- They pursue realistic goals as their returns.

- They take decisive and immediate action when their buy or sell signal is hit.

- They focus on winning trades and not quantity of trades.

- They make logical, informed trading decisions within their system, based on the probabilities.

- They avoid the trap of trying to make perfect trades, and instead focus on being profitable in the long term.

- They trade the right position size that is within their comfort zone.

- They keep things simple and focus on winning trades, not complexity in their trading.

- They focus on learning and making small continuous improvements in their trading system.

- They measure and track their progress with a trading journal.

- They maintain a positive outlook as they learn from their mistakes, and focus on trading with discipline.

- They spend time learning from better traders.

- They maintain balance in their life by spending time with family and friends.

- They love what they do and their passion keeps them going through the rough times.

Latest Posts

rssMarkets Like Water

Water is unstoppable. Given enough time, it will defeat all the mortal ingenuity of the best and the brightest.

Water is unstoppable. Given enough time, it will defeat all the mortal ingenuity of the best and the brightest.

Two atoms of Hydrogen bonded with one atom of oxygen.

How can something so powerful in one context also be so weak in another. Jump off a high diving board and hit the water abdomen first and tell me it doesn’t hurt, but sit next to the pool and you can effortlessly push your finger into the water.

I think it is very helpful to think of relationships between financial markets in this way.

There are circumstances under which past conditionality allows one market to predict another for a given holding period with much greater accuracy than normal. In this context the weak bonds between molecules that allow you to push your finger into the water correspond to those occasions when leading correlative effects are absent and vice versa for those fleeting periods when regularities are plentiful.

It makes some measure of sense to look at what situations might make the molecules (predictive relations) hold closely together and those times when the mistress collects her dues from market protagonists.

Clearly having the predictive relations is enough. But some measure of ‘meta-understanding’ does not hurt, even if such classification is elusive or futile.

There really is nothing to lose by doing so.

The Disciplined Trader: Developing Winning Attitudes by Mark Douglas

Intro

- Reaching the level of success they desire as traders will require them to make at least some, if not many, changes in the way they perceive market action.

- The markets have absolutely no power or control over you, no expectation of your behavior, and no regard for your welfare.

- There are only a few traders who have come to the realization that they alone are completely responsible for the outcome of their actions. Even fewer are those who have accept the psychological implications of that realization and know what to do about it.

- The nature of the markets made it easy no to have to confront anything that otherwise might be perceived as a problem because the next trade always had the possibility of making everything else in one’s life seem irrelevant.

- I CREATED MY LOSSES INSTEAD OF AVOIDING THEM SIMPLY BECAUSE I WAS TRYING TO AVOID THEM.

- Unsuccessful Trading Behaviors

- Refusing to define a loss.

- Not liquidating a losing trade, even after you have acknowledged the trade’s potential is greatly diminished.

- Getting locked into a specific opinion or belief about market direction. I.E. “I’m right, the market is wrong.”

- Focusing on price and the money

- Revenge-trading to get back at the market from what it took from you.

- Not reversing your position even when you clearly sense a change in market direction

- Not following the rules of the trading system.

- Planning for a move or feeling one building, then not trading it.

- Not acting on your instincts or intuition

- Establishing a consistent patter of trading success over a period of time, and then giving your winning back to the market in one or two trades.

"Superior traders have tremendous commitment to their craft..constantly ask what doing right..wrong?."

When CNBC makes a special graphic around a "theme" it's almost over ”

101% Avoid Blue Channels……………….Yes Forget Fundamentals (of Indian Companies ).

No Need to Read Balance Sheets or About Economy.Just Trade with levels ,Nothing else

Benefits of Mindfulness in Trading

Mindfulness in trading can be of significant benefit to traders. Mindful trading will positively impact traders and their trading in a number of ways:

- Reduce loss aversion

- Mitigate the disposition effect (i.e., cutting winning trades short and letting losing trades run)

- Help traders get into “the zone”

- Reduce the negative effects of cognitive biases and heuristics on trading decisions

- Directly reduce stress

- Help traders see the market more clearly

- Increase awareness of the trader’s internal state and how it impacts their trading

- Increased ability to maintain focus on the market and the trading task at hand while trading, even when emotions are running hot

- Increase internal emotional regulation

- Other positive effects on trading and trading behavior

One of the best tests of a trader is what they do when markets are closed

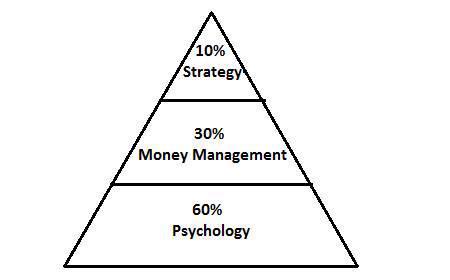

Profitable Trading is: 10% System 30% Position Sizing 60% Discipline

Great Book

Now Finished Reading

Successful Trading & Winning Traders