Only Once in A While ,You're Smarter than the Market

As a simplified illustration of how hard it is to time the market, assume that you are 70% accurate calling market turns. If you are in the market, two calls are required: a sell and a subsequent buy. The probability of being correct (buying back in at a lower price than your selling price) is 70% times 70%, or 49%. That shows you have to be very good (and most people are not much better than a coin toss) to be successful at market timing.

As a simplified illustration of how hard it is to time the market, assume that you are 70% accurate calling market turns. If you are in the market, two calls are required: a sell and a subsequent buy. The probability of being correct (buying back in at a lower price than your selling price) is 70% times 70%, or 49%. That shows you have to be very good (and most people are not much better than a coin toss) to be successful at market timing.

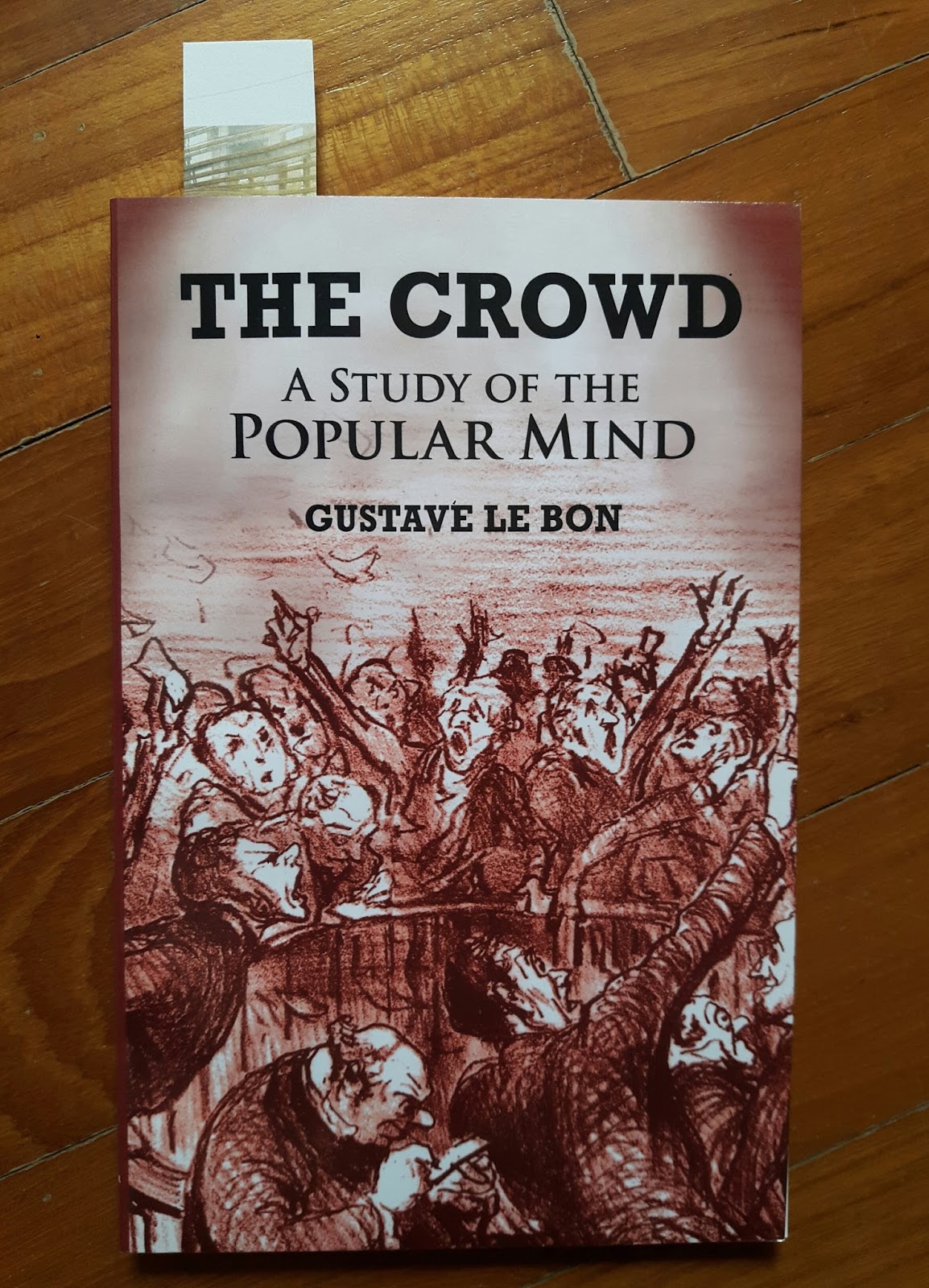

The improbable does not exist for a crowd, and it is necessary to bear this circumstance well in mind to understand the facility with which are created and propagated the most improbable legends and stories.

Crowds, being incapable both of reflection and of reasoning, are devoid of the notion of improbability; and it is to be noted that in a general way it is the most improbable things that are the most striking.

Crowds being only capable of thinking in images are only to be impressed by images. It is only images that terrify or attract them and become motives of action.

Clarification: If crowds are incapable of distinguishing between the improbable and the probable, and the images it associates with the improbable invoke action, then odd things are designed to happen.

…the individual forming part of a crowd acquires, solely from numerical considerations, a sentiment of invincible power which allows him to yield to instincts which, had he been alone, he would perforce have kept under restraint.

A crowd …is not prepared to admit that anything can come between its desire and the realisation of its desire.

Ambitious

Makes and follows long term business plan

•Unambitious

Will ignore long term business plan

•Calm

Will handle times of market volatility and make smart decisions

•Worrying

Will panic when markets are volatile and make stupid decisions

•Cautious

Strictly follows Stop-Loss rules and Protects Trading Capital

•Rash

Will not be diligent with Stop losses and will risk trading capital

•Cheerful (more…)

Your losses are getting smaller and smaller.