"When you are disrupting you need to find the right metrics … these will be new metrics."

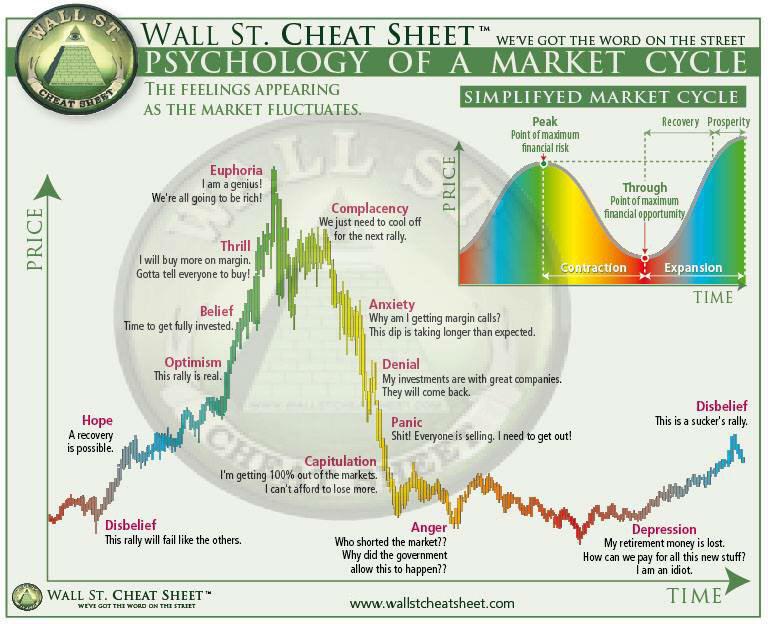

The market, as much as anything in life, has a way of transforming us from cool, calm, collected individuals into irrational, impulsive, disoriented speculators. Clearly it’s in our best interest in terms of long-term profitability to spend the majority of our time in the former group rather than the latter.

Acknowledging when things aren’t going our way is the first step to becoming a more patient trader, but it’s having the patience to wait things out until we find a more harmonic rhythm that contributes immeasurably to our success.

It’s the losing positions that invariably do traders in. A number of the bigger losers many traders experience come as a result of not being patient and waiting on the right opportunity. Many of us tend to press when things aren’t working out, or we’ve just had a losing trade.

Traders can begin to play catch-up and go on an emotional tilt. It’s the paradox of trading in many ways. The same competitive drive we use to achieve our success has components that can hasten our failure.

When going through my daily checklist, I send out to members of my mentoring program, I always emphasize that the markets provide a multitude of chances to trade. One need not force action when the setups aren’t right. Traders who get into positions with “the best of it” or “an edge” significantly increase their chances for success in the long run.

Confidence comes from a number of sources and is developed through successful implementation of a strategy. It is also a byproduct of the unwavering belief that what you are doing will be successful. This is critical because, at the moment of truth, when you are in a position, self-doubt has a way of creeping in. It’s tempting to deviate from your plan at these times.

While I’m not suggesting that you be inflexible in your position management, I am saying that having belief in what you are doing goes a long way toward your success. In fact, it’s the confidence in your trading skill set that can give you the ability to make a decision to get out of a position, knowing that things aren’t working out. This conviction is a hallmark of great leaders and inspires others.

Trust your gut If something looks like crap and smells like crap, then chances are, it is crap. Listen more to your gut to tell you when to cut a loss and move on.

Trust your gut If something looks like crap and smells like crap, then chances are, it is crap. Listen more to your gut to tell you when to cut a loss and move on.

How do you know you’re making progress on the road to successful trading? There’s one obvious answer: Check your financial results. There is little doubt you’re doing well if you’re booking consistent profits.

But raw capital production may not be the best way to judge your growth as a trader. The road to success has many detours where profitability isn’t the best measure of results. For example, we all go through phases in which introspection and skill development are more urgent than short-term profits. So let’s look at 10 ways to know you’re making solid progress on the road to market mastery:

1. Money management becomes your lifeline, and all your trading strategies start to revolve around its core. Risk control becomes a key aspect of every position you take. You accept that controlling losses has a far-greater impact on your bottom line than chasing gains.

2. You develop your own trading plans and strategies rather than relying on books, gurus or other people’s opinions. You notice how you’re finding more opportunities than you have time to trade while looking through your charts. You look forward to the trading day with a growing sense of confidence and empowerment.

3. You feel more like a student than a master. You learn new things every day and can’t wait to apply them to real-life trading scenarios. You listen closely to everything you hear, trying to pick up hints and concepts that will improve your performance. You expand your studies into everything market-related, including economics, fundamentals and balance sheets.

4. You stop visiting stock boards and chatrooms, because they don’t add anything to your trading goals. You realize that everyone in those places has ulterior motives. You develop a healthy skepticism about companies, market-makers and even other traders. You realize that no one is really interested in your success as a trader, except for you. (more…)