Latest Posts

rssAnalogy Between Markets and Gambling.

We attempt to apply Statistics to markets because we see an analogy between markets and gambling. You bet when the deck is rich; count the cards and you will know.

But what if the dealer of the markets:

1. Shuffles under the table or may not shuffle – you cannot know (without inside info)

2. Might be using more than one deck

3. Sometimes uses a deck which favors your opponents

4. Usually favors you but occasionally ruins you

5. Knows that you need the action and abuses this knowledge

6. Knows that you will exploit your knowledge of him to others, especially the weak, ignorant, and women

Analytical adjustments to the long-term debt to equity ratio – Bernstein

Mark Douglas – Mind Over Market

Largest 10 Banks in World (4 From China )

"People I most enjoy working with"

Bertrand Russell's -My Ten Commandments

5 Quotes From : Reminiscences of a Stock Operator first published in 1923

- It takes a man a long time to learn all the lessons of his mistakes. They say there are two sides to everything. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side.

- I think it was a long step forward in my trading education when I realized at last that when old Mr. Partridge kept on telling the other customers, Well, you know this is a bull market! he really meant to tell them that the big money was not in the individual fluctuations but in the main movements that is, not in reading the tape, but in sizing up the entire market and its trend.

- The reason is that a man may see straight and clearly and yet become impatient or doubtful when the market takes its time about doing as he figured it must do. That is why so many men in Wall Street, who are not at all in the sucker class, not even in the third grade, nevertheless lose money. The market does not beat them. They beat themselves, because though they have brains they cannot sit tight. Old Turkey was dead right in doing and saying what he did. He had not only the courage of his convictions but the intelligent patience to sit tight.

- …The average man doesnt wish to be told that it is a bull or bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing. He does not wish to work. He doesnt even wish to have to think. It is too much bother to have to count the money that he picks up from the ground. We love volatility and days like the one in which the stock market took a big plunge, for being on the right side of moving markets is what makes us money. A stagnant market in any commodity, such as grain has experienced recently, means theres no opportunity for us to make money.

- A man will risk half his fortune in the stock market with less reflection than he devotes to the selection of a medium-priced automobile.

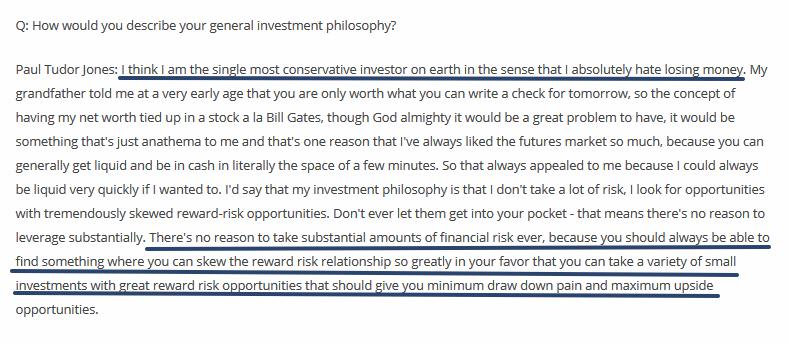

Paul Tudor Jones on risk vs. reward: "I think I'm the most conservative investor on earth."

Feedback in Real Life

If market or individual stock a has a positive predictive correlation with market b, and b had a positive predictive correlation with market a, then there is positive feedback, and an explosive growth when a is up would occur. Similarly, if there is a positive predictive correlation, i.e. the serial correlation of a with b say one day forward is 0.2, then market a goes down. If there is a negative predictive correlation of market a with market b, then when a goes up, b will tend to go down, and vice versa, and there will be a stable equilibrium between the two with each pulling the other in opposite directions.

If market or individual stock a has a positive predictive correlation with market b, and b had a positive predictive correlation with market a, then there is positive feedback, and an explosive growth when a is up would occur. Similarly, if there is a positive predictive correlation, i.e. the serial correlation of a with b say one day forward is 0.2, then market a goes down. If there is a negative predictive correlation of market a with market b, then when a goes up, b will tend to go down, and vice versa, and there will be a stable equilibrium between the two with each pulling the other in opposite directions.

The situation is very similar to what occurs in all feedback circuits in electronics, including what you seen in any kind of amplifiers where there is negative feedback to maintain stability.

What are the markets that have positive predictive correlation with each other, i.e. when a is up today, b tends to go up tomorrow, and when b is up today, a tends to go up tomorrow? There aren’t many. And when such occurs, it is only for a limited time. So you have to be on your toes if you wish to use positive feedback. All this can be quantified with varying degrees of reality and rigor.