Latest Posts

rssTrading Philosophy

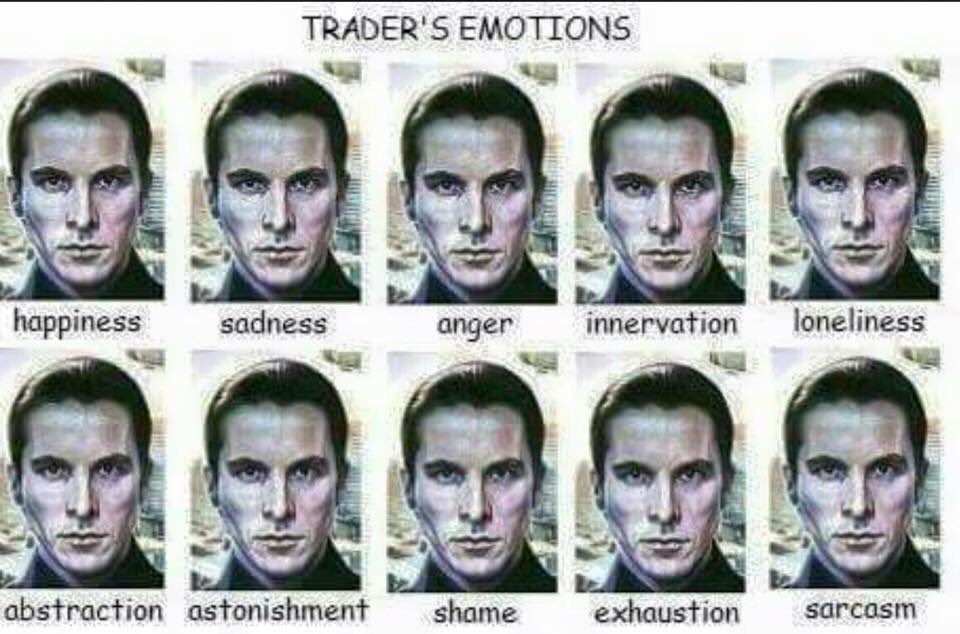

One Picture For Traders -Discipline in Trading is Must

Why I'm an existential optimist.

Happy Sunday Evening

Sovereign Risk and Bank Risk-Taking

Trading Losses

Those who have chosen this very unique career of “trader” face a mountain of challenges each day based on ever-changing market conditions. Added to the market challenges are emotions, which can be 90% of the game. You can have a great method, strategy and be taught by the best, but if fear, apprehension or hesitation come up the trader won’t take the trade…..this is an emotional block. All successful and experienced traders learn quickly to become the masters of their emotions. To accept and manage their weaknesses and leverage their strengths.

Those who have chosen this very unique career of “trader” face a mountain of challenges each day based on ever-changing market conditions. Added to the market challenges are emotions, which can be 90% of the game. You can have a great method, strategy and be taught by the best, but if fear, apprehension or hesitation come up the trader won’t take the trade…..this is an emotional block. All successful and experienced traders learn quickly to become the masters of their emotions. To accept and manage their weaknesses and leverage their strengths.

At first most traders start by researching and determining a method to trade. They do little to emotionally prepare for what’s to come. Yet they quickly find out that their emotions come into play early on, especially if they experience immediate losses. Losing money coupled with one’s own emotional “baggage” can impact the minds thought process and outcome.

My work focuses on the power of the mind and in particular the power of thought. These three problems and solutions do too. Nothing happens without the some form of thought, be it sub-conscience or conscience. After all, isn’t this what we’re left with when sitting in front of our monitors trading? What comes into our minds, as we trade can be avalanches of different thoughts. These thoughts then have the ability to assist us and add to our success or become our worst nightmares resulting in multiple losses.

Traders over time, come to the realization that trading will force them to face ALL their old and current emotional baggage and blocks. And that NOT being able to manage or “dump” the baggage, can hit the bottom line quickly.

When a trader’s plan doesn’t work they tend to blame it on the method, when in reality it usually comes down to an emotion causing them to react inappropriately. We can pick up automatic emotional blocks that prevent us from implementing a method effectively. Many try to get over these emotions on their own, but few master the changes needed.

But lets get specific and to the heart of these three trading problems. The first reason traders lose may seem obvious but in reality it stems from long term social conditioning. It’s their inability to ACCEPT LOSS. Losing generates powerful emotions, such as fear, uncertainty, apprehension, and self-doubt especially with men. And while women today can also be as affected, the data is supported mostly by men as they represent a larger portion of the client base.

Men are socially conditioned to succeed from the time they enter the world. From little boys being read, “The Little Train That Could” to the environments that surround them as they grow up. They are guided to be become achievers. Influenced by family, friends, education, and career environments they are encouraged to seek professions of Doctors, Lawyers, and Bankers. Images and social metaphors reinforce them. Striving to be right, number one, the breadwinner, and the best, always seeking perfectionism. They are socially conditioned to be the family providers. Add to this various cultural pressures and demands and men have a built-in fundamental obligation to succeed. (more…)

The nature of the self

These are Trader's Emotions

Just Trade with Trading levels and Use Trading psychology.

101% No need to watch Blue channels ,Fundamentals ,Results ,Growth/Economy !!

Traders -17-POINT QUESTIONNAIRE TO EVALUATE YOURSELF

To help you with your self-assessment, Dr. Tharp developed a quick 17-point questionnaire you can use to evaluate yourself. Take it and pass it on to your friends; I’m sure you’ll all get some insights into your performance. Answer each question with true or false.

- I have a written business plan to guide my trading/investing. ____

- I understand the big picture about what the market isdoing and what is affecting it. ____

- I am totally responsible for my trading results, and as as result I can correct my mistakes continually. (If either part is false, all of this statement is false.) ____

- I honestly can say that I do a good job of letting my profits run and cutting my losses short. ____

- I have three trading strategies that I can use that fit the big picture. ____

- For trading strategy 1 I have collected an R-multiple distribution of at least 50 trades (i.e., from historical data or live trading). If you don’t know what an R-multiple distribution is, which you’ll learn later in this book, you haven’t collected one, so answer “False.” ____

- For trading strategy 2 I have collected an R-multiple distribution of at least 50 trades (i.e., from historical data or live trading). ____

- For trading strategy 3 I have collected an R-multiple distribution of at least 50 trades (i.e., from historical data or live trading). ____

- For each of my trading strategies, I know the expectancy and the standard deviation of the distribution. ____

- For each of my strategies, I know the types of markets in which they work and in which they don’t work. ____

- I trade my strategies only when the current market type is one in which the strategies will work. ____

- I have clear objectives for my trading. I know what I can tolerate in terms of drawdowns, and I know what I want to achieve this year. ____

- Based on my objectives, I have a clear position sizing strategy to meet those objectives. ____

- I totally understand that I am the most important factor in my trading, and I do more work on myself than on any other aspect of my trading/investing. ____

- I totally understand my psychological issues and work on them regularly. ____

- I do the top tasks of trading on a regular basis. ____

- I consider myself very disciplined as a trader/investor. ____

Emotional Equations for Traders

Despair = Losing Money – Trading Better Do not despair look at your losses as part of doing business and as paying tuition fees to the markets. Disappointment = Expectations – Reality Enter trading with realistic expectations. You can realistically expect 20%-35% annual returns on capital with great trading after you have experience and have done the necessary homework. More than that is possible but you will have to be one of the very best to achieve greater returns than this. Regret = Disappointment in a loss+ Caused by lack of Discipline If you followed your trading plan and lose money because the market did not move in your direction so be it, but if you went off your plan and traded based on your feelings and opinions then you should feel regret and stop being undisciplined. Enjoying your Trading = Winning Trades – Fear of Ruin Trading is much more enjoyable when you are risking 1% of your capital in the hopes of making 3% on your capital with a zero chance of ruin. It is not enjoyable when you are putting a huge percentage of your capital on the line in each trade and are only a few bad trades away from your account going to zero. Trading Wisdom = Understanding what makes money + Years of successful trading To get good at trading you have to trade real money. Wisdom comes from putting real money on the line for years and proving to yourself that you can come out a winner in the long term. Faith in your system = Belief through back testing + Experience of winning with it for years Whether any individual trade is a winner or loser should not influence your faith in your system and trading method. You should trade in a way that each trade is just one trade out of the next 100. Much of emotional trading can be overcome when you do not have doubts about your method. When you hold an almost religious fervor over believing in your method, system, risk management, and your own discipline you will overcome many of the emotional problems that arise in the heat of action during a live market. |