This Same Thing now Happening in India……………..From Years !

Latest Posts

rssA Good Reminder

Trend follower Ken Tropin: In this business you need to have ample payoffs from your winning trades but make sure your losing trades do not generate big losses—so the returns have a fat right tail but not much left tail! Suppose over time you make money on half your trades and lose money on the other half. If the winning trades are double the size of the losing trades, then you have a pretty profitable investment.

Desire and Fear

Desire and fear alternate in the minds of traders as they go through the day. But let me ask you whether desire or fear dominates your thoughts and feelings as you trade?

Desire and fear alternate in the minds of traders as they go through the day. But let me ask you whether desire or fear dominates your thoughts and feelings as you trade?

For many traders the primary emotion is fear. They fear loss: losing profits, losing money, losing equity and even their margin. Some fear losing their touch, their feel for the market, their focus, their luck, the respect of their boss, colleagues, or mate, or worse, their own self esteem.

Other traders are flooded with the emotion of desire. They look forward to what the day will produce. They like the thrill of the chase. They have a sense of unlimited potential and abundant opportunities for profit. They anticipate improving their skills, intuition, and understanding as they go through the trading day and week.

Keep in mind that desire is not greed. Greed is an inordinate wanting. It is excessive desire and comes from a sense of scarcity, a feeling that there is not and will not be enough. Desire is healthy: greed is unhealthy.

What you feel depends upon your mental focus. Do you place your conscious and unconscious attention on the possibility of loss or the probability (hopefully) of gain? (more…)

"A lot of money has been lost in trying to be the first to identify the trend"

10 Trading Lessons

1. Markets tend to return to the mean over time.

2. Excesses in one direction will lead to an opposite excess in the other direction.

3. There are no new eras – excesses are never permanent.

4. Exponential rising and falling markets usually go further than you think.

5. The public buys the most at the top and the least at the bottom.

6. Fear and greed are stronger than long-term resolve.

7. Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chips.

8. Bear markets have three stages.

9. When all the experts and forecasts agree – something else is going to happen.

10. Bull markets are more fun than bear markets.

World :Cities where Rent Swallows Your Salary

Trading Rules

Really Brilliant Students -Humour Time

Mathematical Expectation in Trading Systems-Must read

Here is a brief lesson in how mathematical expectation works.

On the roulette wheel there are 36 numbers, double zero, and the blank. That makes 38 spaces to bet on. Each bet costs $1 to play. The winner pays $35. To calculate the mathematical expectation of the roulette wheel you do the following:

Multiply the probability of winning by what you win when you win. And from that, you subtract the probability of losing by the cost of each bet. The difference is the mathematical expectation. If it’s positive, it’s a fair bet. If it’s negative, you don’t play.

[(1/38) x (35)] – [(37/38) x (1)] = mathematical expectation of playing roulette.

(35/38) – (37/38) = (-2/38) or (-1/19).

So in the case of the Roulette wheel, the best bet is not to play. The problem is playing Roulette is fun! Most professional money handlers don’t find losing money fun. And that’s the difference between the professional and an amateur.

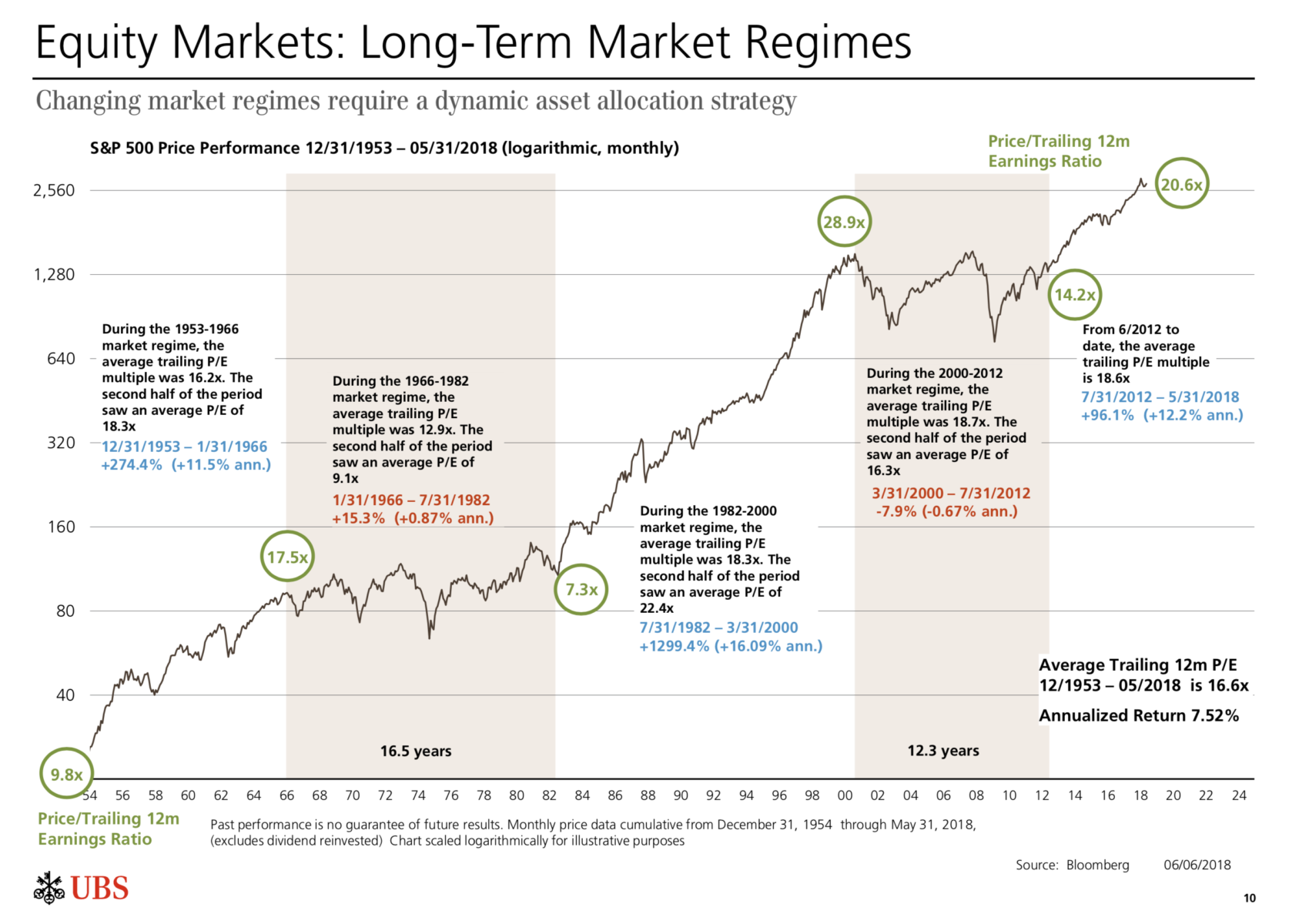

Bull Markets & P/E Multiple Expansion