Psychologists who study the fascinating phenomenon of change blindness know that merely looking at something is not the same as actively paying attention to it. As the demonstration in this video shows, people can be blind to significant changes in a visual scene that are obvious to someone who expects that these changes are going to happen

Latest Posts

rssMinimize The Impact Of A Setback!

First, minimize its symbolic importance. Many people over interpret setbacks by imbuing them with more emotions than are warranted. They view setbacks as a form of punishment, as if a teacher or parent is punishing them for doing something wrong. Take the setback in stride and move on to the next winning trade.

First, minimize its symbolic importance. Many people over interpret setbacks by imbuing them with more emotions than are warranted. They view setbacks as a form of punishment, as if a teacher or parent is punishing them for doing something wrong. Take the setback in stride and move on to the next winning trade.

Second, don’t confuse trading outcomes with personal significance. If you lose big, for example, the loss may have great financial significance but it doesn’t need to have great personal significance. You can wipe out your entire account, but that doesn’t mean you are diminished in the eyes of friends and family. You don’t need to let a loss or setback make you feel less worthy as a person.

Ironically, when you psychologically minimize the impact of a setback, and treat it as if it isn’t important, you’ll stay calm, free, and objective. And when you feel this way, you’ll trade profitably.

Risk/Reward Ratios are a big deal to in determining your needed winning percentage.

12 Cognitive Biases that Prevent you From Being Rational

Confirmation Bias – The tendency for people to favor information that confirms their beliefs or ideas. Investors and economists often fail to fully appreciate other views due to a narrow minded view of the world often resulting from what they think they already know.

Ingroup bias – the tendency to favor one’s own group. In investing and economics we see this in ideologies and particular strategies. Austrians favor those who believe their own thinking. Chartists dislike value investors. Often times, the strongest economists and investors are the ones who are able to move beyond this ingroup bias and explore the potential that other groups have something positive to contribute.

Gambler’s Fallacy – When an individual erroneously believes that the onset of a certain random event is less likely to happen following an event or a series of events. We see this in trading all the time. This is the belief that just because something has occurred in the past that it is more likely to occur in the future. The “trend is your friend” and that sort of thing….

Post-Purchase Rationalization – When one rationalizes past purchases after the fact in an attempt to justify past actions. Investors often learn about how a bad trade turns into an investment when they rationalize their past purchases. If you’ve been in the business for a while you know how destructive this can be. (more…)

Blind and Calculated Risk

An excerpt from Trend Commandments:

There are two kinds of risk: blind and calculated. The first one, blind risk, is always suspect. Blind risk is the calling card of laziness: the irrational hope, something for nothing, the cold twist of fate, winning the lottery, etc. Blind risk is the pointless gamble, the emotional decision, or the sucker play. The man who embraces blind risk never wins in the long run. However, calculated risk can build fortunes, nations, and empires. Calculated risk and bold vision go hand in hand. To see the possibilities, work things out logically, and to move forward in strength and confidence is how you win. Calculated risk lies at the heart of every great achievement and achiever since the dawn of time. Trend followers thrive on taking calculated risks. Like the original Karate Kid movie: Wax on, wax off. Risk on, risk off.

Stock movement changes and so does the complexion of the market. But many rules & disciplines stay constant.

Truth

The market allows you to think you actually know what you’re doing at times, and while you may profit during these times you never ‘make enough’ and when you lose it seems even worse. The actuality is that you never really knew anything in the first place.

“Difficult to see. Always in motion is the future.” – Yoda.

The 5 Fundamental Truths Of Trading

| If you hold these core trading beliefs you will tend to do well in trading: I. “Anything can happen” – the market can go up, down or sideways from any point and negate my edge; II. “You Don`t need to know what is going to happen next in order to make money” III. “To win in the markets you need an edge” – an edge is nothing more than an indication of a higher probability of one thing happening over another IV. “There is a random distribution between wins and losses for any set of variables that define an edge” V. “Every moment in the market is unique” – so the last trade is independent from the next |

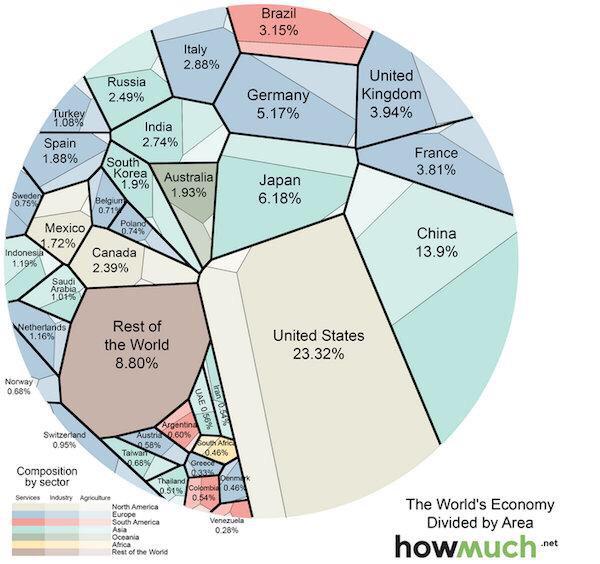

Great Visualization on the World Economy