Losses

- Remain mentally and emotionally focused while trading.

- Losses are part of all systems; knowing when to take losses is important.

- Always try to be extremely disciplined, and exit your losing trades when your system requires you to do so.

- Not taking losses when indicated is dangerous.

- Riding losing trades for too long usually results in larger losses and risk of ruin increases.

- It’s not a good idea to keep changing stops to avoid a loss.

- System traders use stops consistently.

- Separate yourself as a trader from yourself as a person.

- No system can trade the markets without taking losses at times.

- Clumping can happen on the losing side as well as the winning side.

- Your ability to take losses quickly is a great asset to your trading.

Discipline

Now this is vital to trading success. Imagine a person trying to become a pro athlete, but he or she sleeps in every day, eats excessively, stays up late and parties every night. Is this person going to become an elite athlete or not? The answer is no, and the reason why has everything to do with the amount of discipline. Discipline, in my mind, is like homework, only it’s homework that pays off in dollars in the trading industry. Here are a few rules that I use when it comes to discipline in my life as a trader:

- Good trading discipline is vital to my success.

- My three successes to the market are: doing my market homework, following through, and using my stop losses.

- I train my mind every day to be disciplined and focused.

- I see myself every day doing my market homework and following the signals, setting stops.

- I track my system exactly as it dictates.

- If my system gives me daily signals, I follow them every day.

- If my system gives me intraday signals, I follow them during the day.

- I do not allow outside influences to affect my discipline.

- Placing my orders correctly as my system dictates increases my odds for success.

- Discipline to follow through with my system is my friend.

- A system without stop losses puts me in a position of unlimited or unknown loss.

- I understand that a major aspect of being disciplined is using stops.

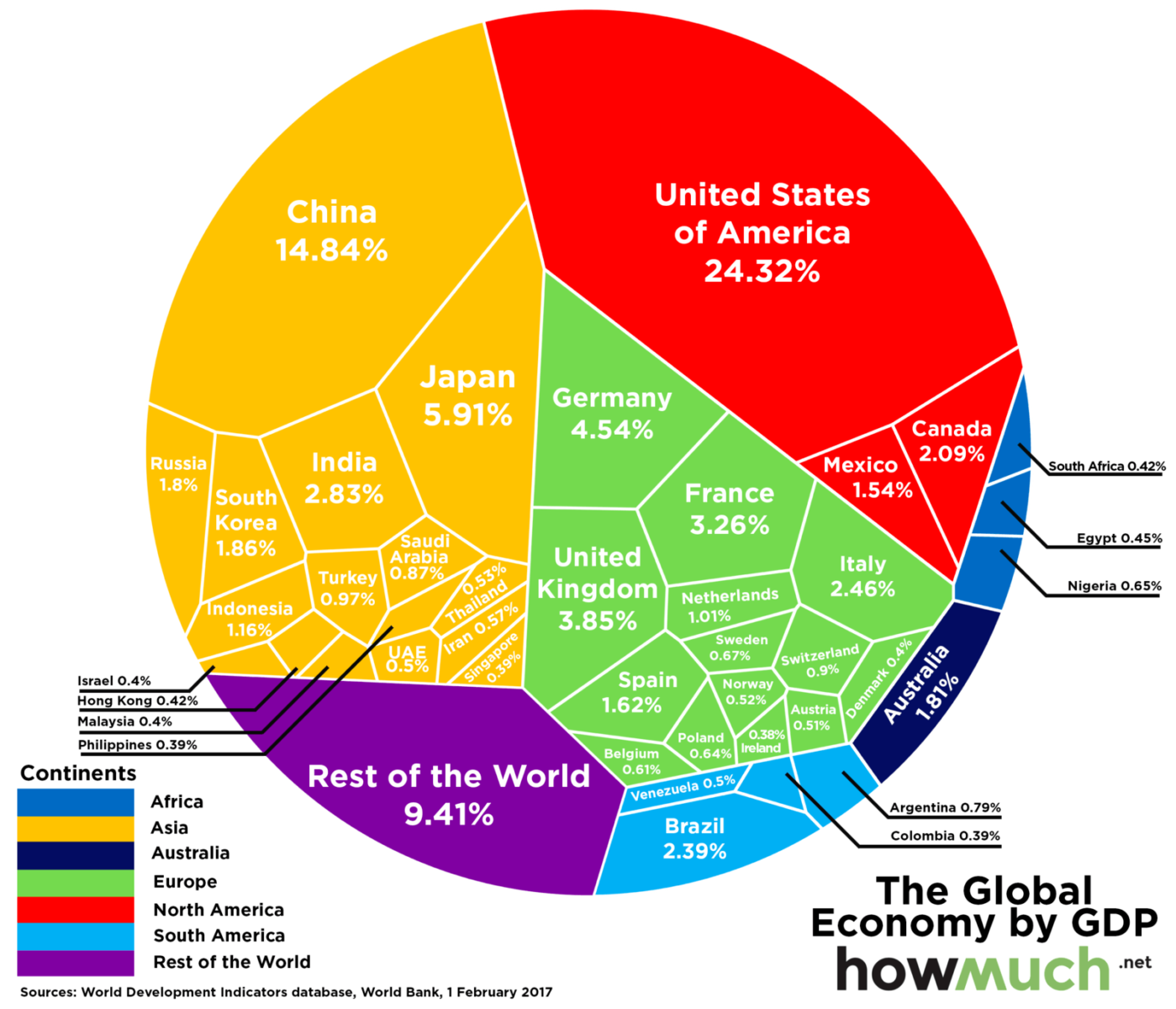

Risk is a part of trading. Every trade carries a certain level of risk. Every trader must know the amount of risk that is being assumed on each trade. Knowing the amount of risk on each trade is one way to limit it and to protect your trading account. The best way to know your risk is to determine the risk-reward ratio. It is one of the most effective risk management tools used in trading.

Risk is a part of trading. Every trade carries a certain level of risk. Every trader must know the amount of risk that is being assumed on each trade. Knowing the amount of risk on each trade is one way to limit it and to protect your trading account. The best way to know your risk is to determine the risk-reward ratio. It is one of the most effective risk management tools used in trading.