In trading as in life, effectiveness has to be the measure of truth. If something doesn’t work, there is no point in continuing to do it. Misperceptions, false unconscious or conscious beliefs, and unhelpful behaviors can contaminate and desecrate your most sought after results.

Imagine the frustration of a trader who perceives that a market is changing direction when in fact it is persisting in its original thrust. Or consider, for further example, an investor who bought into the belief that buy and hold is a valid investment strategy. That investor had to have experienced devastating losses over the past year. Or ponder the trader who repeatedly fails to utilize stop losses and experiences numerous outsize losses because he won’t accept a loss.

When you choose effectiveness as your measure of truth, you can learn from your mistakes. You can make plans, take action, receive feedback, and assess the results. You can revise your plans, take new actions, receive new feedback, on and on, until you find a viable strategy that will work most of the time.

When you fear loss, when greed overcomes you, when you get reckless, or when you hesitate, you become grossly ineffective. When you’re confused or ambivalent yet think you need to take action, you do yourself no good. In each case you need to sort through your thoughts, develop a clear focus, search for the high probabilities, and take prompt and calm action. (more…)

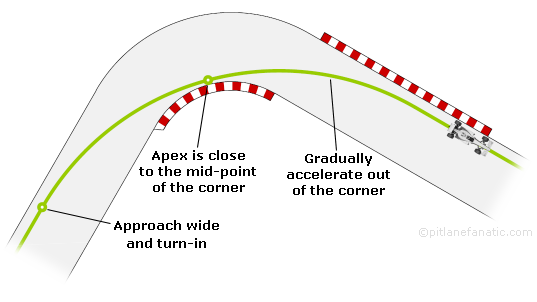

I was watching a formula one race the other evening and it reminded me of the racing line. The racing line is the direction, speed and angle in which a driver goes through a corner. Come in too far from the inside, your exit will be poor. Too far out, someone can pass you. Come out of the corner perfectly but be in the wrong gear, you’re toast.

I was watching a formula one race the other evening and it reminded me of the racing line. The racing line is the direction, speed and angle in which a driver goes through a corner. Come in too far from the inside, your exit will be poor. Too far out, someone can pass you. Come out of the corner perfectly but be in the wrong gear, you’re toast.

I’m sure every trader has run into some kind of negativity from know-it-all chodes who just don’t get what this subject is about – it goes something along the lines of “What good does it actually do? You are just stealing other peoples money?” blah blah *yawn* blah….

I’m sure every trader has run into some kind of negativity from know-it-all chodes who just don’t get what this subject is about – it goes something along the lines of “What good does it actually do? You are just stealing other peoples money?” blah blah *yawn* blah….

When you feel confident, presuming you do sometimes feel confident, where do you feel it? Can you feel it in your brain or is it in your thorax (i.e. middle part of your body)? Better yet, why do I ask?

When you feel confident, presuming you do sometimes feel confident, where do you feel it? Can you feel it in your brain or is it in your thorax (i.e. middle part of your body)? Better yet, why do I ask?