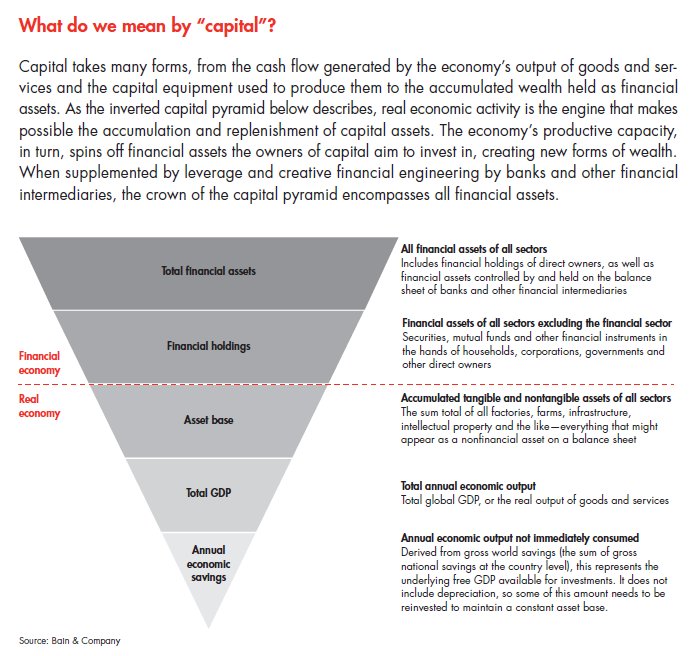

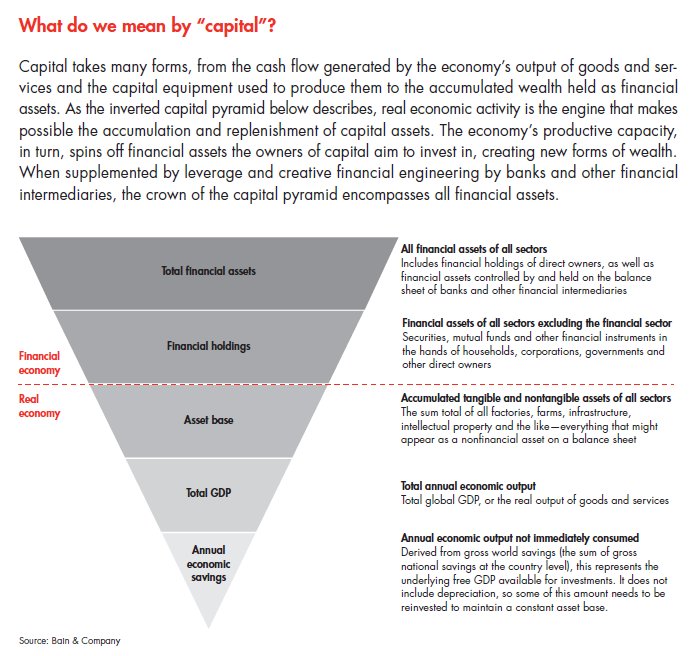

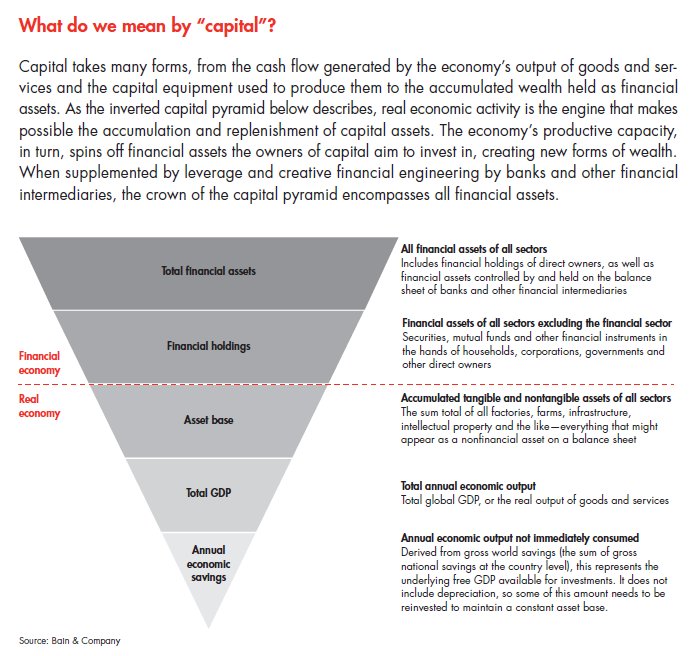

What do we mean by "capital" ?

1. No matter what you read about trading, until you use an approach and test it with your money on the line you will never learn how to trade. Paper Trading is NOT Trading!

1. No matter what you read about trading, until you use an approach and test it with your money on the line you will never learn how to trade. Paper Trading is NOT Trading!

2. If it were really possible to “Buy Low Sell High” or “Cut your Losses and Let your Winners Run”, then almost everyone would be making money rather than losing it.

3. Remember that there is ALWAYS someone on the other side of your trade who is using a trading technique exactly the opposite of yours who hopes to make money with his system.

4. If 90% of all traders lose money, they must be following generally accepted trading rules. The 10% who win do not!

5. You trade your beliefs and your beliefs about your system. If you have a problem with yourself, fix yourself first.

6. Impatience, Fear and Greed will make you poor. Any need to trade is rooted in greed and impatience.

7. If you really understand the markets then YOU KNOW that there is the same opportunity on every time frame, in every market, every single day.

8. Waiting for the perfect trade is “chickening out”, and caused by your lack of faith in yourself or your system.

9. Any hardwired, automated trading system sold that truly works 70 or 80 or 90 percent of the time in every market would be worth hundreds of millions of dollars and would not be for sale at any price.

10. Asking “How small an account do I need to begin trading” is asking to be wiped out.

11. Having a series of winning trades early can be more hazardous to your account than a series of small losses.

12. Learn to trade before you trade. If you win or lose without understanding why, you will never develop a winning strategy.

13. Ninety five percent of everything you hear from everyone about the markets and the markets “reasons” for doing what it did or will do are lies. Neither you nor anyone can predict the future. You can only make educated guesses about potentialities.

14. Asking someone (such as using a service) for advice on where the market is going is a sign you should be on the sidelines until you understand the market better. If the upcoming market direction is not obvious to you, you should not be risking your money. You will lose often enough even when you are right.

15. There is NO GUARANTEED way of making money in the Markets or anywhere else. NONE, NADA, ZIP, ZERO! All you can do is increase your knowledge about yourself and how to estimate the probability of placing a winning trade. Then trade by taking controlled and measured risks.

Great photographers never take a picture until everything is set up correctly and the subject is in focus.

Great photographers never take a picture until everything is set up correctly and the subject is in focus.

If they have not analyzed the situation before taking the picture, their results will not be successful.

Traders need to follow the same steps. Your mind must be in focus and we must have a solid foundation in place before we execute a trade or else we will not have a high chance for success.

Advisor – the one who charges money for a piece of stock advice to cover his/her losses on the market.

Advisory Service – an advisor who lost a considerable amount of money and started new business.

Afternoon – a daily chance to give back the money you made that morning (see Friday).

Apprentice – anyone who peers at your screen shortly after you closed a profitable deal.

Average Down – what you have to do if you opened a long position and had to go to the bathroom.

Average Up – what you have to do if you opened a short position and had to go to the bathroom.

Bad Trade/Stupid Trade – an unprofitable deal that someone else carries out which does not fit your trading strategy.

Bottom – (when you have an open long position) the spot where you give up averaging down and sell; (when you have an open short position) the spot where the book recommends you to open a short position.

Break – a pause you take when you have either 2 profitable or 5 unprofitable deals in a row. (more…)

It has been exactly nine months since the S&P 500 bottomed on March 9th at 676.53. Since then, the index has rallied 62%. Below we provide a chart of the rolling 9-month change (%) for the S&P 500 going back to 1928. As shown, 1933 was the only other time when the S&P 500 had a bigger 9-month gain. The 9-month period ending on May 12th, 1983 is the next best behind the current one with a gain of 60%. Also, the 9-month 62% gain was preceded by a 9-month decline of 51%. The only time that the index fell more over a 9-month period was in 1931/32 when it dropped 68%. It’s easy to forget how crazy things were over the last 18 months, but stats like these provide a staggering refresher.