Ed Seykota, first featured in the book Market Wizards has one of the best records of all time for any trader. Ed Seykota’s returns on capital compares to those achieved by Warren Buffett, George Soros or William J. O’Neil. He is among the trading gods with no doubt. What does he find important in trading success? Mr. Seykota has a keen focus on trader psychology above all other trading dynamics. Seykota’s website Trading Tribe spends more time advising it’s readers on proper trading psychology than anything else. Most traders are not concerned with their own psychology and instead focus on entries and exits, with trading systems and making money, not their mind and emotions. This is generally their undoing. The longer you trade and the bigger your account grows the more I see the crucial importance of mindset in the trader’s success or failure. When a losing streak sets in the trader finds out what his underlying issues are and how he handles losing is the key to his long term success. The traders ego management determines his success as much as his trading system and risk management. An an ego can cause you to let losers run and bet far too much on any one trade. An unchecked ego can destroy your account. The market is a terrible place to learn about internal issues by losing money. Here are some quotes that changed how I thought about trading early on and have kept me on the right path to consistent profits. (more…)

Latest Posts

rssPearls of Wisdom From King of Sugar

The 91-year old tycoon and uncle of Wilmar co-founder and chief executive Kuok Khoon Hong, still watches the sugar market daily, and trades the commodity so he can pay for his bottles of Petrus 1989, one of the world’s rarest and most expensive wines.

Mr Kuok rarely gives interviews, but he shared his trading philosophy with Jonathan Kingsman, founder of Kingsman sugar consultancy and occasional Financial Times commentator, for his recently published book The Sugar Casino .

Here are some of his pearls of wisdom:

Always take profits promptly

“Not knowing when to take a profit is the Achilles heel for a trader. Take profits! Don’t wait. If you have a profit you have to take it. If you wait it will be your downfall.”

The sugar market is prone to over supply

“In the sugar market, there is always over production. There is no point hoarding sugar. There is always a bumper crop coming up.” (more…)

Sometimes the right path is not the easiest one, but follow your heart and do what you know is right.

Excellence is commitment to details

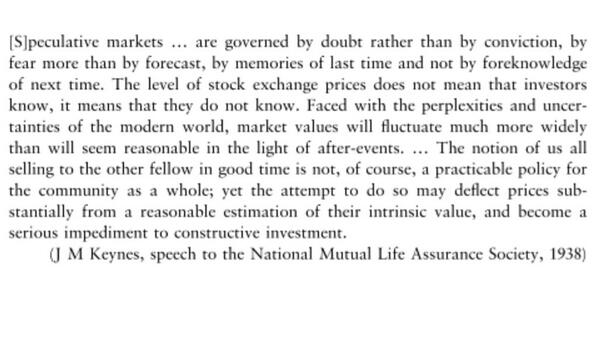

Markets fluctuate, Keynes edition

"Knowledge acquired by reason will dispel ignorance & thus destroy the greatest evil fear…"

Story of a Speculator -Must Read (If u have Time )

4 Types of Trades

Stock trading consists of 4 major types of trades.

The range-bound trade: the stock is tied in a range and will remain there until there is a significant change in the supply/demand dynamics. For this trade you fade any move to the boundaries of the range with a tight stop a little bit below/above the range. If the range is broken, you will lose small amount. It is good for scalpers with shorter trading horizon.

The breakout trade: in order to break from a range, a stock needs to experience a major shift in supply/demand. A dramatic occurrence. News or expectation of news. The news doesn’t have to be connected with the individual stock. It might be something that impacts the whole industry or market. Sudden change in participants’ confidence. Not every breakout will be caused by clear news. Often it will happen at no news at all. In any case, volume should be your tell how genuine the move is. Buy several cents above the range with a stop several cents into the range. (more…)

Self-Awareness

“You can’t kid yourself in trading. You have to deal with who you really are, and take responsibility for all your shortcomings, which the markets have a way of revealing rather starkly. You have to confront all your fears and tame them. You have to check your ego at the door.

You learn from each experience. There’s nothing in life that you can do that can guarantee that you’re not going to go through some pain. Trading is certainly not a singular pursuit in that regard. What I have learned is this: Patience and diligence are rewarded. Profits will eventually accrue if you do the right thing and stick with it. That’s the most important thing!