Latest Posts

rssUruguay! Home of Great Soccer, Beautiful Women, & Argentina Capital Flight

Punta del Este, templo de celebridades

Messi’s offshore tax mess

Barcelona star Messi, was already under investigation in Spain on charges that he and his father, Jorge Horacio Messi, used offshore companies in Belize and Uruguay to avoid paying millions of dollars in taxes when the Panama Papers revealed he owned yet another offshore company: Mega Star Enterprises, based in Panama. – The Irish Times

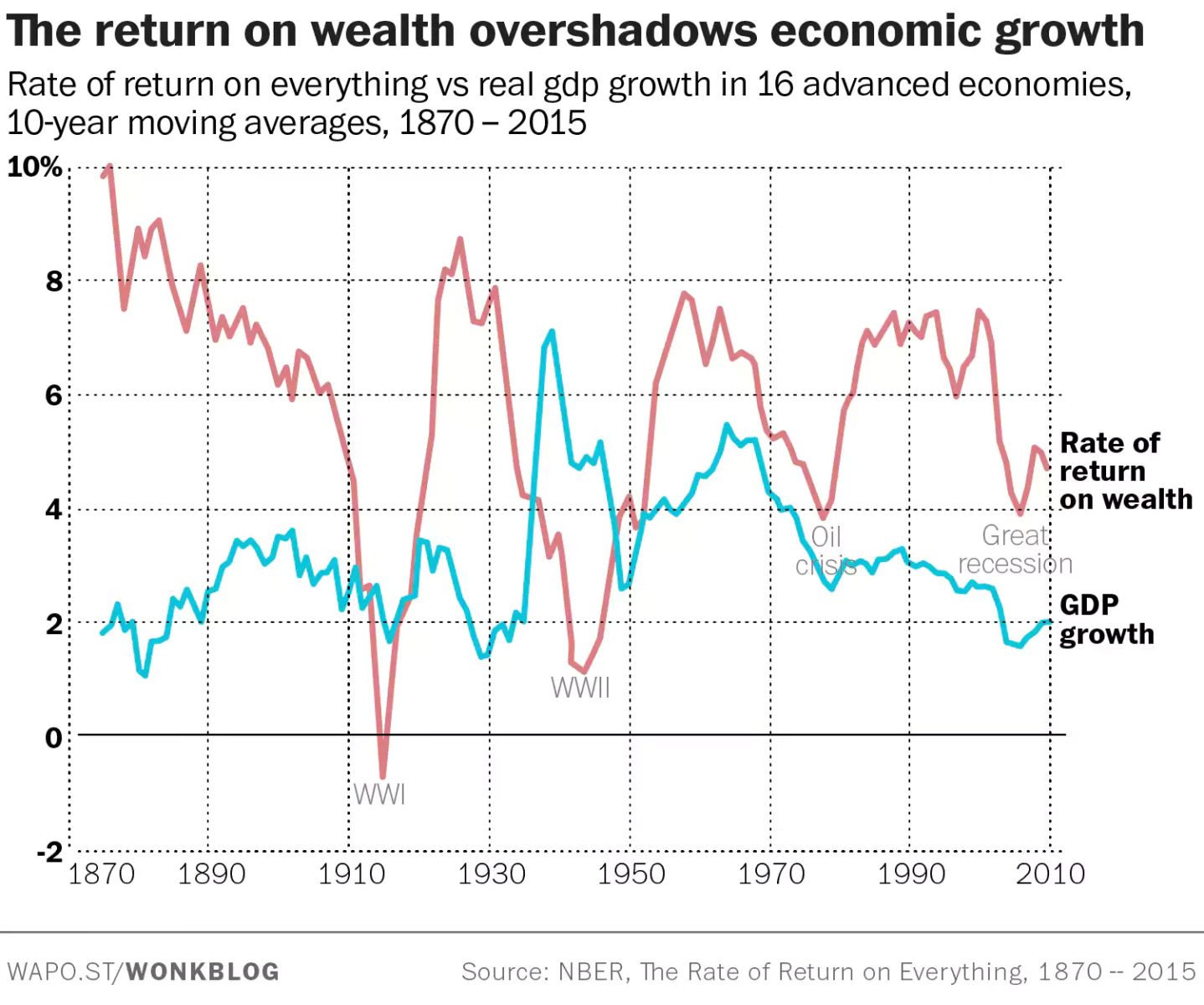

Massive new data set suggests economic inequality is about to get even worse

Cash comfort for PSU banks -Not An Good Idea at all

Let’s make it a good one this time okay?

The disconnect between GDP growth and asset prices.

Characteristics Of A Losing Trader

Advance Decline -Line and the Mystery

What the hell behind the AD-line which keeps on declining continuously for more than a year in this rising market? If you check the NSE stock most of them are either moving sideways or trending downwards only the Nifty 50 pack is moving up rest are still in the silent mode. What could be a possible reason for this kind of action. Definitely it doesn’t sounds like euphoria in the market. But market is moving upside in rotational trading fashion.

Think it over………..In need of Comments from Intelligent Traders,Investors & Readers

Updated at 12:43/19th Oct/Baroda/India

Mark Douglas : Trading in the Zone

Without doubt the foremost reading, it seems, in trading circles. Douglas’ book, in my view, deserves its place at the top of a traders reading list. Whether you are trading currencies, commodities, stocks or futures this book will have something for everyone. The book tackles the psychology involved in being a successful trader. The book attempts to give the reader the tools to develop the Confidence and discipline to become and consistent winner.

Without doubt the foremost reading, it seems, in trading circles. Douglas’ book, in my view, deserves its place at the top of a traders reading list. Whether you are trading currencies, commodities, stocks or futures this book will have something for everyone. The book tackles the psychology involved in being a successful trader. The book attempts to give the reader the tools to develop the Confidence and discipline to become and consistent winner.

I think the book is a superb read and although I cannot say right now how succesful it has been, it is one of the few books that I pick up nearly every day and read another chapter again and remind myself of some of Douglas’ inspiring ideas and thoughts.

The book ends with a great 20 trades learning excercise that is a must.

The key learnings I get from reading this book :

1)The market is random; you cannot predict it. Unless you know every individual who has a position in the market and you know their strategy for each trade it is impossible to know what will happen next.Give up trying to predict, and focus on the now moment and managing yourself , your money and your strategy.

2)The Power of Association. Douglas uses throughout the book a story about a boy and his fear of dogs. He uses this analogy to describe how previous experiences that have given pain, or expected pain, to us will mean that our mind will do everything possible to protect itself from future pain when it is exposed to similar circumstances at some point again in the future. i.e. If you recognise a market pattern where previously you lost a trade you will be compelled to exit the trade at that point or not take that trade on; because you will not want to experience pain. Douglas again talks about the here and now and describes how we can overcome these internal obstacles.

101%….Don’t miss to Read this Book !!!!

Thought For A Day