Economists were seduced by physics because it made their claims seem more scientific. Their belief was in the concept of equilibrium, in which it would be impossible to profit from trading around a circle of goods or a circle of currencies without actually producing anything. Of course, that is possible, and that did happen, and that’s because you’re never really at equilibrium.

Latest Posts

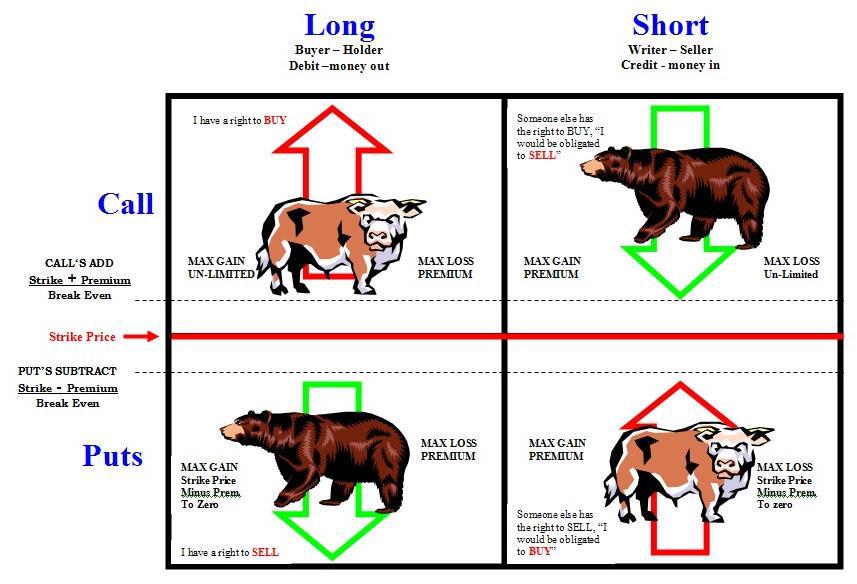

rssOption chart -Graphic

OPTIMISTIC & PESSIMISM in Trading

PESSIMISM

Pessimism is defined as a tendency to stress the negative or unfavorable or take the gloomiest possible view. Obviously, the successful trader is not pessimistic. If so, then he would never trade in the first place or if he did, he would only trade short; a “permabear” if you will. A purely pessimistic trader would also doubt his edge, doubt any market direction, only trade after the move has happened, cut his winners short while allowing his losers to run, overtrade, under invest, etc etc. In other words, a purely pessimistic trader would break all the rules.

OPTIMISM

Optimism is defined as the inclination to anticipate the best possible outcome while believing that most situations work out in the end for the best. The unsuccessful trader, especially the beginning trader, is optimistic about getting rich in the stock market. No matter what every trade will eventually make money he reasons. The optimistic trader also loads up on a “sure thing”, seeks to justify every trade via confirmation bias, adds to losers, brags about winners while hiding losers, refuses to develop as a trader, etc etc. Just as with pessimism, the optimistic trader breaks the rules.

This should be posted in all schools and work places.

10 Cruel Rules of Traders

I) You will not buy low or sell high.

II) You will cut your winners and let your losers run.

III) You will wish you owned more of what’s going up and less of what’s going down.

IV) You will be fearful when others are fearful.

V) You will fight the trend.

VI) You will not buy when there is blood in the streets.

VII) You will spend too much time worrying about low probability outcomes.

VII) You will invest for the long-term, or until we get a ten percent correction, whichever comes first.

IX) You will go broke taking small profits.

X) You will not just sit there, you’ll do something.

“In investing, as in flying [a plane], human error can be a bitch.”

Trading Profits in relate to Time and Accuracy

The size of profits of a trading system, is related to time and accuracy. They are inter-related and it is not possible to get the best out of all 3 factors in any trading system.

Before I elaborate further, I shall define what these 3 factors mean.

Size of profits – I am referring to the average amount of profits the system will earn per trade.

Time – The average length of time you held on to a trade.

Accuracy – The percentage that the system is correct and earns you a profit.

Big Profits = Long Time = Low Accuracy

For systems that aim for big profits, they must allow a greater range of fluctuations for the trade. By having a large trading range will in turn prevent you from getting stopped out so soon. Hence, you will be in a trade for a longer period of time. Besides having a larger profits, it will also serve you losses that are bigger, because your stop loss limit has to be further from your entry point. It is more difficult to grasp for the relationship with accuracy.

Small Profits = Short Time = High Accuracy (more…)

10 Trend Commandments

You shall learn from successful trend followers to make big returns in the market.

- You shall follow the trend only, and have no guru that you bow down to.

- You shall not try to predict the future in vain, but follow the current price trend.

- You shall remember the stop loss to keep your capital safe, you shall know your exit before your entry is taken.

- Follow your trend following system all the days that you are trading, so that through discipline you will be successful.

- You shall not give up on trading because of a draw down.

- You shall not change a winning system because it has had a few losing trades.

- You shall trade with the principles that have proven to work for successful traders.

- You shall keep faith in your trend following even in range bound markets, a trend will begin anew eventually.

- You shall not covet fundamentalists valuations, Blue Channels talking heads, newsletter predictions, holy grails, or the false claims of black box systems.

If you want news and entertainment watch BLUE CHANNELS, if you want to learn how to trade & Mint Money then Read www.AnirudhSethiReport.com

Statelessness overlapping with radical Islam

The Zurich Axioms on risk