You can buy M. William Scheier’s book Pivots, Patterns, and Intraday Swing Trades: Derivatives Analysis with the E-mini and Russell Futures Contracts (Wiley, 2014) for a little north of $50 or, if you have money burning a hole in your pocket, can take his ten-lesson e-mini trading course for about $3,000 or buy his indicator package software (included in the price of the course) for $250. Let’s look at the cheapest alternative.

You can buy M. William Scheier’s book Pivots, Patterns, and Intraday Swing Trades: Derivatives Analysis with the E-mini and Russell Futures Contracts (Wiley, 2014) for a little north of $50 or, if you have money burning a hole in your pocket, can take his ten-lesson e-mini trading course for about $3,000 or buy his indicator package software (included in the price of the course) for $250. Let’s look at the cheapest alternative.

The book is divided into four parts: time frame concepts, day model patterns, repetitive chart patterns, and confluence and execution.

Scheier’s methodology combines “old school” technical analysis with a “new school” proprietary algorithm for what he calls the Serial Sequent Wave Method. In the book he focuses exclusively on the former. (more…)

Latest Posts

rssPersonality Traits

The research of Costa and McCrae suggests that personality traits fall into five broad categories, with each category displaying a number of facets. Their NEO-PI personality trait inventory labels these categories and facets as follows:

The research of Costa and McCrae suggests that personality traits fall into five broad categories, with each category displaying a number of facets. Their NEO-PI personality trait inventory labels these categories and facets as follows:

* Neuroticism – Anxiety, Angry Hostility, Depression, Self-Consciousness, Impulsiveness, and Vulnerability;

* Extraversion – Warmth, Gregariousness, Assertiveness, Activity, Excitement-Seeking, Positive Emotions;

* Openness – Fantasy, Aesthetics, Feelings, Actions, Ideas, Values;

* Agreeableness – Trust, Straightforwardness, Altruism, Compliance, Modesty, and Tender-Mindedness;

* Conscientiousness – Competence, Order, Dutifulness, Achievement Striving, Self-Discipline, and Deliberation.

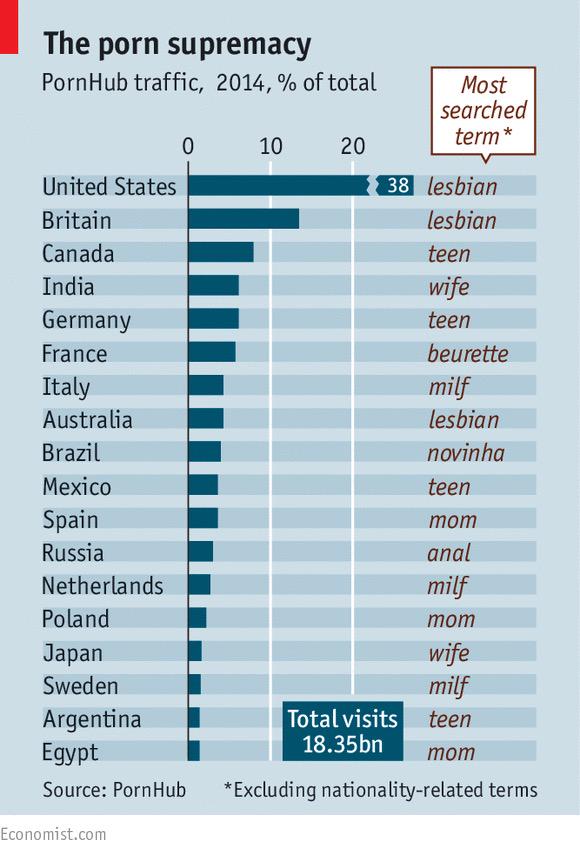

According to The Economist, US, UK, Canada top 3 in Internet porn traffic. India at 4th Number-Digital India ?

Who was having this NEWS ?

http://www.business-standard.com/india/news/ril-loses-bid-for-canadian-firm/388837/

Above is the hrly chart of Reliance (Yesterday’s trading ).From 1030 to 1072…What a rally ?

On 3rd March ,LyondellBasell NEWS was out and stock zooomed from 992 to 1027 level in single session.

-Just think it over :Why this is happening with all companies listed in INDIA ?

-If u hunting to buy some company….is it Bad NEWS for company ?

If u lose …….and if u are not able to get Foreign Company…is it good for Domestic company ?

Technically ,I had written stock looking Hot only.

But who was having this NEWS …that it had has lost out on its $2-billion takeover bid for Calgary-based Value Creation.

-Media is reporting Today morning …so somebody was having this NEWS during trading hrs itself ??

Yes ,Chart indicated 2 days back only…Fiery move on card.

But reasons were known to some Insiders only…..Jai ho !!

Updated at 6:35/17th March/Baroda

Traders, cement these words into your minds…

How are you perceiving your market?

15 Rules for Stock Market Traders-Investors

1. Reward is ALWAYS relative to Risk: If any product or investment sounds like it has lots of upside, it also has lots of risk. (If you can disprove this, there is a Nobel waiting for you).

2. Overly Optimistic Assumptions: Imagine the worst case scenario. How bad is it? Now multiply it by 3X, 5X 10X, 100X. Due to your own flawed wetware, cognitive preferences, and inherent biases, you have a strong disinclination – even an inability — to consider the true, Armageddon-like worst case scenario.

3. Legal Docs protect the preparer (and its firm), not you: Ask yourself this question: How often in the history of modern finance has any huge legal document gone against its drafters? PPMs, Sales agreement, arbitration clauses — firms put these in to protect themselves, not your organization. An investment that requires a 50-100 page legal document means that legal rights accrue to the firms that underwrote the offering, and not you, the investor. Hard stop, next subject.

4. Asymmetrical Information: In all negotiated sales, one party has far more information, knowledge and data about the product being bought and sold. One party knows its undisclosed warts and risks better than the other. Which person are you?

5. Motivation: What is the motivation of the person selling you any product? Is it the long term stability and financial health of your organization — or their own fees and commissions?

6. Performance: Speaking of long term health: How significantly do the fees, taxes, commissions, etc., impact the performance of this investment vehicle over time?

7. Shareholder obligation: All publicly traded firms (including iBanks) have a fiduciary obligation to their shareholders to maximize profits. This is far greater than any duty owed to you, the client. Ask yourself: Does this product benefit the S/Hs, or my organization? (This is acutely important for untested products).

8. Other People’s Money (OPM): When handing money over to someone to manage, understand the difference between self-directed management and OPM. What hidden incentives are there to take more risk than would otherwise exist if you were managing your own assets? (more…)

How to Win the Loser’s Game (Full Version)-Must Watch Video

Just Spare 1:20 Minutes…………………….Must Watch !!

Do you still ride the learning curve?

An interesting quote from the book Hedge Fund Market Wizards