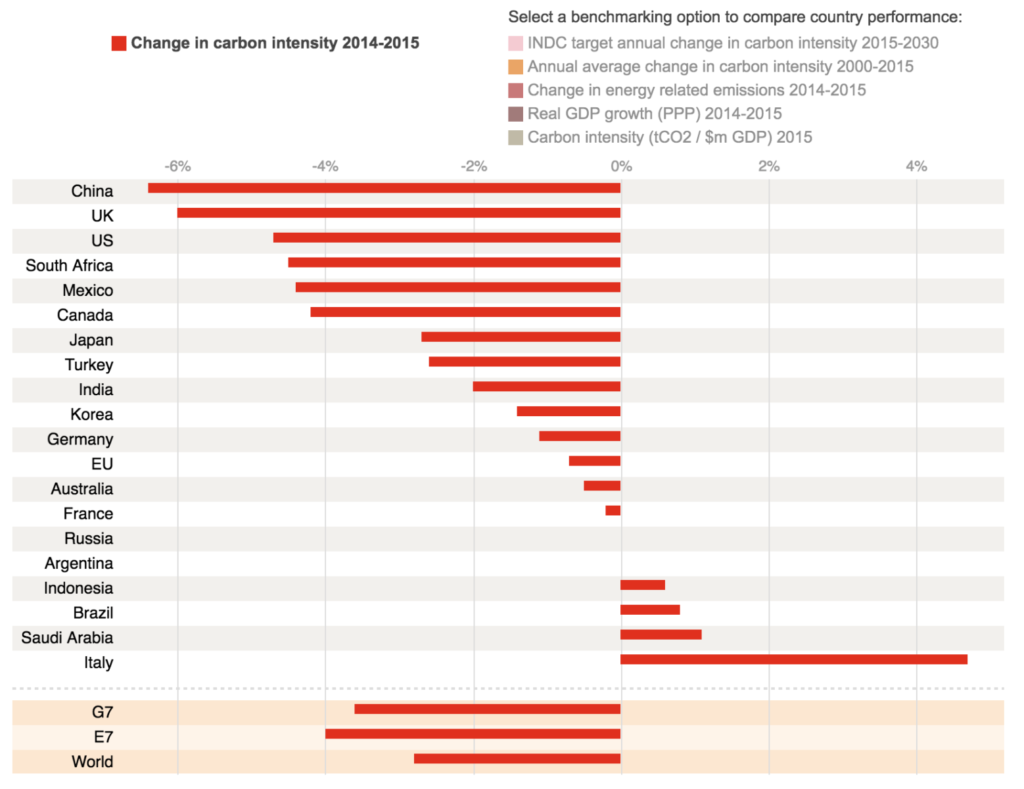

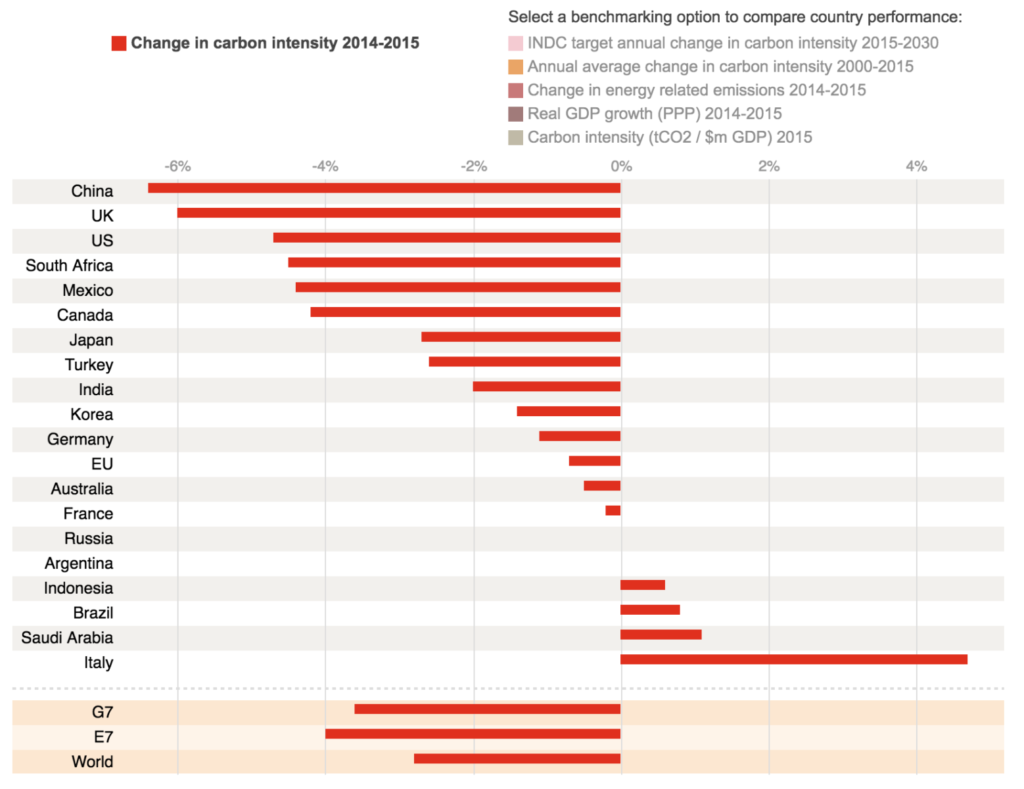

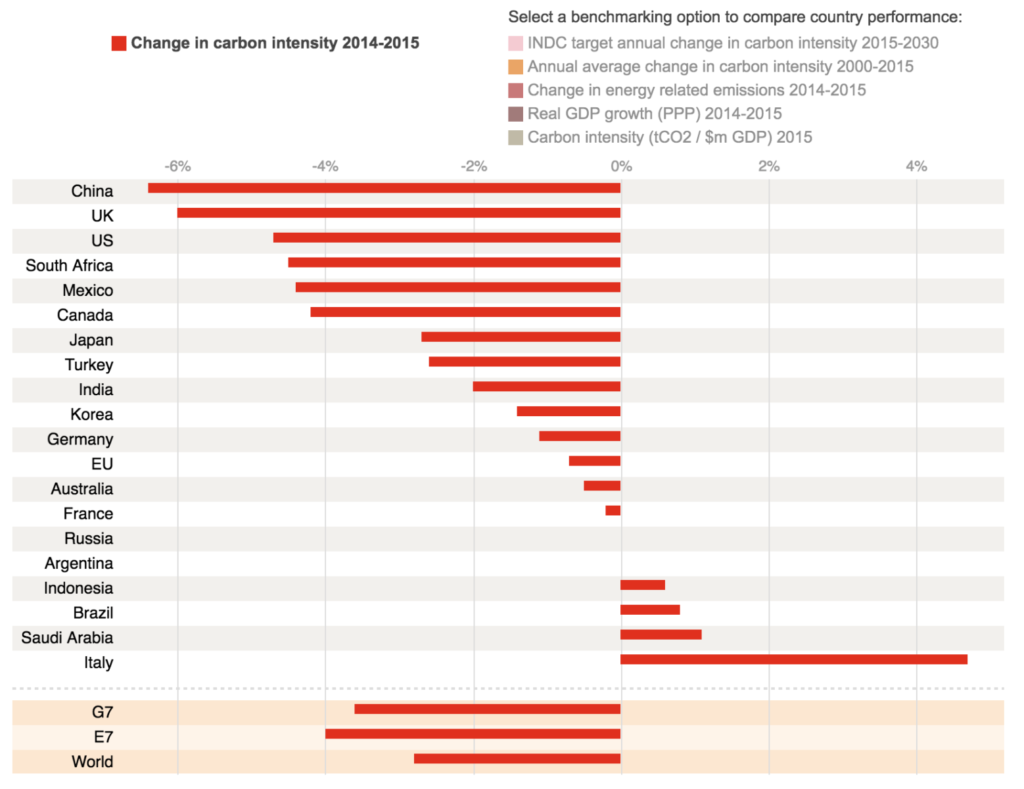

Change in Carbon Intensity 2014-2015

Don’t over-leverage yourself or have all of your money tied into one position. Keeping cash on hand is okay as a trader. These days brokers are offering extremely competitive margin requirements for day trading futures, but low margins can be a wolf in sheep’s clothing.

Don’t over-leverage yourself or have all of your money tied into one position. Keeping cash on hand is okay as a trader. These days brokers are offering extremely competitive margin requirements for day trading futures, but low margins can be a wolf in sheep’s clothing.

An anonymous bidder has paid $3,456,789 for a lunch date with the investment guru and founder of Berkshire Hathaway, some 47 per cent more than the winner of the charity auction last year.

Mr Buffett will meet the winning bidder and up to seven friends for an intimate meal, in what has become an annual tradition that has netted more than $23m in total for the San Francisco charity, Glide.

Mr Buffett’s late wife Susan used to be a volunteer at Glide, which offers meals, medical testing and other services to homeless and low-income people in the San Francisco’s Tenderloin district. Volunteers and supporters sang and cheered as the five-day auction moved into its final minutes on Friday night, and a late bid swelled the proceeds from $2.8m, where bidding had hovered for most of the day, to a final total that matched the all-time record from 2012. (more…)

* How you prepared for the day/week: What was your market preparation? What research did you conduct or consume? What did you read? What conversations did you have, and with whom? How did you eat? Sleep? Exercise? Prepare yourself mentally?

* How you generated your trading ideas: Where did the ideas come from? What was the process that led to the ideas? What made them good ideas? What gave you “edges” in your trades?

* How you expressed your ideas: What market(s) did you use to express your views? What instruments? How did your expressions provide you with superior risk/reward? If you held multiple positions, how did you size them relative to each other and gauge their correlations?

* How you managed your positions: What kind of trade planning did you do? How did you size positions and gauge your risk taking? How did you manage your risk? What led you to scale into or out of your positions?

* How you managed your performance: How did you review your performance? What did you learn? How did you use your learning to improve your future performance? (more…)

Learning the technical aspects of trading and the markets takes time and what you think you know after 1,2, 3 years is nothing. Really, nothing. As the years roll by and you accumulate 1000’s of hours of seat time honing your edge and system you get to learn a few things about yourself as well. This is where you become a trader. And if you are humble, the learning never stops. To think otherwise is a recipe for disaster.

Learning the technical aspects of trading and the markets takes time and what you think you know after 1,2, 3 years is nothing. Really, nothing. As the years roll by and you accumulate 1000’s of hours of seat time honing your edge and system you get to learn a few things about yourself as well. This is where you become a trader. And if you are humble, the learning never stops. To think otherwise is a recipe for disaster.