ll need to wrestle with them. And sometimes you lose some body parts along the way.

How Leeson broke the bank -Must read

It was the 1980s. Traders were young and greed was good. Nick Leeson, a working class lad from Watford, the son of a plasterer, was chuffed to land a job in the purportedly-glamorous world of the City of London in 1982.It was a relatively low-grade job, but he quickly made a name for himself. He worked his way up, becoming a whiz-kid in the hardworking atmosphere of the far eastern currency markets.

Soon, he was Barings Bank’s star Singapore trader, bringing substantial profits from the Singapore International Monetary Exchange. By 1993, a year after his arrival in Asia, Leeson had made more than £10m – about 10% of Barings’s total profit for that year.In his autobiography Rogue Trader, Leeson said the ethos at Barings was simple: “We were all driven to make profits, profits, and more profits … I was the rising star.”He and his wife Lisa enjoyed a life of luxury that the money brought.

He earned a bonus of £130,000 on his salary of £50,000

Nicholas Leesson ,the trader who brought down the Barings Bank in Februrary ,1995 ,is a made to order example of the business of not facing up to a loss ad getting out.He’s also a perfect example of the dangers of adding to a losing postioin in hopes of digging your way out.The Barings Bank was the bank that lent the United States the money to make the Louisiana Purchase.When Nicholas Lesson finished his trading for the bank ,Barings was sold for the equivalent of $ 1.40. (more…)

in Februrary ,1995 ,is a made to order example of the business of not facing up to a loss ad getting out.He’s also a perfect example of the dangers of adding to a losing postioin in hopes of digging your way out.The Barings Bank was the bank that lent the United States the money to make the Louisiana Purchase.When Nicholas Lesson finished his trading for the bank ,Barings was sold for the equivalent of $ 1.40. (more…)

Market Rewards The Rich …..??

No Words to Write :Really Mera Bharat Mahan !

Sticking to the Plan

A Trading Plan only has value if it is utilized as intended. It does you no good to have one if you do not stick to it. We all know this, yet traders find reasons to deviate from their Plan, almost always with negative consequences. Why? There are several reasons.

A Trading Plan only has value if it is utilized as intended. It does you no good to have one if you do not stick to it. We all know this, yet traders find reasons to deviate from their Plan, almost always with negative consequences. Why? There are several reasons.

- The Plan does not match the trader: A Trading Plan is a personal thing intended for a specific trader, based on her/his personality and circumstances. If it is not created honestly based on reality rather than hope, then it will not match the trader, and likely it will be neglected.

- Lack of Patience: Trading Plans are intended to be long-term, at least relatively so. Many traders give up on their Plan, or often more specifically the trading system in the Plan, after a period of sub-par performance rather than sticking it out through the inevitable rough times.

- Lack of Discipline: Trading according to a plan requires continuous performance of a set of actions in a proscribed manner. Doing so takes discipline. Traders lacking discipline do not stick to Trading Plans. (The word “discipline” is probably the most frequently used in regards to trading success.)

- Self-Destructive Behavior: Sometimes traders have deeply ingrained issues of a psychological nature which tend to sabotage them. It is something which can be overcome with work, but first it must be recognized and addressed.

These are not the only reasons traders fail to stick to Trading Plans, but they do represent a large portion of the explanations for it happening. The point is that a Trading Plan is little more than a document if not put in to practice.

I hope this sequence has been helpful to you. Definitely feel free to drop me a question or leave a comment with your thought, experience, or ideas on the subject.

Why India remains the most surprising country in the world…

Man with 4 aces loses to a royal flush [video]

Imagine the elation of having four aces in a game of poker. Your hand is essentially unbeatable. The only way to lose is if someone has a royal flush. And what are the odds of that, right?

Ten Ways to Trade Like the Legendary William J. O’Neil:

- Do not diversify broadly, instead focus on the leading stocks in the best industry groups.

- Cut any loss when the stock is down 7%/8% from your buy point.

- Buy stocks that are going up in value, not down.

- Add to a position as the stock goes up in value from your buy point not at lower prices.

- Buy stocks near their highs for the year not their lows.

- Study price charts to discover how the best stocks behaved historically in price action.

- Trade in the right direction based on the trend of the general market.

- Buy the best stocks in the market as they break out of properly formed bases or when they bounce off their 50 day moving averages.

- Do not be influenced by others, trade your plan.

- Buy stocks with the best earnings and sales growth at the right time using charts.