“…Small choices don't make much of a difference at the time, but add up over the long-term.”

This is a tough book to review, because I generally respect the author, but there are many things I don’t like about the book. Let’s start with the main one:

My friend Alice Schroeder came to speak to the Baltimore CFA Society early in November. It was a great talk, and afterward, I took her back to the Amtrak station. What was our main topic of conversation? The many authors with limited or no dealings with Warren Buffett who invoke his name in order to get better sales. I won’t name names. I have relationships with a number of them.

I will review “The Snowball” soon. Alice Schroeder spent around five years creating that lengthy book, and I can see why she would be upset over those that use Buffett for their own personal gain.

This book is another example of that. Only chapters 1 and 2 have anything to do with Buffett, and there he is quoted extensively to the point where he should be listed as a secondary author, and get a cut of the royalties. But in the next nine sections have almost nothing from Buffett; it is all the philosophy of Larry Swedroe. (more…)

Risk: your loss limit in per trade and the total dollar loss per day. What you will do after x number of losses in a row. Your strategy for increasing and decreasing your trading size.

Risk: your loss limit in per trade and the total dollar loss per day. What you will do after x number of losses in a row. Your strategy for increasing and decreasing your trading size.

Goals: how many R’s you are trying to make today. How many trades do you plan to make. How long do you plan to hold winners and losers

Reporting: your plan for writing a brief narrative of the day’s trading your plan to keep statistics of your trades (hold times, results, et cetera). How you will mark your trades on the same charts you use to trade.

Contingencies: what phone number do you call to get out of trades should your system crash. Who can you contact to troubleshoot or repair your computer. Who do you call to get your Internet connection checked and fixed, if needed.

With a well developed, clear plan you will be ahead of the majority of traders and, through this detailed planning, you can concentrate

They have the resilience to come back from early losses and account blow ups.

They focus on what really matters in trading success.

They have developed a trading method that fits their own personality.

They trade with an edge.

The harder they work at trading the luckier they get.

They do the homework to develop a methodology through researching ideas. (more…)

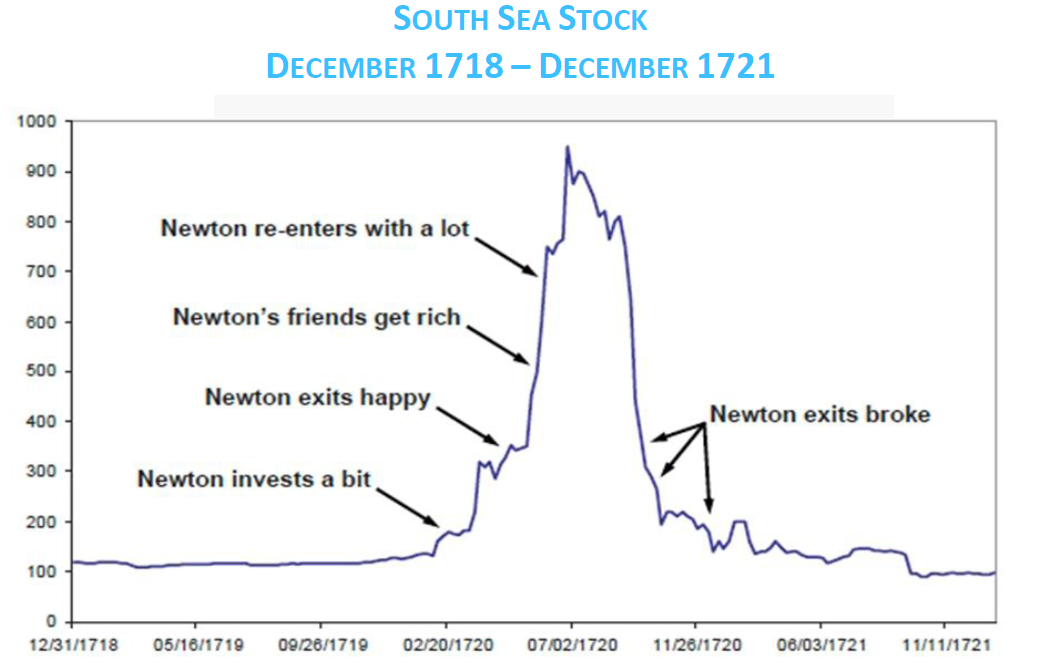

Issac Newton is probably one of the most brilliant men ever lived on this planet, but even he lost a fortune when the so called South Sea Bubble bursted. Shortly after the crash, he reportedly declared that:

“I can calculate the motion of heavenly bodies, but not the madness of people.”

Dear Raaders & Traders ,Just spare 5 minutes and enjoy.This is my first Video.

Technically yours

Anirudh Sethi

Updated at 12:05/18th Feb/Baroda

This is a better talk than I imagined. Robert L. Joss, Professor of Finance and Dean Emeritus of the Stanford Graduate School of Business, offers 10 life lessons.

10. Life is like cricket

9. Life is too short to deal with “bad” people

8. Run it like you own it

7. Don’t forget to manage side-ways

6. Don’t take yourself too seriously

5. Without fear — there is no courage

4. Life is full of “character building experiences”

3. Find the words

2. Use CAT and GSB learning throughout your life

1. Don’t forget to renew yourself