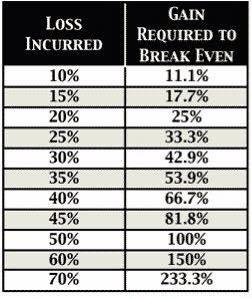

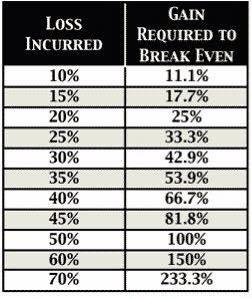

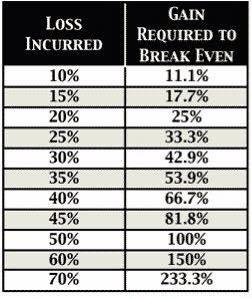

Why big losses are a bad idea. Capital destruction is an uphill climb to comeback from.

Coates, John M., Mark Gurnell and Aldo Rustichini (2009) Second-to-fourth digit ratio predicts success among high-frequency financial traders. Proceedings of the National Academy of Science, 106/2: 623-8.

Introduction

What does traders’ success on the market floor depend on? Earlier studies have shown that one’s level of testosterone did affect one’s daily results. Since “prenatal androgens have organizing effects on the developing brain, increasing its later sensitivity to […] testosterone”, it would make sense that prenatal androgens also have a structural effect on a trader’s results on the long term.A surrogate marker is commonly used to define one’s exposure to prenatal androgens: the second-to-fourth digit length ratio, noted 2D:4D. Such market has been found to predict professional athletes’ performance. In this paper, the autors test the hypothesis that a high exposure to prenatal androgens as indicated by 2D:4D would also predict traders’ long-term profit.

Just Sit & Enjoy ,Technically Yours/ASR TEAM/BARODA/INDIA

I am sure most of the questions on the eve of the third round of the British Open revolve around Tiger Woods absence. “What’s wrong with Tiger?” “Is he losing his mental edge?” “Is he hurt?” “Has something gone wrong in his personal life?” “Why so many mistakes?”

Here is my question: Why can we not celebrate the fact that Tiger Woods is human? He is human isn’t he? I know he is as mortal as we all are. That is what we all have in common. Why do we insist on him winning every tournament he enters? He won the last tournament he entered.

I think someone who always wins dies a slow death. You know, the Alexander the Great syndrome. “He [Alexander] wept with sorrow,” Plutarch said, “Because there were no more worlds to conquer.” (more…)

“When you see a position that is going against you and the market is dropping, and you are losing money on a trade, but your stop loss hasn’t been hit yet, how do you stay with the position? What is your secret? Do you pullback and look at the big picture or do you simple assume its all noise as long as it doesn’t hit that lower low? This is my biggest problem with tracking your trades and most of the time you are right in holding on.” … Because we thought our answer to his question may be beneficial to other traders as well, we wanted to share our reply to his e-mail, which was… “The key point you stated is ‘but your stop loss hasn’t been hit yet.’ When we put on a trade, it’s like entering into a contract, so we try to stay the course and simply follow the plan. Over the years, we’ve found it’s best to stick with our original analysis because we usually plan a trade at night, or in the pre-market, without the stress of live trading. During the trading session, in the heat of the moment, there is so much pressure that we have to fight the voice in our heads telling us to sell the position when everything around is crumbling. It basically comes down to planning the trade and trading the plan…easier said than done, right? Sometimes, if you have a feeling things are going bad, and you’re an active trader, you can maybe sell 1/4 or 1/3 of the position to ease your mind. However, you must have the discipline to get back in once the coast is clear. Try to lay out a plan, write it on paper, and stick to it. The one thing every trader must accept, in order to be successful, is a loss. You must be fully prepared to lose what you’re risking. Once you accept losses as part of the trading game, the pressure to be right is not so intense. By the way, we at ASR are no different; we fight the same urges to sell that most traders do. It’s a constant battle, that’s for sure!” |